Authorize someone to make your legal decisions. Downloa fax, print or fill online more fillable forms, Subscribe Now! No Hidden Subscription to cancel. Million customers served. You can print other Indiana tax forms here.

What is Indiana limited power of attorney form? How to obtain a power of attorney in Indiana? All proceeds and negotiations must be to the benefit of the seller (“Principal”) and must be signed in front of a notary public to be usable. Each entity has its own. Find power of attorney attorney on AllSearchSite.

We show you top so you can stop searching and start finding the you need. Looking for power of attorney attorney? Explore power of attorney attorney. Easy to Use Templates.

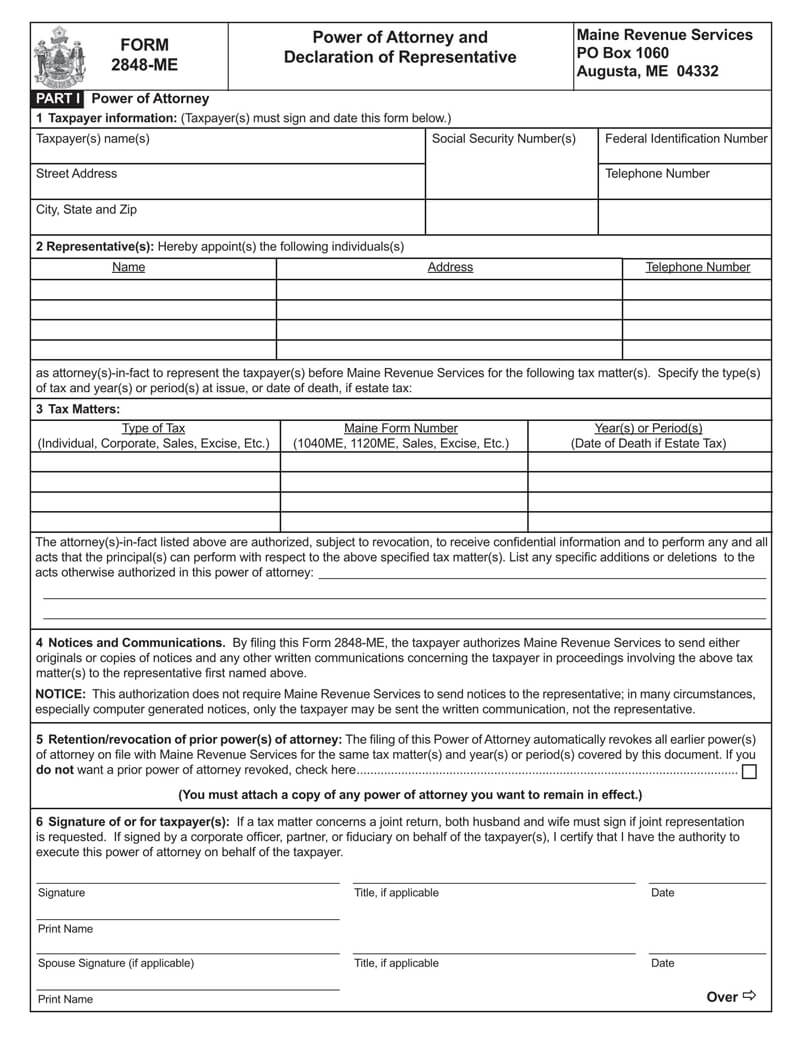

If a copy is provide the person forwarding the copy certifies, under penalties for perjury, that the copy is a true, accurate and complete copy of the original document. Otherwise known as the form ‘ POA – , the document is recommended to be forwarded to a CPA (Certified Public Accountant) or tax attorney because this will. Power of Attorney Form. Mail: Indiana Department of Revenue PO Box. Get Your Answer Quick!

Otherwise known as the “ POA – ” form, the document is recommended to be forwarded to a CPA (Certified Public Accountant) or tax attorney because this will ensure that he or she has some knowledge of the tax system in Indiana. Completing the form in Indiana is simple. You simply check off the actions you want to authorize your agent to do, and sign the form in a notary public’s presence. Read if the principal or agent would like to view their full rights and responsibilities of Indiana law.

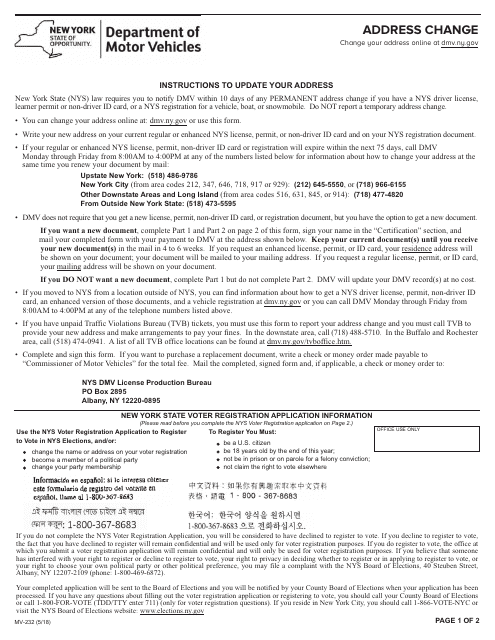

Edit, Sign, Print, Fill Online more fillable forms, Subscribe Now! Discover power of attorney attorney. Our Personalized Online Process Was Made For You! Legally Binding Poa Forms. Only when DOR has received the properly completed POA-can a DOR employee speak with the representative about the specific tax type and period indicated in the POA-form.

Please note that the POA-form does not need to be notarized. Contact and Mailing Information: Indiana Department of Revenue P. A revenue or tax power of attorney gives an individual or entity you appoint (that is, your agent) the legal capacity to file taxes and manage other tax issues on your behalf. In Indiana , this form is also known as a POA-1.

Renew the POA-in five years if desired. The POA-will remain valid for five years from the date that it is signed. It will need to be renewed by executing a new form when the five years expires.

Step by Step in Minutes. As with all POAs, it is important that you know and trust the person being designated as your agent. Indiana tax power of attorney permits a person to hire someone else to file taxes to the Department of Revenue on their behalf.

Choose a decision maker. Independent attorney help.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.