Can LLC members change their fiduciary duties? What is member fiduciary duty? Are LLC members fiduciary in Texas?

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement. An LLC can be structured as manager-managed or member-managed. In a manager-managed LLC, the members appoint a manager or managers to run and manage the LLC business. The managers who have been charged with the responsibility for running the LLC have a duty to the members and other managers to act in good faith and promote the interest of the LLC.

In most states, the manager’s fiduciary duties include the duty of loyalty and the duty of care. See full list on lawyers. LLC members have fiduciary duties only if their LLC is structured as a member-managed LLC.

If the LLC is member-manage then the members share in management responsibilities of the LLC. In that case, the members (like managers in a manager-managed LLC ) have a duty to the other members and the LLC to act in good faith and promote the interests of the LLC. As with managers, this generally includes the fiduciary duty of loyalty and duty of care to the other members and the LLC. The fiduciary duties of LLC members and managers are laid out in a state’s LLC statute and relevant case law. Some states do not allow LLC members or managers to change or eliminate their fiduciary duties.

Others allow changes within certain specified parameters. Recently some states, like California and Delaware, have amended their laws to give LLCs more flexibility in deciding the scope of the fiduciary duties for their LLC managers and members. Under Delaware’s amended law, LLCs can eliminate fiduciary duties altogether as long as they do “not eliminate the implied contractual covenant of good faith and fair dealing. The intent was to give parties wide latitude to determine by contract the fiduciary duties for their LLC members and managers.

You may want to consult an experienced business law attorney if you are trying to decide whether an LLC is the right structure for your company or to review your operating agreement. An attorney can also help you learn about the LLC fiduciary duties that exist by law in your state and whether or not those duties can be reduce expande or eliminated by agreement. The two key fiduciary duties are the duty of loyalty and the duty of care. Whether you have a fiduciary duty will depend on the LLC ’s management structure and whether you have management responsibilities.

Understanding your duties is essential to avoiding liability. FIDUCIARY DUTIES –MANAGING MEMBERS OWED TO LIMITED LIABILITY COMPANY AND MEMBERS –AGENCY. Managing members of an LLC owe common law fiduciary duties to the LLC and to the other members based upon the fiduciary relations governing the principles of agency. BREACH OF FIDUCIARY DUTY AS AN INDEPENDENT CAUSE OF ACTION.

The duties associated with this obligation are known as fiduciary duties. The key fiduciary duties , specifically defined under California law, are the duty of loyalty and the duty of care. However, in allowing fiduciary duties to be waived or eliminate the LLC Act provides: To the extent that, at law or in equity, a member or manager or other person has duties (including fiduciary duties) to a. Next, LLC members could be held to a fiduciary duty of loyalty.

Rather than making decisions that may bring personal benefit, members should act in the best interests of the business. Additionally, they should be mindful of any actions that could represent conflicts of interests. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

However, the limited liability protections offered to members of a LLC are not to be limitations on the liabilities of members when it comes to their fiduciary duties to the LLC and to each other. Fiduciary obligations of members of a LLC are derived from the Indiana Business Flexibility Act and common law. Refraining from dealing with the LLC in.

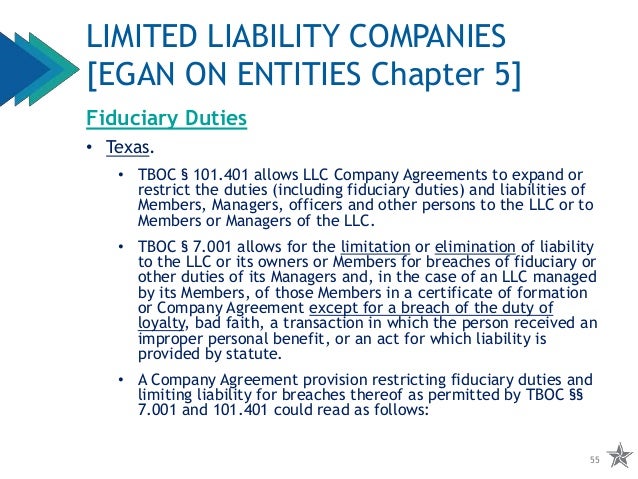

A fiduciary duty is a legal duty to act solely in another party’s interests. T The individuals to whom a fiduciary owes a duty to are called principals or beneficiaries. Although Texas Law does not impose fiduciary duties on members of an LLC, the Texas Business Organization Code provides an inference that fiduciary duties do exist. The Court’s ruling was made in connection with the claim that IMICO and BRG Gramercy aided and abetted the breach of fiduciary duty by Benedict. When an LLC agreement clearly disclaims all statutory fiduciary duties of the directors, the directors’ duties are limited to (i) those.

Whether these duties run to both the LLC and the other members depends on the management structure of the LLC. Actions taken to further a. Delaware LLC Act fiduciary duties were originally not specifically stated in the text of the law, so Delaware limited liability company managers were not bound to the same fiduciary care and loyalty as Delaware corporate officers and directors.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.