What is export agent commission? Is Commission for export negotiable? How do import export agents make money? For only generating a ‘lukewarm’ lea this may just be.

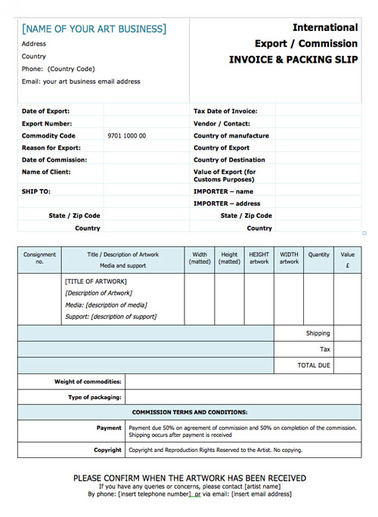

The transaction needs to be finishe means that seller should have received the payment first, then it is your time to get commission fee. The easy example about import export agent commission rate. Let us look at the realistic example from import export business, for an agent. The rate will depend on your negotiation skills, experience and the company you are dealing with. Meeno’s Commission Rate and Fee Structure.

We keep our sourcing agent commission rate and fee structure transparent to client. Our pricing is divided into parts: order amount, commission rate and freight. We have listed all our service standard charges below.

See full list on meenogroup. Connect2India providers end to end solutions to export Commission Agent from any country in the world. We provide help and support in Commission Agent export documentation, Commission Agent export procedure, logistics, shipment and goods delivery to the specified location. For example, you may identify a producer in the U. Or you may work as an import agent based in the country where the product will be sol in which case you represent the buyers. Some of the benefits of the agent option are the reduced start-up costs and the limited working capital you need.

The initial investment and costs of doing business as an agent are significantly lower than those that come along with operating as a distributor. On the downside, when you’re doing business as an agent, you run the risk that the parties will bypass your firm and deal directly with each other on any future transactions. To minimize the risk of being eliminated from future transactio.

The rate of commission when working as an agent depends on the nature and type of product, the nature of the market you’re selling to, and the level of competition. If you bring a buyer from one country together with a seller from another country, can you earn a commission from both parties? Because as an agent, you’re representing someone. If you represent the seller, you have an obligation to sell that company’s products at the highest possible price.

It is observed that RBI has not revised its earlier instructions as regards the limit of payment of agency commission. Therefore, it is clarified that the field formations may continue to permit export benefits on f. They will charge commission at a prearranged rate for every customer they find that you end up selling your offering to. Central Tax ( Rate ) dated 24.

This will typically take between 2. APMC or board or services provided by the commission agents for sale or purchase of agricultural produce” from GST. Thus, service provided by the commission agent for sale or purchase of agricultural. Our Customs House Agent (CHA) says there is a limit of 12.

We are paying commission to a foreign agent against export orders. RCM will be applicable or not? Browse through potential providers in the commission agent industry on Europages, a worldwide B2B sourcing platform. Commercial agents , on the other han promote your products and earn commission on sales made in their territory.

Agents are generally independent and can represent several clients in a designated area. In both cases, the relationship between you and an intermediary must be based on the notion of a partnership. For commissions as a percentage of gross margin, (sales price minus direct expenses) a standard range is anywhere from to.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.