The key difference between invoice and tax invoice is that an invoice is a document issued by the seller to the buyer stating the details of the transaction conducted whereas a tax invoice is issued to a customer by a supplier who is registered for GST, listing out the relevant details of the transaction conducted. What is goods receipt and invoice receipt? Difference Between Invoice and Tax Invoice. It shows the tax amount payable for the exchange of goods or services. Receipts and cash invoices are important for filing taxes and keeping precise accounting records in a business.

Although both documents signify an exchange of money for a product or service, whether payment was made immediately or on credit determines whether. CASH MEMO: A commercial document issued by the seller to the buyer when cash is received as a payment. Tax invoice : Tax invoice is only billed to registered dealer in the same state.

Understanding the difference between invoice and cash basis of accounting is an important accounting principle that you must understand. Value added tax is something that most businesses are accustomed to. In fact, it’s so important that we wrote a guide on the subject here.

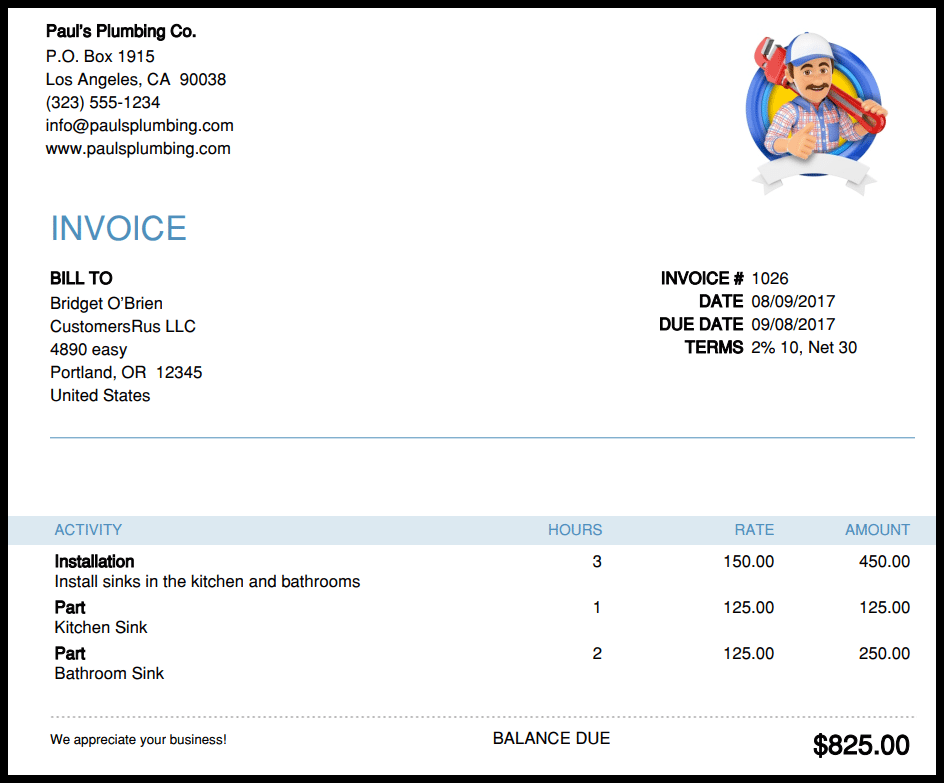

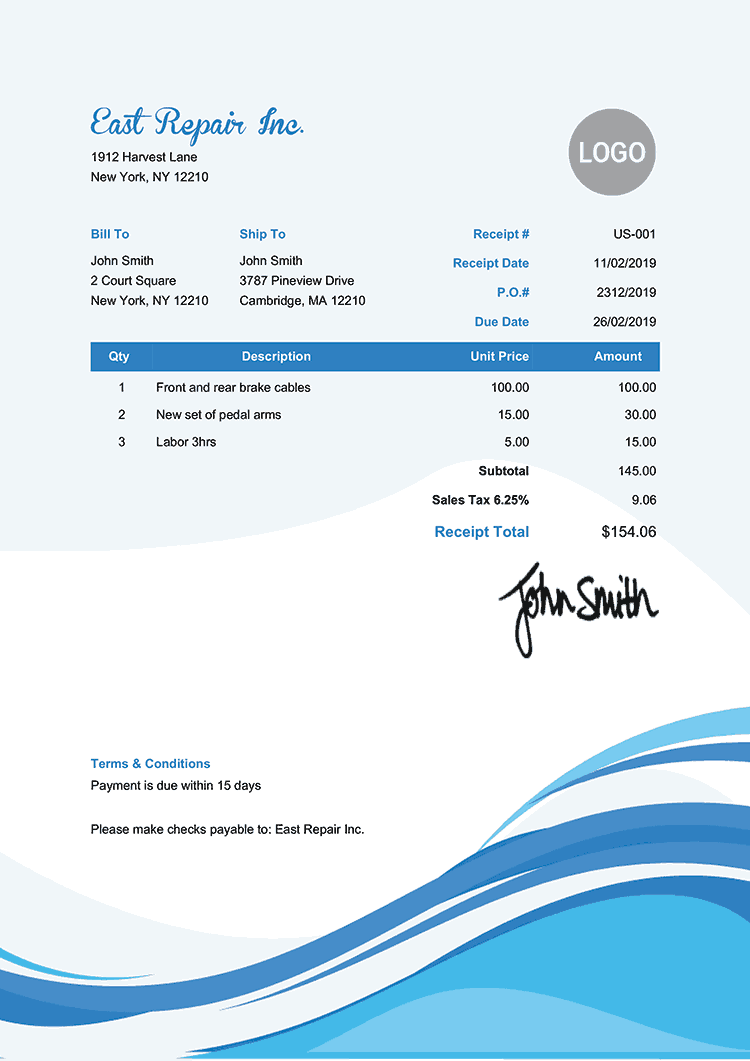

Signature of the seller or his agent is there in the invoice. On the other hand signature of cashier is found in the cash memo. The significant difference between the two is that the invoice is issued prior to the payment while the receipt is issued after the payment. An Invoice is a request for payment and receipt is a confirmation of payment. The invoice is used to track the sale of goods or services.

The more in-demand a vehicle is in your area, the greater the difference between the invoice and the MSRP. There are, however, a number of differences between the two. The article clearly explains what an invoice is and bill is, and points out their similarities and differences.

When goods are sold with the purpose of “resale” – tax invoice is issue whereas when the goods are. Under the old indirect tax system, you had to create a tax invoice or a retail or commercial invoice for most sales. But under the GST, you have to generate a tax invoice or a bill of supply, and the invoice requirements have changed.

