What is board resolution for issue of shares? What are the rules for preference shares? Are preference shares irredeemable? Authorisation in Articles of Association (AOA) Before issue of preference shares, check whether Articles of Association permits, if not then AOA needs to be amended.

Request your advise regarding the allotment of shares. Convene the Extra Ordinary General Meeting and pass the requisite Special Resolution. File Form MGT-with ROC within days of passing of special resolution. The Share Certificates will be issued to the shareholders within months from the date of Allotment of Shares.

The Stamp duty should be paid as per the provisions of the State. Issue Share Certificate. A company needs to file MGT-with the ROC within thirty days from passing the special resolution in the general meeting.

It also needs to file PAS-within fifteen days of allotment of shares. File PAS-within days of passing of resolution for allotment of shares. Attachment: Resolution for allotment of Shares. OCPS aggregating to Rs.

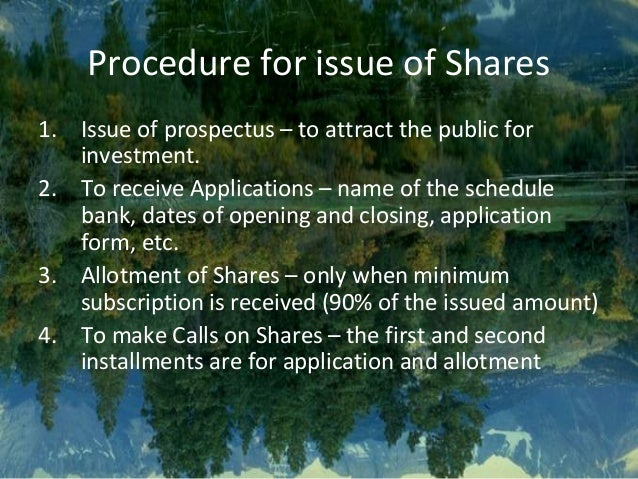

Shares are allotted via board resolution. Short form board minutes approving the allotment and issue of shares by a private company, where any necessary shareholder resolutions will be passed using the written resolution procedure. Directors will then need to allot by passing a board resolution.

As explained above, when done properly, the allotment of shares can protect shareholders, capital and businesses in regards to issues related to shareholding structure. Therefore, it is vital that companies ensure best practices when allotting shares to all parties and follow the procedures outlined by Singapore law. Deliver duly stamped Share Certificates in form SH-to the allottees within months from the date of allotment of rights shares. Make entry of allotment of shares allotted against rights offer in the Register of Members maintained in Form No.

With reference to your applicationNo. Describe ways a preference share may take preference over an ordinary share ? The number of shares issue their pricing, and preferred companies or individuals is also decided as per the preference of existing shareholders upfront. No company shall allot any preference shares or convert any issued shares into preference shares unless there are set out in its constitution the rights of the holders of those shares with respect to repayment of capital, participation in surplus assets and profits, cumulative or non-cumulative dividends, voting and priority of payment.

Important note: There are statutory restrictions on the circumstances under which the board of directors can authorise allotment and issue of shares , e. In other circumstances, e. Allotment pursuant to any resolution passed at a meeting of shareholders of a Company granting consent for preferential issues of any financial instrument, shall be completed within a period of three months from the date of passing of the resolution. If allotment of instruments and dispatch of certificates is not completed within. Rupees Ten Only) each aggregating to Rs. Sixth, once the resolution is filed with the registrar in Form MGT-1 a board meeting is called up with the way of due notice to approve the allotment of sweat equity shares accordingly.

Seventh, once the resolution is passed for the allotment of the shares the company is required to fil e Form PAS-within days of passing of the Board. Board Resolution - Allotment of Preference Shares. Board may in its absolute discretion deem necessary or desirable for giving effect to this resolution. Rated Non-Convertible Redeemable Cumulative Preference Shares.

Not applicable, as the securities are non-convertible preference shares which are proposed to be issued (at par) at face value. For infrastructure ppj projects preference shares can be issued for a period of more than years but for less than years. This includes the relevant board minutes, resolutions , class consents, new articles of.

Preference shares shall liable to be redeemed within a period not exceeding years.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.