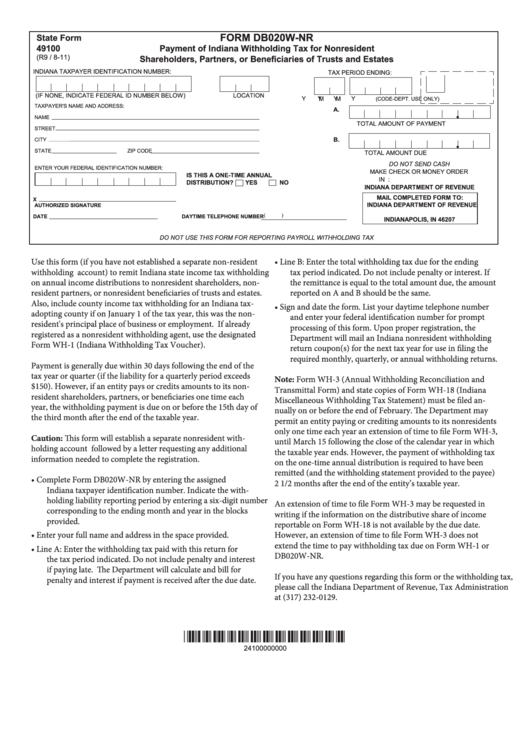

Payments can be made by Visa, MasterCard or ACH (e-check). If paying by credit car a fee will be charged by the credit card processor based on the amount you are paying. The online transaction fee is $ plus 1. There is no fee for an ACH (e-check) payment. When you receive a tax bill you have several options: Send in a payment by the due date with a check or money order.

Make a payment online with DORpay by credit card or electronic check. Business tax types are now being administered in INTIME. Know when I will receive my tax refund.

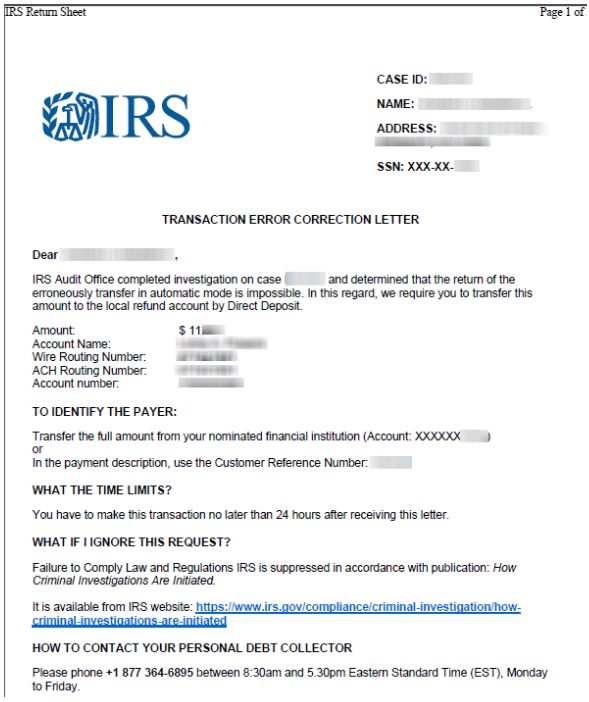

Have more time to file my taxes and I think I will owe the Department. Even if you establish a payment plan with the Department, you will still be required to pay a percent penalty and interest that will continue to accrue on your unpaid tax balance until it is paid in full. Step 1: Enter Case ID.

Increase in Gasoline License Tax, Special Fuel License Tax, and Motor Carrier Surcharge Tax. Individual Payment History. Pay my tax bill in installments. Powerful and Easy to Use.

Please enter your Payment Locator Number(PLN) which was the confirmation provided after making your payment. Pay the amount due on or before the installment due date. Write your Social Security number on the check or money order. Note: All payments must be made with U. To pay by credit car you may make an estimated tax payment online. Enter one ID and primary customer zip code to retrieve your Case ID.

Choose and enter only one. We expect to be back as soon as possible. Thank you for your patience during. If you cancelled this payment in error, you will need to submit a new payment transaction for processing.

Access DORpay hours a day, days a week, and make a tax payment by Visa, MasterCar or e-check. Some payment methods may incur additional charges. Use the worksheet below to determine how much you’ll owe. A separate application is required for each business location.

Application for Direct Payment Authorization. When you arrive, wear a mask and stay feet away from others. Reschedule your appointment if you feel ill.

Go to EFT Registration in the INtax menu on the left side of the screen. Complete and submit the online registration form. Although the registration form status states it is pending, your bank information is stored and you may make an ACH debit payment immediately. Most motor carrier-related transactions can be done online.

A representative can research your tax liability using your Social Security number. Can I pay the taxes I owe online? We will attempt to answer Your questions about Your payment , such as the amount, date, Agency to which it was directe and payment type based on system records available to us.

Revenue , Department of Articles.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.