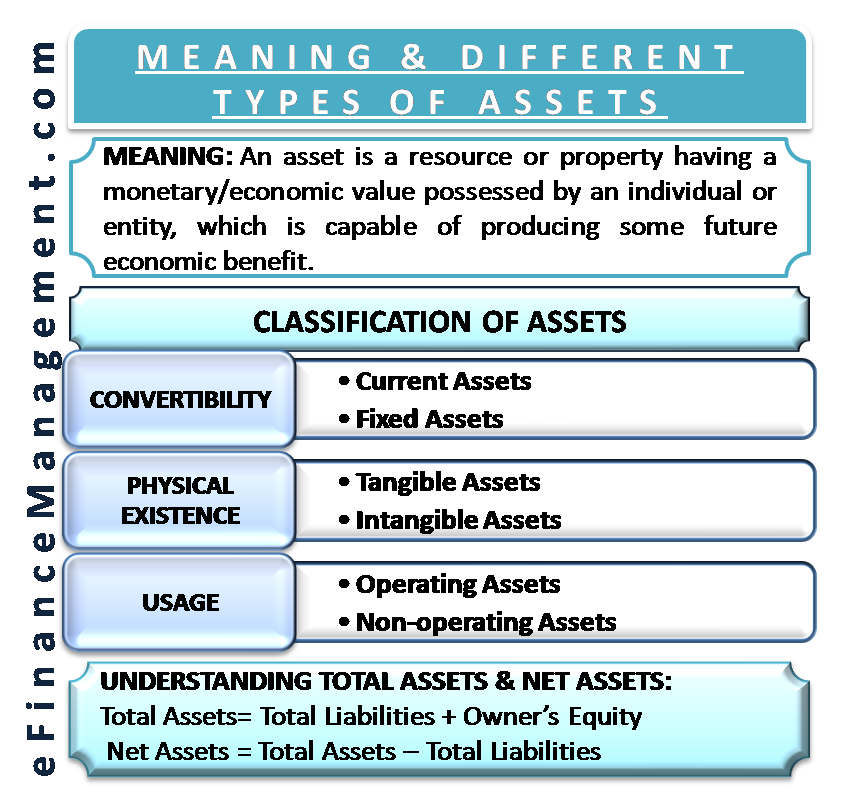

Losses from Investments. Damages Caused to Fire. The most common types of non - operating expenses are interest charges and losses on the disposition of assets. The general rules for deducting busi-ness expenses are discussed in the opening chapter.

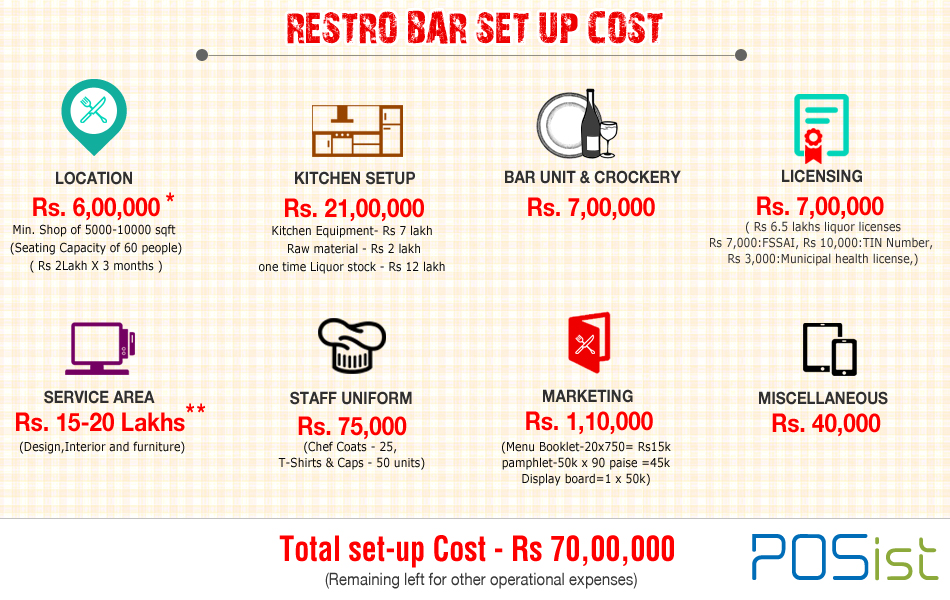

The chapters that follow cover specific expenses and list other publications and forms you may need. Individuals can deduct many expenses from their personal income taxes. Below is a list of deductible expenses , organized by category. MEDICAL AND DENTAL EXPENSES You can deduct most expenses relating to medical or dental diagnosis, treatment or prevention as long as those expenses are in excess of 7. WORKSHEET 3: MONTHLY OPERATING EXPENSES Some of your start-up expenses will also become ongoing monthly costs once your firm is in operation.

It is necessary to estimate all of your monthly costs so that you are realistic about the income your firm will need. What is included in operating expenses? What are the types of operating expenses? Generally, monthly bills are payable for them.

See full list on wallstreetmojo. These are the expenses which are paid by the company for their staff during their official visit. The staff can travel to meet customers, for some supplies or any other event.

In such a case either company pays staff expense directly or reimburses the staff after their visit. These expenses are charged in the PL as traveling expense. For example, pen, papers, clippers etc.

