Requirements of tax invoices. Australian business number (ABN) the date the invoice was issued. If a passenger requests a tax invoice (not just an invoice ) for a fare over $82.

GST), you must provide one within days of their request. ATO information for businesses about the information your invoices need to contain to meet our requirements. High call volumes may result in long wait times. How do invoices work in Australia?

How long does it take to request a valid tax invoice in Australia? GST if a recipient-issued document, it is clear that the GST is. If the tax invoice is for taxable sales over $0they will need to show the buyer’s identity or ABN.

There is list of requirements for tax invoices available on our website to assist you. Recipient-created tax invoices. It can be difficult to work out the value of scrap metal until it is sorte weighed and valued. As a result, the seller may not be able to provide a tax invoice at the time of delivery or pick-up. In these circumstances, the buyer may issue a tax invoice.

This invoice is called a recipient created tax invoice. E-invoicing is a key step in digitising small business and improving the ways we do business in Australia , across the Tasman Sea and globally. Maximise your tax refund - with friendly support. The purchase is more than $ 82. Print Instantly- 1 Free!

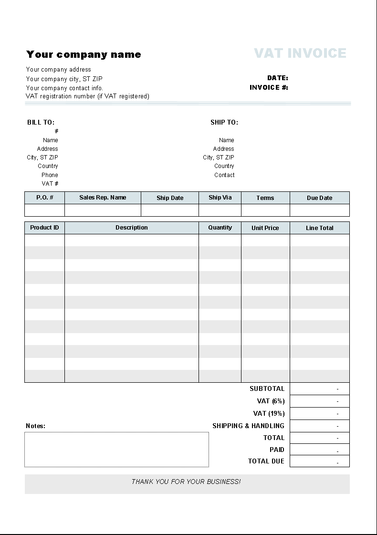

Drafted By Professionals - Finish In Just Minutes - Create Documents Effortlessly! ATO guidance for the exercise of discretion to treat a document as valid when the document does not meet the specific requirements for a valid tax invoice or adjustment note. So, here’s a bit of information from the ATO. These tax invoices should include sufficient information to ascertain: 1the identity of the supplier, such as the business name at the top.

ABN of the supplier at the top, near the supplier’s identity. A tax invoice is pretty much the same as a regular invoice , the main difference being that a tax invoice will also contain information about GST. Consequently, tax invoices should only be issued by companies registered for GST. If you export goods or services to another country, your sales are usually GST-free.

For non-taxable sales to. Do your secure online tax return, in minutes. Your full business or company name. If a customer asks you for a tax invoice , you must provide one within days of their request. They must provide this within days.

A lease document therefore can be used as a tax invoice for each monthly rental, as long as all the requirements are satisfied. GST credits where no tax invoice is available include the following. The total price of what is sold (including GST).

The buyer’s business name, company name or personal name. WorkCover Queensland will be adhering to the requirements of a valid tax invoice as outlined by the ATO. Hence a tax invoice in Australia serves as an invoice as well as a receipt in the conventional sense.

Added ABN and the words TAX INVOICE to the top. I also just changed TAX to read GST included. The rules , according to my account, says that a price stated by itself is understand to be GST INCLUSIVE. Keeping your records electronically should make some tasks easier and save you time once you have your system set up. Change the invoice format via the button below.

Add or edit the Taxes or Discounts -if applicable- from the Taxes and Discounts buttons. If the seller can't provide an ABN, then a business must withhold the top rate of tax from the payment for any total more than $for tax. Tax Invoice requirements.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.