Recipient Created Tax Invoice - atotaxrates. What is a recipient created tax invoice? Can Monash issue a recipient created tax invoice? Who is required to issue a tax invoice?

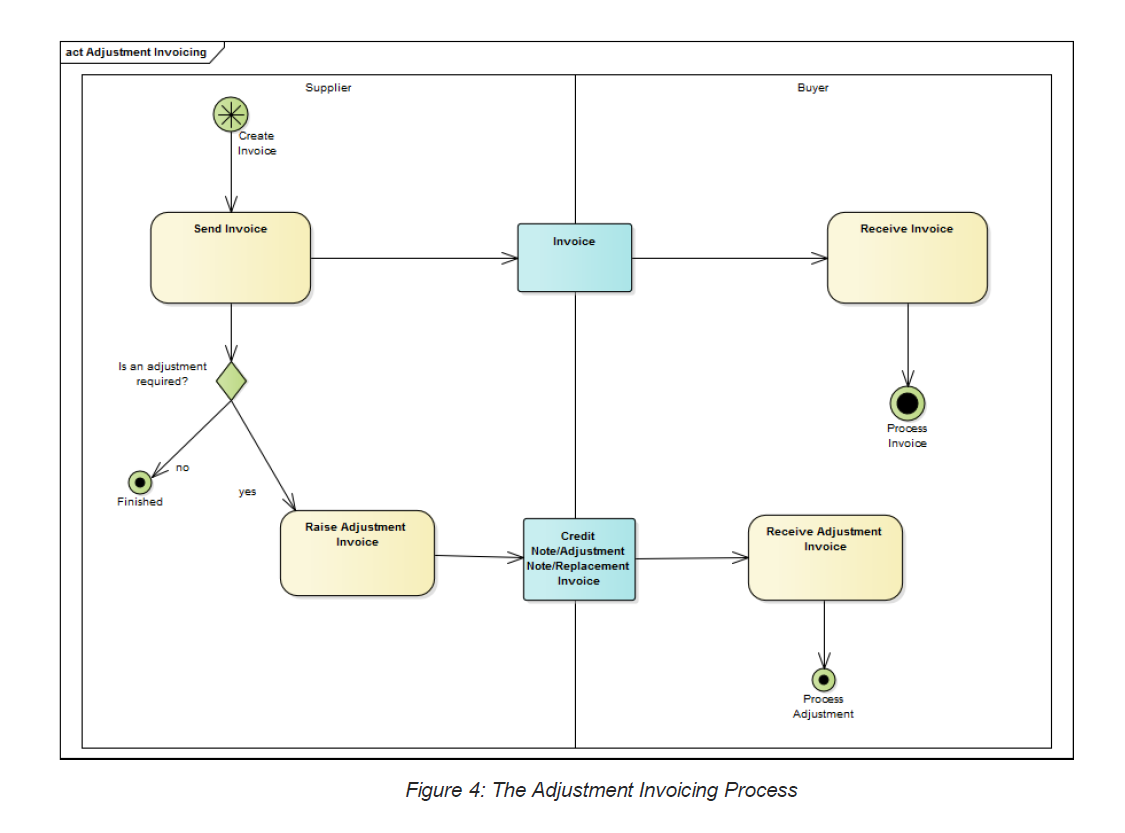

Is it appropriate to raise a tax invoice? You can use this form as a template for creating RCTIs , or as a reference for information you need to create your own RCTI. In these circumstances, the buyer may issue a tax invoice. This invoice is called a recipient created tax invoice ( RCTI ). However there are occasions which are provided for in the GST rules when the recipient is permitted to create a valid tax invoice. Tax office approval of RCTI.

Essentially an RCTI can only be issued in circumstances which have Tax Office approval. Acceptance of this recipient created tax invoice (RCTI) constitutes acceptance of the terms of this written agreement. Both parties to this supply agree that they are parties to an RCTI agreement. The supplier must notify the recipient within days of receiving this document if the supplier does not wish to accept the proposed agreement. In such a case it is possible that Monash (the recipient of the supply) could issue a recipient created tax invoice (RCTI).

