Tax payer Id entification Number s (TIN or EIN) Form to Receive Number from IRS. Easy, Quick, and Secure Filing. All content updated daily using top from across the web. Find tax id number how to get on Smarter. TheAnswerHub is a top destination for finding online.

Browse our content today! Increase in Gasoline License Tax , Special Fuel License Tax , and Motor Carrier Surcharge Tax. Enter one ID and primary customer zip code to retrieve your Case ID. Social Security Number - SSN.

The EIN, on the other han is assigned by the IRS. To apply for a TIN, register online as a new business via IN. The basic information required to fill out the application is listed below.

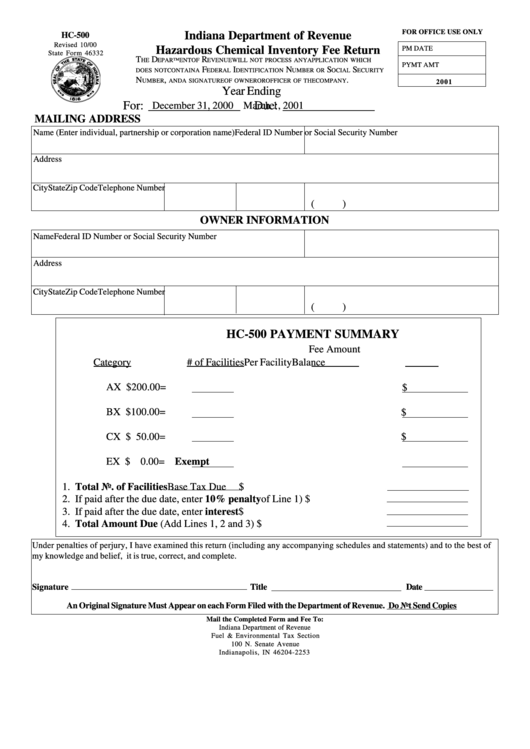

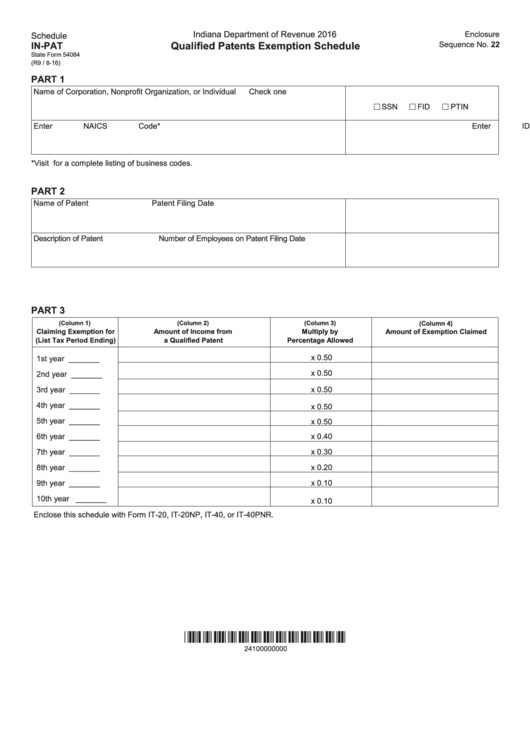

Please review the list to make sure you have this information prior to starting the online process. Indiana Department of Revenue. Quickly and easily, no strings attached. Use it Immediately for Your: Business, Non-Profit, Estate or Trust.

General Information on Sales Tax. Virtually every type of business must obtain a State Sales Tax Number. If your business sells products on the internet, such as eBay, or through a storefront, and the item is shipped within the same state, sales tax must be collected from the buyer and the sales tax must be paid on the collected tax to the state.

The department assigns TID numbers, and each entity has its own TID number. The Internal Revenue Service provides the employer identification number (EIN). Prov id e your basic details and a filing experts will help you complete your EIN filing.

Caution: Many of our offices are in Federal Office Buildings. The Secretary of State, Department of Workforce Development and the Department of Revenue have created a best-in-class portal that provides a streamlined and expedited process for your business needs. Your state tax ID and federal tax ID numbers — also known as an Employer Identification Number (EIN) — work like a personal social security number , but for your business.

They let your small business pay state and federal taxes. Looking for how to obtain a tax id ? Start a Business in your State by First Getting a Federal EIN from the IRS. As you may already know, dealing with the IRS can be frustrating.

It seems to confuse even the easiest tasks, which is true when it comes to the tax ID number process. To avoid the hassle, you can go through Govt Assist, LLC. Get your Tax ID Today. Fully Online Process to Receive your EIN Tax ID for a New Entity or Sole Proprietor.

This automatic extension does not extend the payment of any tax due. Apply In Under Minutes. If cars or trucks (less than 10lbs Gross Vehicle Weight) will be rented for less than thirty (30) days from this location, complete this section. Content updated daily for how to get the tax id number.

Search Informationvine today! An EIN is required to open a bank account, get a business loan, and more. An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.