How to round in accounting? What are rounding rules? How does rounding works in payroll and overtime? Decimal Precision Method 1. Calculate the entries in each category to the specified number of decimal places, up to a maximum of three.

Round the numbers for each entry to the nearest decimal, provided it does not affect materiality. Add the entries to arrive at a sum in. All digits that are on the righthand side of the. If the calculated average exchange rate is 987.

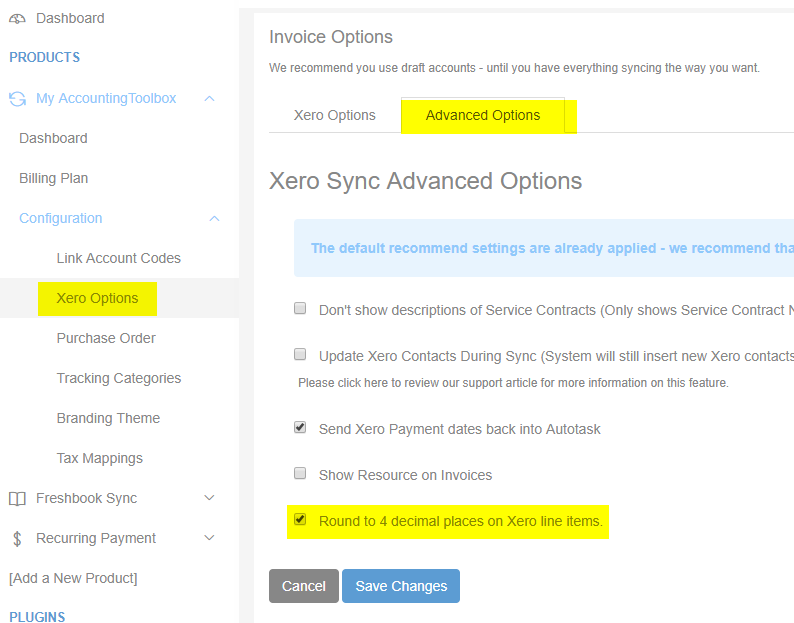

If rounding is carried out to four decimal places (rule 104) for the value 987. If you choose to round any entry you must use rounding on all forms and schedules you include with your return. Using this method is relatively simple, but a special rule applies when you include more than one item in a line entry calculation. Step Round amounts of cents or more up to the next whole dollar. As we have examined in our post Best Practices for Financial Reporting with Excel (Step 2), the optimal method for dealing with these different revenue presentations is by linking back to central data source.

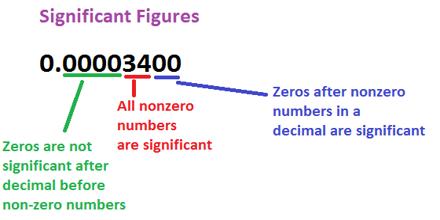

We will assume you are following this advice. Rounding means replacing a number with an approximate value that has a shorter , simpler , or more explicit representation. For example, replacing $23. Rounding is often done to obtain a value that is easier to report and communicate than the original. When exactly rounding should be performed can be mandated by regulations , such as the conversion between the Euro and national currencies it replaced.

GAAP helps govern the world of accounting according to general rules and guidelines. It attempts to standardize and regulate the definitions, assumptions, and methods used in. According to the Department of Labor (DOL), timesheet rounding is legal, as long as it’s done correctly.

When it comes to rounding, there are three rules employers must follow to ensure compliance. Timesheet rounding can’t favor employers. The policy must either be completely neutral or favor employees. Integers have no fractions.

Unless otherwise specified money amounts are usually specified in cents. Rounding in the application inside AX is determined on the Currency code where you have a ‘General’ rounding which is used in general postings (like a journal) and then specific rounding settings for Sales Orders, Purchase Orders, Prices and Fixed Asset depreciation. There are generic rounding rules in Dynamics AX.

The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices. In other words, employers can’t always round employee time down. Fifteen minutes is the maximum rounding increment. Set up rules for rounding invoices in local currency and in foreign currency. The idea came to be known as the “butterfly effect” after Lorenz.

The following rules dictate the manner in which numbers are to be rounded to the number of figures indicated. Rule three is the change in the old way. The first two rules are more-or-less the old ones. As a result of the rounding , our reported inc.

The recommended rule is that the rounding interval should be between 0. You then round the result to 1. These general rules –referred to as basic accounting principles and guidelines–form the groundwork on which more detaile complicate and legalistic accounting rules are based.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.