With Equidam, you can seamlessly compute your valuation using methods, of which are properly using these multiples , start now! Valuation Multiples by Industry. See full list on eval. Abercrombie and Fitch Co : Q - 0. What are industry valuation multiples? What is the EBITDA multiples of the industry?

Can construction firms have EBITDA multiples? How do you calculate industry multiples? There are four different types of valuation methods that can be used to value retail businesses, as follows: 1. Asset-based valuation The basic formula to use for this method is: The fair market value of a company’s assets less the fair market value of its liabilities = the fair market value of a company’s equity. Income approach to value (capitalization of earnings) This method is most the accurate for retail clothing companies, which usually have a constant growth of earnings. Market approach to value This method utilizes market indications of value such as publicly traded comparable retail clothing companies company stock and acquisitions of privately held retailers.

The retail clothing industry is very concentrated and the largest companies bring in of the total industry revenue. Most companies in the retail clothing industry are specialized and have found a niche market of customers to appeal to such as women’s wear, sporting apparel, maternity, men’s clothing, or children’s clothing. The size of retail clothing companies range from small independently owned boutique shops to large department stores.

Trends in the retail clothing industry have changed dramatically over the past couple years, especially in response to the recent economic turmoil. Reduction in Advertisement Spending Like many companies today, retail clothing stores are looking to cut costs wherever possible. Many clothing stores are reducing their spending on advertising.

Retail stores are looking for any incentive to get people in the door and shopping. Fewer Premium-Priced Products Introduced Since many consumers are not currently buying things that are not deemed as “necessary”, many retail clothing stores will introduce fewer premium priced products and instead focus their efforts on more affordable apparel. The following are performance metrics that the retail clothing industry use to benchmark their performance to others in the industry : 1. Same-store sales growth 3. Sales per Square Foot 2. Operating cash flow 4. Some organizations and websites that publish helpful information include: 1. National Retail Federation 2. American Apparel and Footwear Association 3. There are approximately publicly traded clothing companies in the U. Market capitalization ranges from $80to $billion. The top five publicly traded retail clothing companies ranked by sales are: 1. The size of private retail clothing companies that were bought and sold recently varies greatly, both in terms of their sales, and the purchase price paid for the companies. This range of market multiples is too variant to be useful without further analysis.

A proper value for the company that is being assessed should be based on the performance of the subject enterprise, compared to the performance of others in the same industry. Industry economic conditions also vary at different times, which affect retail clothing stores as investment opportunities. With the recent economic conditions, the retail clothing industry has struggled to maintain their revenue levels.

Many consumers are not shopping and are hesitant to spend their discretionary income on clothes. The recent levels of unemployment have decreased the total discretionary income of the U. These economic trends have forced many small privately owned clothing stores to shut their doors and have required larger stores to make budget cuts and reduce their expenses wherever possible. For now, retail clothing stores are offering sales and promotions to bring customers in the door.

However, it is hard to tell how long these drops in revenues will last or how quickly the retail industry will bounce back from the current economic conditions. These industry and economic factors have had a negative impact on the value of retail clothing businesses. Fulcrum Inquiry performs business appraisals for retail clothing stores, and other businesses.

Determining the multiple of EBITDA (by industry ) to use for company valuation can be a challenging and debated decision. There are many attributes that factor into choosing an EBITDA multiple, with one of the most influential aspects being the industry in which the valuated business operates. This is primarily due to future growth considerations.

For instance, high tech businesses will typically be valued at higher EBITDA multiples than manufacturing businesses because of growth potential. However, there are many other factors that influence EBITDA multiples other than industry growth prospects. The size of the business and the level of EBITDA itself plays a huge part in selecting an EBITDA multiple, with the general perception that investments in larger businesses have less risk. The current economic climate,. The How to Sell a Business Newsletter Series on this website helps explain how to value a business using multiples of SDE, EBITDA or Adjusted EBITDA.

We strongly encourage you to read the six articles mentioned in the section below. It really depends on the type of company, the sector it’s in, and your own judgment. It is more rare to use the ratio for financial or energy companies. Or approximately to of annual gross sales including inventory. Broker Comments: Many business sales professionals and appraisers give slightly higher multiples for valuing retail clothing stores than what I am showing here.

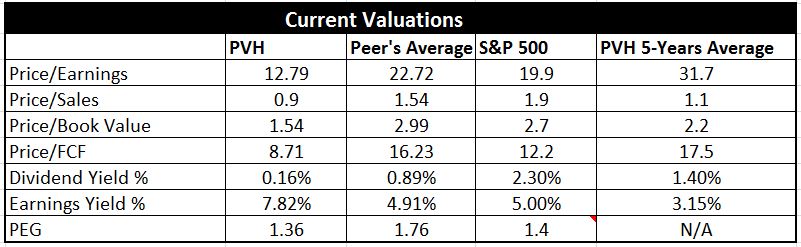

The Retail (Online) industry saw the highest valuation multiples with 23. The report provides an overview of market multiples of companies in major industries in the SP BSE 5Index. The media, apparel and energy sectors experienced the largest decline in multiples during this. Investment decisions make use of equity multiples especially when an investor aspires for minority positions in companies. The list below shows some common equity multiples used in valuation analyses.

So you have a set of business sales, each with its own set of financials and the actual business sale price.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.