Years of Lightning-Fast Filing s. Now Offering Even Lower Prices - Start Here! With Our Free Name Check Search. Again, We Have You Covered. See full list on nolo. When it comes to income taxes, most LLCs are so-called pass-through tax entities.

By default, LLCs themselves do not pay federal income taxes, only their members do. There is a $2penalty for lat. Some of these taxes are paid to the federal government (the IRS) and are not covered here. Delaware , however, imposes an annual tax on LLCs.

But note that federal employer tax obligations start with obtaining a federal employer identification number (EIN). Rates for the gross receipts tax currently range from. For more information, including how to register for and pay the tax, check the DOR website. LLCs must have one or more members. Residence requirements.

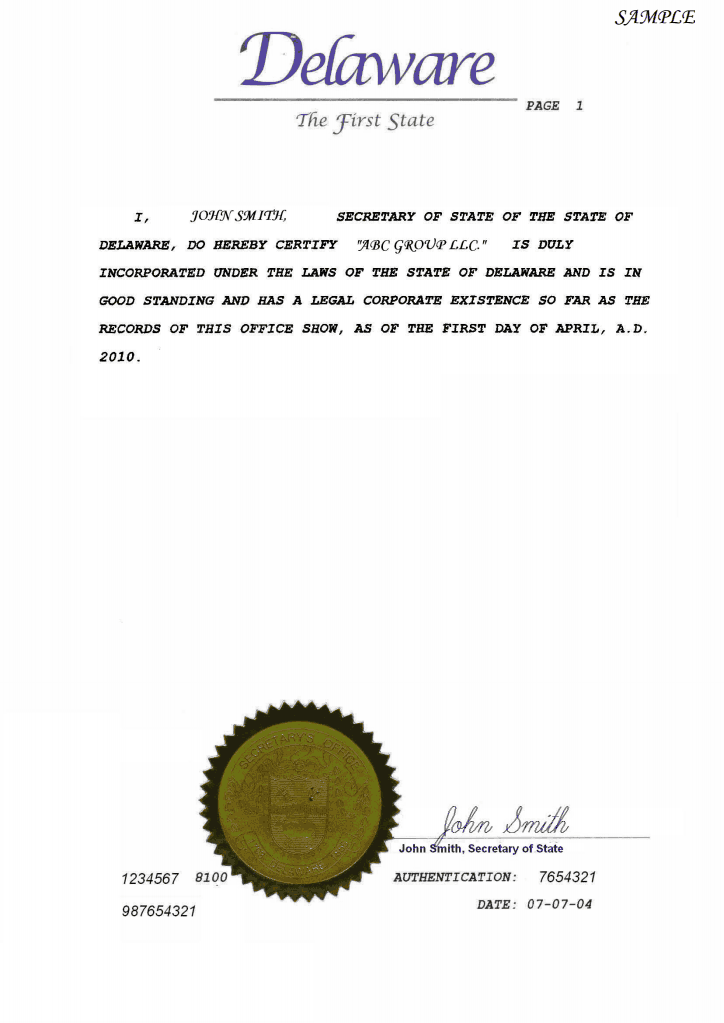

How to Form a New Business Entity. When choosing a business entity type , we. You can download all the forms that your corporation needs in PDF. Taxes for these entities are due on or before June 1st of each year. The filing fee is $ 200.

Penalty for non-payment or late payment is $200. Real Estate, Family Law, Estate Planning, Business Forms and Power of Attorney Forms. Get Instant Quality Info at iZito Now!

Limited liability company operating agreement. This in multiple filing fees and annual reporting requirements. A PARTNERSHIP RETURN MUST BE COMPLETED BY ANY BUSINESS TREATED AS A PARTNERSHIP FOR FEDERAL PURPOSES WHICH HAS ANY INCOME OR LOSS, REGARDLESS OF AMOUNT, DERIVED FROM OR CONNECTED WITH A DELAWARE SOURCE. IF THE PARTNERSHIP HAS NO DELAWARE SOURCED INCOME OR LOSS, NO RETURN S REQUIRED TO BE FILED.

Most states do not restrict ownership, so. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! However, additional information can be obtained for a fee. Upon the filing of a certificate of transfer and domestic continuance, or upon the future effective date or time of a certificate of transfer and domestic continuance, as provided for therein, the limited liability company filing the certificate of transfer and domestic continuance shall continue to exist as a limited liability company of the. Fees for such service typically start at about $1per year.

Estimated Tax, Requirement of Filing. Personal Credits…………. Extension of Time to File………. Corporations have different tax filing requirements than either disregarded entities or partnerships. LLC Filing Requirements.

A limited liability company agreement of a limited liability company having only member shall not be unenforceable by reason of there being only person who is a party to the limited liability company agreement. This fee ranges from $25-$5and is based on New York Adjusted Gross Income. Pursuant to Title Del.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.