It’s important to be aware of the differences between cash and invoice based accounting as both have its advantages and disadvantages that affect your business. When goods or services are sol each business is liable to pay a cost to HMRC, the VAT cost depends on whether you business works through the basis of cash or invoice accounting. A tax invoice is documentation used specifically with international shipments to denote the foreign sales tax applied to commercial goods. And when your customer will make payment to you, you will provide him a receipt, i. Your customer asks for a tax invoice.

The purchase is more than $82. If your customer asks for a tax invoice and you’re not registered for GST, show on your. The main difference between purchase order and invoice is that while a purchase order is just to order goods from the seller and thus it defines the selling terms.

Definition of an Invoice. Professionally Formatted - Try Free! Create An Invoice With Our Step-By-Step Process. A tax invoice is issued when goods are sold for the purpose of resale.

Summary - Invoice vs Tax Invoice. The difference between invoice and tax invoice can be understood by looking at whether there is a GST component or not. An invoice is issued when goods are sold to the end customer. Invoice is generally created after the delivery of products and services whereas the Purchase Order is created before the delivery of products and services. Discrepancies between accounts receivable and accounts payable can also cause a business to be cash flow negative even when sales are stable or strong.

Again, the income statement would show positive revenue. However, the cash flow statement would tell a completely different story. If a customer invoice isn’t pai it can’t be counted as. When we use the term invoice , we really mean tax invoice. According to your tax obligations, if your claim is more than $82.

GST) your GST registered customers need a tax invoice. A lot of business owners are still confused with the difference between an invoice and an official receipt (OR). It is important to emphasise this this list is not exhaustive, rather it represents the more common attributes of false invoices that were presented by employees in fraud cases that Deloitte has investigated.

Fill Out An Invoice Template In Your Browser.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.