What are the expenses of a business? What expenses can be written off as business expenses? Startup assets: Typical startup assets are cash (the money in the bank when the company starts), business or plant. Just choose a business plan template and download it. Open it in Word or Excel (or another program that can display the DOC or XLS format), edit it, and print your personalized business plan.

Retirement Plans - Retirement plans are savings plans that offer you tax advantages to set aside money for your own, and. Business expenses are part of the income statement. Your business plan is the foundation of your business. Learn how to write a business plan quickly and efficiently with a business plan template. One-time expenses are the initial costs needed to start the business.

Buying major equipment, hiring a logo designer, and paying for permits, licenses, and fees are generally considered to be one-time expenses. You can typically deduct one-time expenses for tax purposes, which can save you money on the amount of taxes you’ll owe. In finance and accounting, costs are the direct costs you have in your sales forecast, and expenses are operating expenses like rent, advertising, and payroll. There are three common types of spending in a normal business.

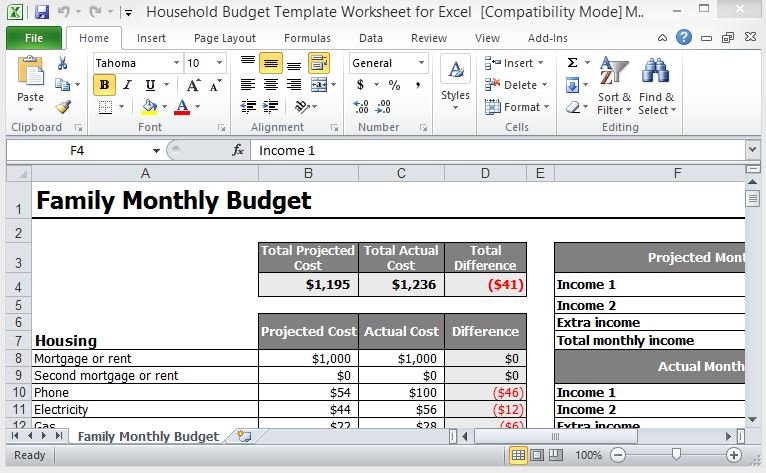

They are not the same thing. For efficiency, these costs should be covered in the monthly budget. These are the things you write checks for. The financial plan of the business requires growth financed by positive cash flows from operations. Additional outside investment or owner investment is not necessary.

The new business line is not capital-intensive, but will increase fixed costs of the business which must be covered almost immediately by additional revenues from bookkeeping sales. Set up a spreadsheet projecting your sales over the course of three years. Create an expenses budget. Develop a cash-flow statement.

What’s included in an income statement? The top line of your profit and loss statement will be the money that you have coming in, or your revenue from. Direct costs, also referred to as the cost of goods sol or COGS, is just what it sounds like: How much. The organizational structure of the company is an essential element within a business plan because it provides a basis from which to project operating expenses. Any allowed expense must be ordinary and necessary.

An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your business. These might be contracts, leases, purchase orders, intellectual property, key managers’ resumes, market research data or anything that supports assumptions or statements made in the plan.

Expenses must not be lavish or extravagant. Strategic plan expenses estimate List expenses associated with any goal or action in the plan that aren’t part of your normal operating expenses. Additionally, estimate your current operating expenses by forecasting each item based on how it increases to accommodate for the expected growth. Make sure you understand expenses as a technical financial term. You need to understand that difference if you are going to run a business and manage cash flow.

This means substantiating the reimbursement amount with actual billing statements, with business calls noted and an offset for the cost that the employee would have paid anyway. This level of paperwork can be daunting. In order to develop the overhead expenses for the expense table used in this portion of the business plan , you need to multiply the number of employees by the expenses associated with each employee. The time you spend making your business plan thorough and. A business plan is also a road map that provides directions so a business can plan its future and helps it avoid bumps in the road.

You may be able to articulate the business overview, vision , objectives, and concise action items in a single page, but you might want more detail in the financial and marketing sections. Simplify your accounting processes with an easy-to-use solution.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.