Book An Appointment Or Call Us Today. Business Loan Calculator. Most will require monthly payments, such as the SBA or conventional loan. Others may require weekly, daily, or interest only payments.

A select few can require repayment when the loans mature. Regarding small business loans , lenders may also ask for origination, documentation, or closing fees among many others, which can make the actual cost or rate of the loans higher than the interest rate given by the lenders. Calculate a monthly payment for your comemrcial loan or apartment loan. Interest only payment and monthly savings provided.

You also need to consider how much you’re borrowing and how long. For the interest-only perio payments each period will be the interest rate per period multiplied by the full value of the loan. For the remainder of the loan perio calculating the full payments after the interest-only period is no different than it is with any ordinary loan.

Other forms of small business financing are also discussed below. Are you considering an interest-only loan? It helps to know what your payment will be before you sign on the dotted line. See full list on financialmentor. There is no amortization of principal during the loan period.

At the conclusion of the interest-only term, borrowers usually have the option to convert to a conventional loan, or pay the balloon (principal owed). Payments for conventional loans amortize principal by including both principal and interest in every payment. The principal is the face amount o. For most people, the interest-only loan is a good option if you do not intend to keep your property for a long period of time.

Related:Why you need a wealth plan, not a financial plan. You should also be aware that there are risks associated with interest-only loans. For example, interest-only mortgage loans are very risky if the market price of the property falls during the loan period and you want to sell the property. If the sale price of the property is less than the face amount of your mortgage loan you will be “upside-down” – meaning you owe more than your property is worth. Additionally, the interest rate of an interest-only loan is us.

However, interest-only loans can be very beneficial if used in the right situation. This is known as negative equity. They can offer more value for your money than any other refinancing option if used for a brief period of time. However, if this is the only way you can afford to purchase a home then consider reassessing your needs to find a more affordable options. The key is to not be overly lured in by the appeal of a lower monthly payment.

Be sure to seek professional advice before signing up for an interest only loan. Principal – The face amount of the loan, denoting an original sum invested or lent. Mortgage Payment – The amount of money usually charged on a monthly basis for a mortgage that normally includes interest and. Amortization Schedule Calculator: How can I get a full amortization schedule? Loan Repayment Calculator: How much will my monthly payment and total interest cost change for different repayment periods?

Accelerated Loan Payoff Calculator: How fast can I pay off all my loans using the rollover (debt snowball) method? How do you calculate a business loan? What is an interest only business loan? Who offers interest only mortgage? How is interest calculated on a business loan?

Frequently bonds pay only coupon interest , and thus they are interest only loans. The term (duration) of the loan is a function of the Number of Payments and the Payment Frequency. These amounts reflect the amount which would need to be paid in order to maintain a constant principal balance.

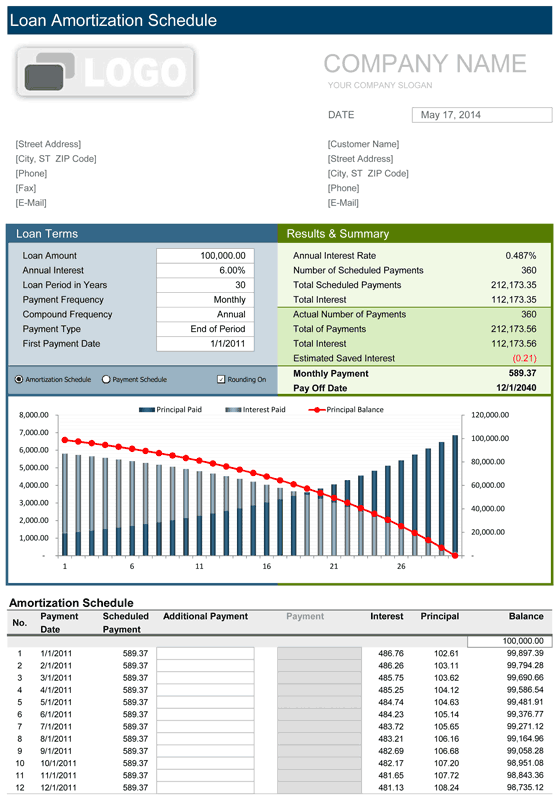

We also have calculators which you can use to amoritize loans over any desired schedule. Free loan calculator to determine repayment plan, interest cost, and amortization schedule of conventional amortized loans , deferred payment loans , and bonds. Using an interest-only mortgage payment calculator shows what your monthly mortgage payment would be by taking factoring in your interest-only loan term, interest rate and loan amount. Let Us Get Your Application Ready to be Submitted to A Lender When the New Program Starts. All captured in colorful diagrams, charts, and scheduled tables.

The business loan calculator summarizes amortization variables that include your monthly payments, the principal amount, your monthly interest rate and a number of payments over the entire lifespan of the loan. Bank Rate’s Calculator is an independent calculator that provides you with a basic estimate of your loan cost and payment schedule. You input interest rate, loan amount, term, and monthly payments.

You will then be given data on the loan, as well as an amortization schedule. Under the Citizens One brand we offer Auto Loans , Credit Cards, Mortgages, Personal Loans and Student Loans. To learn more, please visit: CitizensOne. Your interest only rate per period : 0. First enter the principal amount of the loan and its interest rate.

Then click on CALCULATE. Instantly, you’ll see what your interest-only payment will be. Online commercial Loan calculator. Calculator Use Use this loan calculator to determine your monthly payment, interest rate, number of months or principal amount on a loan.

Find your ideal payment by changing loan amount, interest rate and term and seeing the effect on payment amount. Enquire online about a business finance loan - a business banker will call you back. Money when you need it.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.