Where suppliers would like Monash to issue RCTIs on their behalf they must approach Monash for formal approval. This ruling constitutes a BGR issued under sectionof the TA Act. When can a RCTI be issued ? Expertly Designed Forms - Try Free!

Professionally Formatted - Try Free! However, in special cases, the recipient of the goods or services may create a tax invoice and send it to the supplier (sometimes with payment). This is known in Australia as a recipient created tax invoice (RCTI), or in New Zealand a buyer created tax invoice.

There are rules and regulations governing the use of recipient created tax invoices. The RCTI will contain all information required by the ATO ruling issued on RCTIs. These systems rely on DVA issuing tax invoices on behalf of a supplier. An employee has sold me a vehicle, and although he has a registered business number (ABN), he doesnt actually use it much, and I think his mother does his bookwork most of the time.

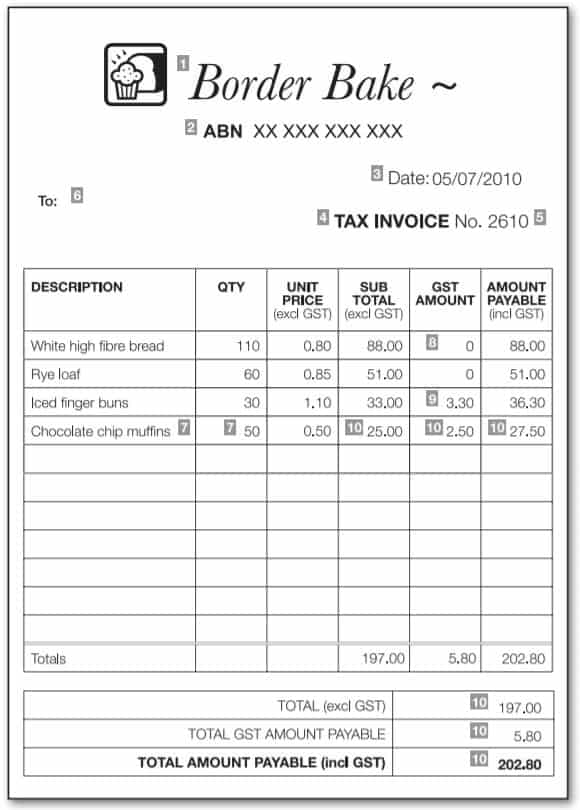

Getting him to produce a tax invoice is nigh impossible. In Australia tax invoices are usually issued by the supplier or seller. However Australian Taxation Office also allows the purchaser or recipient of the goods or services to issue tax invoice for the purchases, knowns as recipient - created tax invoices (RCTI). For example, a sugar cane farmer and a mill have entered into an agreement that the Buyer will Invoice and provide Payment for a delivery of cane based on.

In special cases, the buyer can provide you with the tax invoice. These are called recipient created tax invoices (RCTIs). Go to the ATO website to learn more about RCTIs, including when and how you can use them.

Create an Invoice to Assure Your Transactions are Legal - Try Free Today! Instead of being issued by the supplier, a recipient created tax invoice is a tax invoice that is issued by the buyer of the products or services. These invoices can be issued only when there’s a written agreement between the recipient and the supplier that is current and effective.

SPSL in respect of which SPSL has issued or is entitled to issue a recipient created tax invoice or adjustment note. You agree and acknowledge that: a. The GST Legislation permits a government agency that is a recipient of education delivery and related education services (taxable supply) to issue a recipient created tax invoice. You” and “yours” means the organisation named at item 1. This decision is on condition that the recipient of the services complies with therequirements of Interpretation Note No. GST), you must be registered for GST and have a valid tax invoice or recipient created tax invoice (RCTI).

If you use an incorrect or incomplete tax invoice to claim a GST credit, the GST credit may not be allowed. To claim GST credits for purchases that cost $82. Electronic invoices are equivalent to paper – national tax authorities cannot require businesses to provide any notification or to receive authorization. Businesses are free to issue electronic invoices subject to acceptance by the recipient.

However, e-invoicing will become obligatory in public procurement. The supplier must issue a tax invoice , except if the provisions of section20(2) apply, where the allowance is regarded by the supplier and the recipient of the supply as consideration for the supply of a service. The tax invoice must satisfy the requirements of sections 20(4) and (5).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.