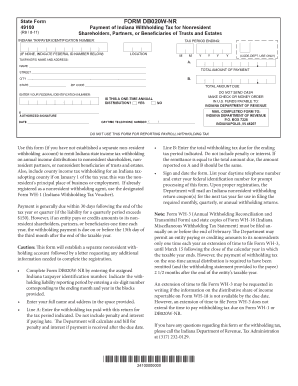

How do I register a new business? WH-: Annual Withholding Tax Form Register and file this tax online via INTIME. You have two options for electronic payments: the DOR’s INtax system or electronic funds transfer. Print or type your full name, Social Security number or ITIN and home address.

Note: Withholding is required on any entity that is not an individual. Search for Payroll Tax Problem info. Find all the information you need for Payroll Tax Problem online on Alot. For more information. Small Business Events in Your Area.

Depending on what products and services you offer, you may also need to pay sales tax, use tax, withholding tax, alcohol excise tax and more. The county tax rate will depend on where the employee resided as of January 1. The department assigns TID numbers, and each entity has its own TID number. The Internal Revenue Service provides the employer identification number (EIN). If yes, enter your Reporting Number (TID). Indiana Tax ID Number.

If taxpayers are looking for services, dial 2-1-to find a nearby VITA location and schedule an. Resources To view the updated tax formula, go to the HR and Payroll Clients page from the MyNFC drop-down menu on the National Finance Center (NFC) Home page. Multiply the taxable income computed in step by 3. You may select any amount over $10.

Section of the W-is a bit more open ended. Here you’ll be able to state other income and list your deductions, which can be used to reduce your withholding. Download Blank Forms, PDF Forms, Printable Forms, Fillable Forms. Request for Taxpayer Identification Number (TIN) and Certification. NOTICE: This site contains confidential and personally identifiable information.

Frequently Asked Questions. Deposit withholding from pensions and annuities combined with any other nonpayroll withholding reported on Form 9(e.g., backup withholding ). The account is generally referred to without the “R” at the end. If you withhold an additional amount: You can request an additional amount withheld from each paycheck. Note: You must specify a filing status and a number of withholding allowances on Form W–4. You cannot specify only a dollar amount of withholding.

If you have already registered and are ready to transfer your withholding information go to E-file and Payment Options in the top right hand corner of most of the pages within the DOR webpage. Know when I will receive my tax refund. Pay my tax bill in installments.

Have more time to file my taxes and I think I will owe the Department. Pence used private AOL. This number is entered on state tax forms used to report state income taxes withheld from employee's pay. State Withholding Number. Check with your state.

Include your account number , tax type, start date and end date for the periods needed. We will generate and mail the form(s) to you.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.