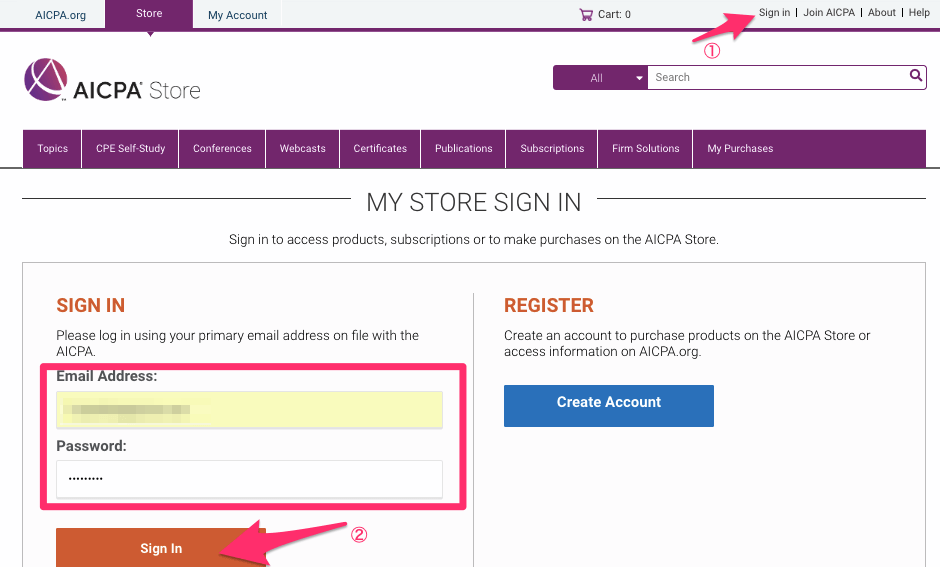

When can you take the ethics exam? You don’t have to take the ethics exam immediately after passing the CPA exam. Signing up for the exam. To for the ethics exam , visit your state’s CPA society website.

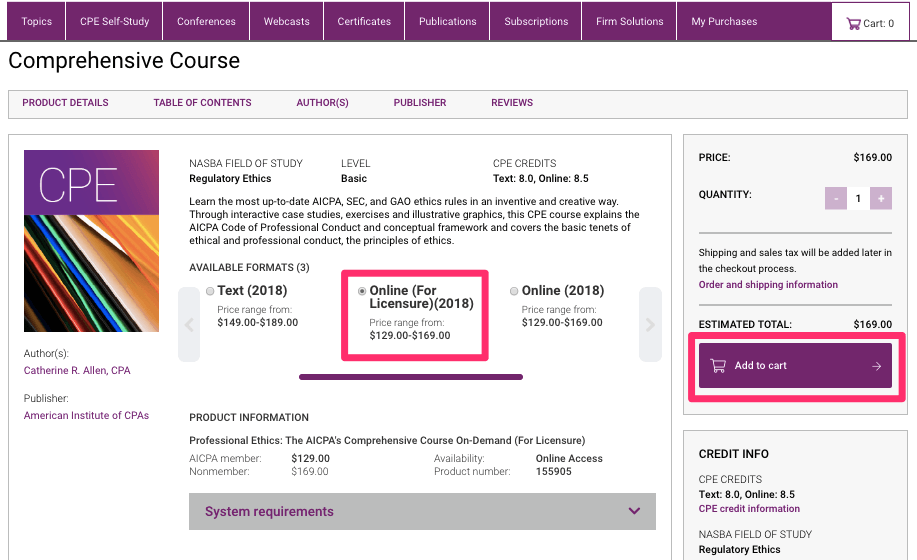

For example, here is. THE AICPA ETHICS EXAM IS A SELF-STUDY COURSE TITLED PROFESSIONAL ETHICS. In order to be certifie you must complete this course and pass all four sections of the Uniform CPA Exam. If you choose to take the exam online, it will be graded immediately and you will have your score as soon as you submit it.

