While she won’t collect sales tax on the repair service, she will be required to collect sales tax on the components she sells. All businesses wishing to become members of Streamlined Sales Tax must register at the following national registration site. Upon receipt of a national registration, DOR will send. Indiana Department of Revenue is launching a new e-services portal to manage your corporate and business tax obligations.

Find Indiana tax forms. Know when I will receive my tax refund. How to file a sales tax return in Indiana? What is the sales tax rate in Indianapolis? Do I owe Indiana use tax?

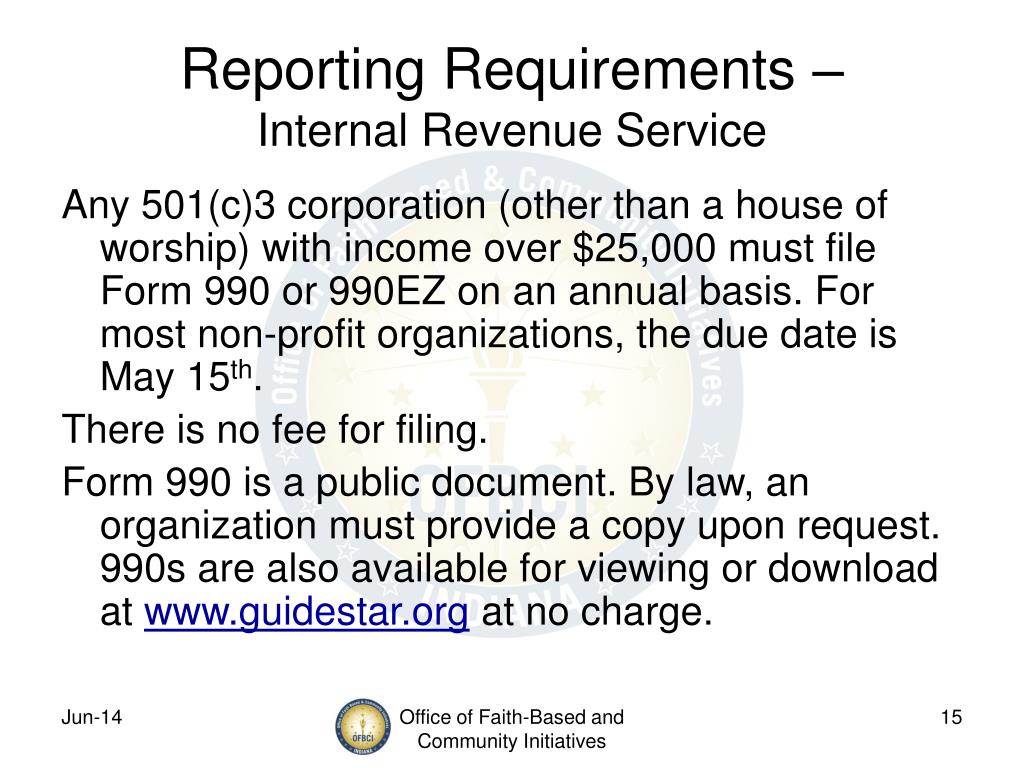

Increase in Gasoline License Tax , Special Fuel License Tax , and Motor Carrier Surcharge Tax. Copy of federal determination letter (ruling from the Internal Revenue Service) showing the section of the Internal Revenue Code exemption from federal tax has been granted. Indiana Taxpayers to pay their Individual tax bills and set up payment plan.

Home User Guide Contact Us. If the purchaser is from another state and does not possess an Indiana TID Number, a resident state’s business license, or State issued ID Number must be provided. Sales into Indiana or sales transactions include any combination of sales of tangible personal property delivered into Indiana , products transferred electronically into Indiana and services delivered in Indiana. In addition to state and local sales taxes , there are a number of additional taxes and fees Indiana car buyers may encounter. For all other tax type registrations please visit our new platform.

Enter the Individual Case ID and Identification ID for verification. Step 1: Enter Case ID. Important Data Notes.

It is derived from the BT-application for sales tax and sales tax return ST-1that Indiana businesses and those out-of-state businesses conducting business in the state of Indiana must fill out. Brief descriptions of the data. General Information on Sales Tax.

Virtually every type of business must obtain a State Sales Tax Number. If your business sells products on the internet, such as eBay, or through a storefront, and the item is shipped within the same state, sales tax must be collected from the buyer and the sales tax must be paid on the collected tax to the state. Indiana is a member of the Streamlined Sales and Use Tax Agreement, an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states.

Because Indiana is a member of this agreement, buyers can use the Multistate Tax Commission (MTC) Uniform Sales Tax Certificate when making qualifying sales - tax. The state sales tax is consistently the source of the largest percentage of the state government’s revenue. Indiana property taxes provide the greatest overall income to the state, with almost all of the proceeds going to fund local government. Please use the information below based on the tax type selected.

Section A Section B Section C Section D Indiana Dept. I understand that this authority will expire years from the date this POA is signed or a written and signed notice is filed revoking this authorization. Illinois sales tax , the purchaser owes use tax and is responsible for paying use tax directly to the department using Form ST‑44.

Quarter-monthly payments — If a retailer or service-person’s average monthly liability is $20or more, quarter-monthly payments must be made. Doing Business in the State. Small Business Events in Your Area. Please direct all questions and form requests to the above agency.

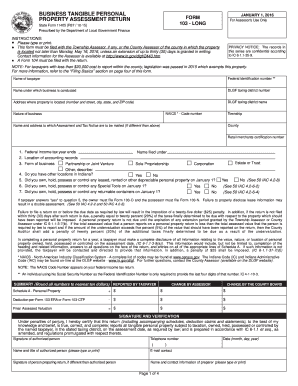

Aircraft Property Tax : In Indiana , aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes ( Indiana Code 6-6-). The use tax is a back stop for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The forms are scannable forms for processing purposes.

Investment Tax es in Indiana.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.