Today we are going to learn about the Eway bill login system or eway login portal where you are to register as a new taxpayer or will have to login to generate eway bill for. Step 3: Select the State from the drop-down list and enter the PAN number in the respective fields. An e way bill is a document which can be generated online, and is required by the person in charge of the transportation for the movement of goods exceeding ₹ 50in. How to login in E-waybill?

Firstly, go to ewaybillgst. Enter the Username and Password. EXCELLENCE IN MOTION Courierit has acknowledged the fact that it is time for an innovative courier company in South Africa. A company that is motivate in providing flexible IT systems to completely support and integrate with the burgeoning IT requirements of a 21st century business.

The taxpayer can visit on the portal, register his business and generate an electronic way bill. The system allows its generation through various means. The login button is provided to login into the system. Click on the “login ” option to enter into e way bill system as shown above.

E-Way bill registration, 2. The process is pretty simple. But because they are only good for one day for every 1kilometers travelle you should. E-way bills can be generated using the GSTN e-way bill system. You must enable JavaScript to use this service.

The government has established that e-way bills are to be generated online throughout the nation for intrastate. E way bill system is used to generate online e way bill for the movement of goods from one place to another. India office A : 30 Kalapuram Complex,C G Roa Ahmedabad.

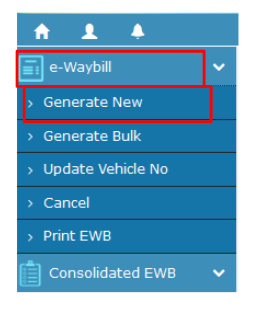

Next Post Next post: E- Way bill requirements- Transportation of goods by. However, when a supply is made by an unregistered person to a registered person, the receiver who is the registered person will be responsible to ensure all the compliances are duly met by suppliers. Process to create e - Waybill. On the main menu of the e-way bill portal, click the option “ E-way Bill ”, and within that click the sub-option “Generate New” 3. Please enter your User ID. Login to your Account.

The e-way bill is required to transport all the goods with the value exceeding fifty thousand rupees except the goods specified in Annexure to the notification. Upload the valid document in the e - way bill portal. Create a login ID with the user id and password.

Finally, you get a transporter ID on your screen after a successful registration. Way Bill is mandatory for Inter-State movement of goods of consignment value. A person who is required to generate the E - way bill must register in the portal of E - way bill i. After login through the registered I a dashboard will be open on the portal of the E - way bill.

Once logged in, you will be directed to the Main Menu. Above shown is the main menu of the e - Way Bill Portal. By watching this video you can get to know how you can register yourself for E-way Bill in less than minutes for registered person, e way bill registration. Additionally, unregistered transporters obtain a Transporter ID or TRANS ID. All three credentials are extremely important in order to Generate an EWB.

Webtel’s integrated e-Way Bill solution has multiple auto-validation checks that ensure data accuracy by raising the flag for error, data repetition and correct the mistakes of invoice data, GSTINs, HSN codes, and many more. This is indicating that you had tried to login to the e-way bill system with incorrect username and password for more than times. Hence, the system has blocked your account for security reasons and it will be unblocked after minutes. Find out how e-way bill system works in SAP and keep track of all your e-way bill details in SAP ASP Cockpit.

Goods Issue or Generate Invoice in SAP. Under the GST regime, transporters will have to procure e-way bill from the GST Network portal when hauling goods worth more than Rs 500 within or outside a state. An e-way bill is required for movement of goods worth more than Rs 5000. Provisions regarding the e-way bill were finalised in August earlier this year. Welcome to e -Invoice System.

Taxpayers having TO more than Rs.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.