Similar to the states in the US, Canada has provinces, and each province has its own regional accounting body. Canada has taken a bold move by merging its accounting qualifications (CA, CMA and CGA) into one big “CPA “designation. The process has been completed with much success.

In order to get starte candidates should follow the rules applicable to their status. See full list on ipassthecpaexam. This is the default route to become CPA in Canada.

Complete a bachelor degree in relevant concentration, e. Comm with an accounting major 2. You can get more info and dow. You will also need to complete the experience requirements in yo. For information about the module fees and scheduling, please contact your provincial body. There are two routes: 1. Take pre-approved programs in training positions that are offered by your employers and have been pre-approved by the profession. These programs are designed for you to meet the practical experience requirements within months.

I don’t cover them for now, but heard from friends that Prepformula, Densmore and Pass are the bigger providers. CPA candidates are also required to complete a period of practical experience to qualify for certification. The CPA certification program meets or exceeds the requirements of regulators, global accounting organizations and the Canadian business community for professional accountants working in both public practice and industry. It provides you with the technical and softer skills you need in today’s business marketplace.

It is designed to meet the needs of industry, government and public practice and provide professional accountants with the knowledge and skills to succeed in whatever role or position they take on. The national program is one of two pathways to complete the Professional Education Program ( PEP ) and become a Chartered Professional Accountant ( CPA ) in Quebec. The 12-to-24-month program is offered on line in collaboration with university partners.

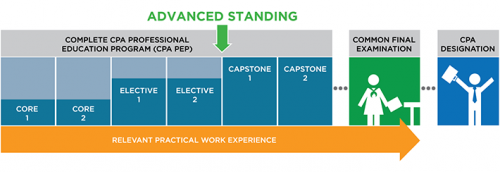

The CPA Practical Experience Requirements has been updated to include both the general practical experience requirements for certification as a CPA , and the specific practical experience requirements for those seeking registration to practice public accounting. Certified Public Accountant ( CPA ) The CPA license is the foundation for all of your career opportunities in accounting. Learn about the CPE requirements for CPA licensure renewal in your state. Earn CPE from the AICPA Choose from thousands of hours of CPE ranging from foundational to expert, covering hundreds of topics, and delivered via webcast, live events, on-demand self-study, and more. PEP – Professional education program PER – Practical experience requirements PERT – Practical experience reporting tool PPR – Pre-approved program route.

A single course may appear against more than one subject area in cases where it covers competencies across multiple content areas. CPA PEP : BECOMING A CANADIAN CPA. Becoming a licensed certified public accountant requires successfully completing multiple steps.

The formal requirements to sit for the CPA exam and to ultimately become a licensed CPA are governed by the individual State Boards of Accountancy in the jurisdiction that you plan to practice. While the specific steps are similar across the country, each individual state may have small differences. Each diploma program includes all the prerequisite courses for admission to the CPA Professional Education Program ( PEP ). B-) or higher is generally required for the recognized diploma and the prerequisite courses be admitted to the PEP. Prerequisites courses for each university. The knowledge and competencies gained through practical experience complement those developed through education.

CPAWSB delivers the education and examination requirements of the CPA certification program and does not provide assistance with finding positions to meet the experience requirement of the CPA certification program. Language Benchmarking. Maintain CPA Canada membership in good standing. Be a CPA in good standing as defined by CPA Canada.

Pass the CITP exam and meet the minimum business experience requirement within years of applying for the CITP credential. Grade and GPA Requirements. Upon graduation, students will fulfill all of the PEP Core modules and all Electives (Assurance, Taxation, Performance Measurement, and Finance). Students are strongly encouraged to.

It is possible to complete Capstone and the CFE in months. Designed with the working professional in min courses are offered on a part-time basis and combine online learning and self-study with options for in-class sessions.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.