Residents are taxed on all rental income regardless of where the property is located. This property tax differs from any form of rental income tax or expenses related to that property. Whether you live at that property or not, if you own it you have to pay the taxes. If you are a cash basis taxpayer, you report rental income on your return for the year you receive it, regardless of when it was earned. Does california have income tax?

You must attach a copy of the other state return to. This is similar to the federal income tax system. You will get a state tax credit in your home state for any nonresident state taxes paid on income that is being taxed in both your resident and nonresident states. You can add a state under the state taxes. The taxes on selling a rental house can add up fast.

It might sound like being a landlord and collecting rent is a big tax headache. California Income Taxes. But remember that you can also deduct expenses to shrink your tax liability. Catastrophic Loss Helen does not carry flood insurance. You might not use the rental property personally.

If so, you don’t need to prorate your expenses between personal and rental use. Reporting rental income. Deduct rental expenses in the expenses section of Schedule E. If you have a rental profit, you may be subject to the Net Investment Income Tax (NIIT).

For more information, refer to Topic No. Additional Information. Paul’s rental activity is reported on a December year‑end basis.

Therefore, his net rental income before deducting CCA was $1($0– $900). Paul wants to deduct as much CCA as he can. Income taxes are reported and paid annually to the federal government and many state governments on “ taxable ” income , which is income after allowed expense deductions. You pay this tax directly to the government.

Lodging taxes on a short-term rental are a percentage of the cost of your guest’s stay that is added to the price of the bill. Under current law, rental income is classified as “passive income ” and that income simply passes through to the owner’s personal tax return and they pay ordinary income tax on it. Your rental income is tax free if, during the year.

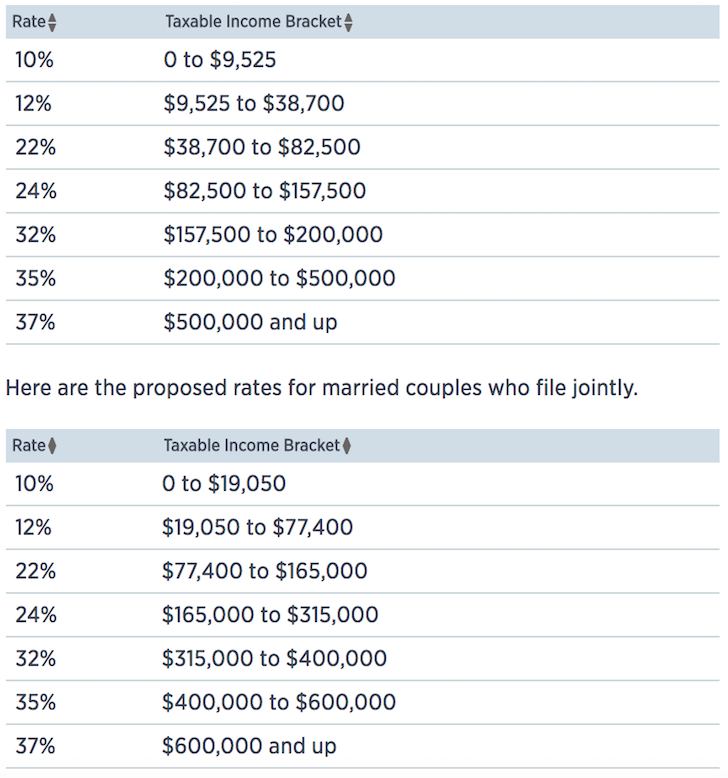

Mental Health Services surtax that isn’t included in the marginal tax rate schedule. Your filing status and the amount of income you earned for the year determine at which rate you will be taxed. Rental properties generally show taxable losses for the first many years. This chart below shows an example of how a loss would be calculated.

The IRS can go after any of the parties (tenant, property manager and foreign owner) who fail to send in the of the gross rental payments tax. A non-US owner earning rental income from US real estate (and not having sent into the IRS) is liable to the IRS for the failure to have the withholding on their rental income , unless they follow. Of course, rental income is taxable. But you also can deduct many costs associated with your rented second home.

If you rent out a room in your home, the tax rules apply to you in the same way as they do for landlords who rent out entire properties. For instance, if you owed another state $5in taxes for the income earned on a rental property there, you can take a credit of $5on the taxes owed to your home state. Rental Income and Expenses - Real Estate Tax Tips.

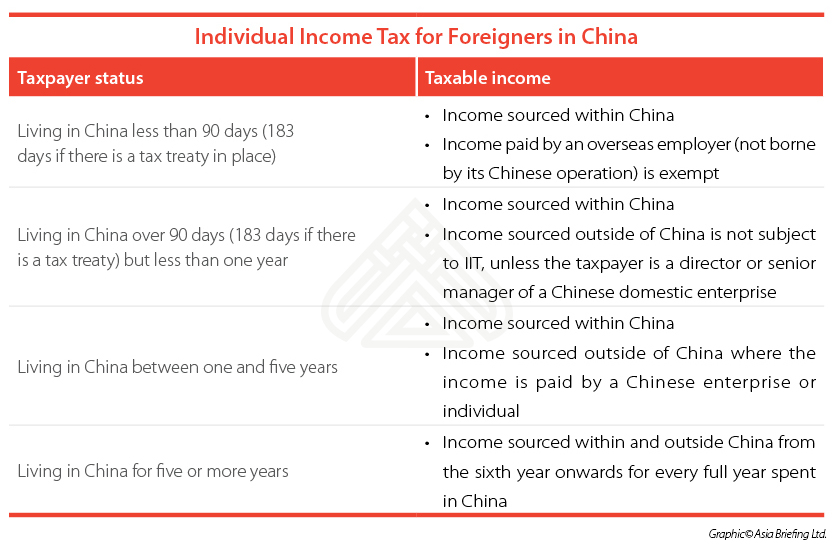

Internal Revenue Service. Tips on Rental Real Estate Income , Deductions and Recordkeeping. The general rule for nonresident aliens is that for rental property, you are taxed at a flat (or lower treaty) rate on your gross income from U.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.