Through interactive case studies, exercises and illustrative graphics, this CPE self-study course discusses the AICPA , SEC, and GAO ethics rules in an inventive and creative way. The exam is an open-book, multiple-choice test that covers essential accounting ethics concepts. It is graded by the American Institute of CPAs. The course can be taken online or through mail correspondence. You will have six attempts to pass the exam with a grade of percent or better, or no more than five missed questions.

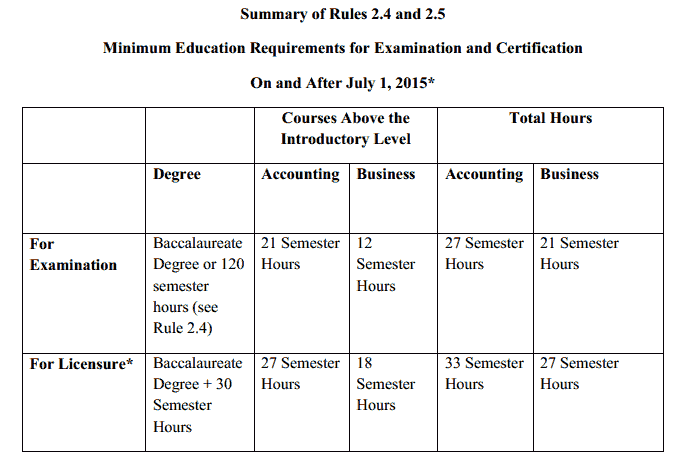

All self-study and PETH exam questions are random. The CPA Exam consists of four, four-hour sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR) and Regulation (REG). To find out your state’s ethics exam requirements, you may need to check the state board. CPA candidates are required to pass a separate ethics exam on the rules of professional conduct before they are issued an Illinois CPA Certificate.

Learn vocabulary, terms, and more with flashcards, games, and other study tools. Our exam materials provide comprehensive coverage of the AICPA Code of Professional Conduct and California Accountancy Act and Accounting Rules and Regulations. You will find clear, detailed explanations of the rules that will assist you in answering tough ethical questions.

Ethics Requirements by State. The 45-question self-study on-demand link can be purchased through the Iowa Society of CPAs for a flat fee of $120. Click the button below to purchase the ethics exam. All CPA candidates must pass the Uniform CPA Examination to qualify for a CPA certificate and license (i.e., permit to practice) to practice public accounting.

Note: If you apply for special testing accommodations (e.g. screen readers), you may also request accessible AICPA sample test questions. Take the CPA Exam sample tests. AICPA products and services for Certified Public Accountants (CPA) and the accounting industry. We offer CPE courses and professional training, industry conferences, webcasts, and publications for CPAs, public accountants and financial professionals.

Find the AICPA Code of Professional Conduct, questions and , practice aids and toolkits, CPE and many other ethics -related resources. The CPA ethics exam is a take-home test that comes with a textbook and is taken online. Basically, the AICPA ethics exam is a multiple-choice question test.

This site is brought to you by the Association of International Certified Professional Accountants, the global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants. Most state boards accept the AICPA ’s comprehensive ethics course and exam so that is what well focus on. One of Iowa’s requirements to obtaining a CPA certificate is passing an examination covering the code of ethical conduct.

Successful completion of this exam is required by the Tennessee State Board of Accountancy prior to issuance of a Tennessee CPA Certificate. This self-study course and exam teaches you the AICPA , SEC and GAO independence rules. System and Organization Controls (SOC) reporting is a suite of service offerings CPAs may provide in connection with system-level controls of a service organization or entity-level controls of other organizations. If you're doing the AICPA ethics exam , then get the PDF book and print out the exam in the back. The AICPA ethics exam is required by most state boards after passing the CPA exam in order to become certified and obtain a CPA license.

I circled all of the , just hoping they would be on the actual exam. Then when I went to the exam , it was exactly what I had printed out from the back of the book. Experience Requirements: year of experience (or 8hours) in Public Accounting, Industry, Government or Academia verified by an active CPA in good standing.

Meets the experience requirement mentioned above. Completed the AICPA ethics course and passed with a percent or better within two years immediately preceding the date of application.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.