The expenses which are related to payment of utility bills of the company like expenses of water and electricity that generally are used for the daily operating activities are the utility expenses and are charged to the profit and loss account of the company. The property tax paid by the company on its properties forms the part of the operating expenses of the company. These operating expenses which are incurred for using the legal services by the company. The fees charged by the banks for the general transactions going in the business are known as the bank charges. The Repair and maintenance operating expense on the asset used for production like repairing requirements of machines, or the vehicles in the company.

The expenses which are incurred for taking insurance of health care, general insurance of staff and fire insurance are to be charged to the profit and loss account under the head insurance expenses. The same however does not include the trade discount which the company gives to its customers. This type of operating expenses which are incurred for research of the new products are treated as revenue expenses and should not be capitalized. The entertainment expenses incurred for the sales and related support activities forms the part of the operating expenses of the company.

Cost of the Goods Sold is the Costs which are incurred for the Goods or products sold by the organization during a specific time period. This operating expenses that are incurred for the purpose of increasing sales are part of the sales expenses. The cost which is considered while calculating the cost of goods sold refers to the cost which is directly attributable to goods or products sold by the company. Freight-in is the shipping cost which buyer has to pay for purchasing the merchandise when terms are the FOB shipping point.

The expense related to freight-in is considered as part of the cost of merchandise and in case if the merchandise is not yet sold then the same should be considered in the inventory. Freight out is the cost of transportation which is associated with the delivery of the goods from the place of the supplier to customers and the same should be included within cost of the goods sold classification in the income statement. These are the costs which are incurred to make the product in the condition to sell it to customers. Rental Cost which is paid for the properties used for providing the support related to the production. The Salaries, wages, and other benefits are given to the staff related to the production of goods.

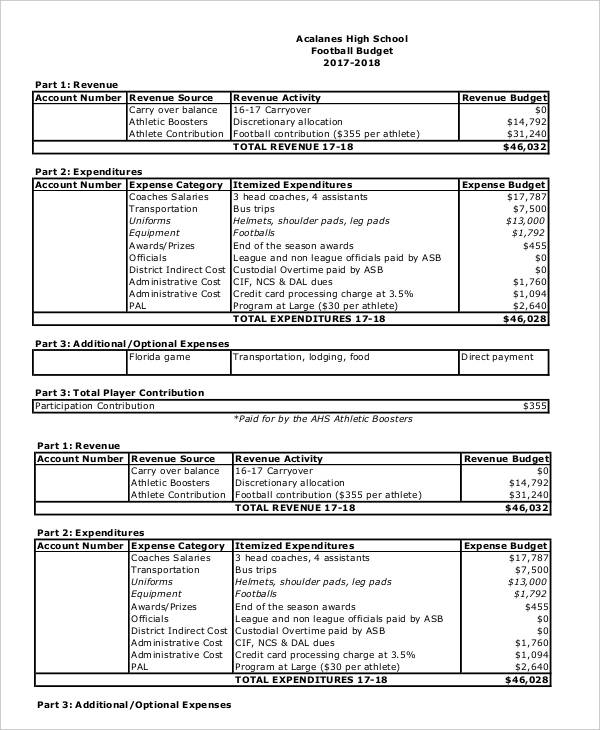

The reduction in the value of the asset due to wear and tear while using at the time of production is the depreciation expense and forms the part of the cost of goods sold. These are incurred which is directly attributable to production form part of the cost of goods sold. You may learn more about accounting from the following articles- 1. Difference Between Actual Cash Value vs Replacement Cost 2. Industry Examples of Cost Product 4. Meaning of Product Cost 5. Often operating expenses receive the most scrutiny from a company, as these types of costs may be less fixed than their non - operating expenses , manufacturing costs and capital expenditures. Operating Expense Examples 3. A company’s senior management may try to reduce operating expenses by outsourcing areas of the business or allowing some of the existing staff to work.

Non-operating expenses normally arise due to a financial or legal responsibility of the business which needs to be paid to meet liabilities of that business. Compensation and related payroll tax expenses for non -production employees. Sales commissions (though this could be interpreted as a variable cost that is therefore part of the cost of goods sold) Benefits for non -production employees.

Pension plan contributions for non -production employees. Business Expense List B. Automobile Expenses : 1. We have updated the summary of significant changes in the BARS manual. Includes expenditures for employee benefits, salaries, special payments, and wages of state employees.

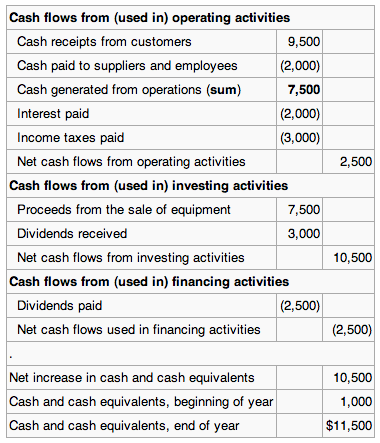

Some business owners don’t have an income statement for their business, or their income statement doesn’t separate expenses into cost of goods sol operating expenses , and non - operating expenses. In this case, you can still get a sense of how much it costs to run your business. When a property purchases operating equipment items, it must determine the period of consumption and expense the purchase over that time period.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.