It is likely that the fair value of the assets is different from the cost less depreciation shown on the balance sheet. A balance sheet contains specific information about the net worth, assets, and liabilities of a business. It is essential for this tool to be precise as financial records are taken seriously by investors and other stakeholders of the business no matter what industry the company belongs to. Understand Balance Sheet items like Cash, Accounts Receivable, and Deferred Revenue.

Learn the differences between Assets and Liabilities, and how to calculate Total Equity. Businesses report information to outsiders in the form of financial statements. Below is a completed sample balance sheet.

This was achieved using six transactions which are explained in six steps. The following balance sheet example is a classified balance sheet. See full list on accountingcoach.

The notes (or footnotes) to the balance sheet and to the other financial statements are considered to be part of the financial statements. The notes inform the readers about such things as significant accounting policies, commitments made by the company, and potential liabilities and potential losses. Go to the website for a company whose stock is publicly traded and locate its annual report. Review the notes near the end of the annual report. A number of important financial ratios and statistics are generated by using amounts that are taken from the balance sheet.

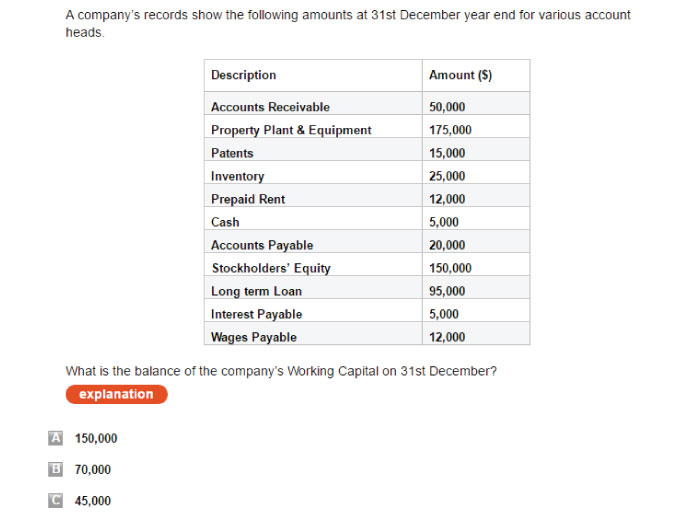

For an illustration of some of these computations see our Explanation of Financial Ratios. What does a balance sheet tell you? What must balance on a balance sheet?

Should balance sheet always be balanced? What are the items in a balance sheet? Profit or loss statement shows profit or loss for the period.

You are reading this article because you want to know what audit assertions you need to consider whilst conducting an audit of profit or loss statement. This is why sacred accounting have explained each of these assertions in detail (A little bit though!). What is written in the profit and loss statement? All these sales are valued at an accurateamount.

All the sales of $40pertain to the current periodi. How will we Test profit and loss assertions in the above example? Balance sheet or statement of financial position has assertions. Nhirkm Engineers has all therightsof these fixed assets.

We willtest all these assertions of balance sheet item i. Thesefixed assets actually exist. We’re ready to put everything into a standard template (you can download one here). Here’s what a sample balance sheet looks like, in a proper balance sheet format: Nice.

Your balance sheet is ready for action. You can also see how the company resources are distributed and compare the information with similar companies. The FAR test will make a distinction between a subsidiary ledger and general ledger. As the name implies, a subsidiary ledger posts transactions for a portion of the activity in an account. A good example is a company that tracks many different types of inventory items.

Suppose that Sturdy Hardware has a subsidiary ledger for tools in inventory. This quiz and worksheet will test your knowledge of a classified balance sheet and the items listed on it. There are various items presented on a classified balance sheet. COM (Bachelors of Commerce), MBA (Finance), Company Secretary, Chartered Financial Analyst, Chartered Accountancy, ICWA, M. COM, Ratios, Financial Statements, Profit and Loss Account, Balance Sheet , Cash Flow Statement, Fund Flow Statement, Partnership Accounts. Get this test now Check Download as PDF Download as PDF.

The definition of insolvency is “the inability to discharge your liabilities as and when they fall due”. To demonstrate this, we have set out below an example of a balance sheet , that, whilst showing the company to have positive shareholders’ funds, on a technical basis, is actually insolvent. This is different from an income statement, which covers a period of time. Let’s assume Carole’s Clothing Store is applying for a loan to remodel the storefront.

The bank asks Carole for a detailed balance sheet, so it can compute the quick ratio.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.