Australia Income Tax Treaty exempts superannuation from U. We can provide a Tax Opinion to secure the legal exemption. What is SMSF competency exam? Public practitioners who are auditing SMSFs must meet the following professional standards requirements : hold a practising certificate issued by the professional accounting body of which they are a member have continuing professional indemnity cover undertake continuing professional development.

Are SMSF audited annually? Professional requirements. Hold a practicing certificate issued by the professional accounting body of which you are a member (CA ANZ, CPA, NIA).

SMSF auditor number (SAN) meet ongoing obligations as prescribed by the. The programs are quality, credible and feature current SMSF content presented by leading, SMSF industry experts. These competency standards are closely aligned with the Competency Requirements for Auditors of Self-Managed Superannuation Funds issued by the joint accounting bodies , with the exception of the competency for documentation which is unique to the ASIC competency standards. CPD relating to SMSF Audits. Learn the smarter way.

This comprehensive, in-depth suite of online continuing professional development ( CPD ) learning resources, SMSF webinars and SMSF training enables practitioners to stay at the forefront of the SMSF industry – whether you want to be the expert or not, you can rely on our specialist knowledge to ensure that you are enabling better retirement outcomes for your clients. At Advisers Digest, our SMSF Auditors ongoing CPD gives you an hour of CPD each month. This means over a three year period you will complete hours of SMSF audit CPD. Well in excess of the requirements.

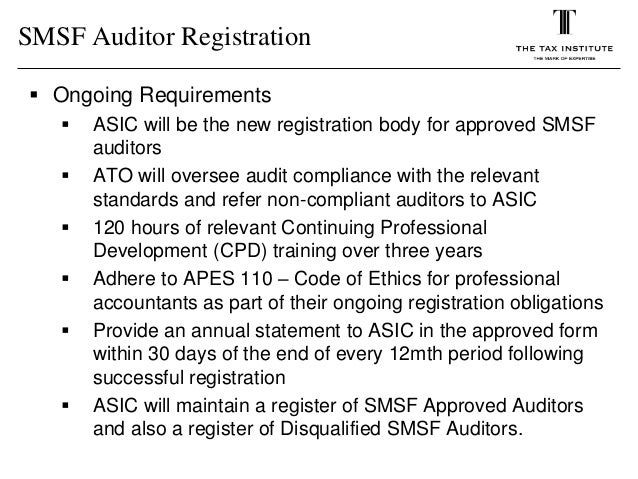

This must include hours of development about superannuation at least hours of which relates to auditing of self managed superannuation funds. Complete continuing professional development ( CPD ) of at least 1hours of relevant CPD activity over each rolling three-year period. This is a detailed checklist of what our staff look for when auditing or reviewing a self-managed super fund ( SMSF ) auditor. SIS Regulations require an approved SMSF Auditor to undertake at least 1hours of continuing professional development every three years.

ATMA SMSF Audit Requirements. Self Managed Super Fund Association (SMSF Association). New members are subject to the same three year period as existing members, however will be permitted to meet the requirements on a pro-rata basis until a new three year period commences. SMSF audit exam set at Masters level equivalent, review of their continuing professional development activities and SMSF auditing experience, a referee check and must hold adequate professional indemnity insurance in relation to the SMSF audit services they provide. Update on ASIC referrals.

Of the four top 1auditors referre Mr Grant stated that two were actually referred for independence issues because they were doing a large number of audits from just one referral source. To bridge the gap in training, education and tools so you can grow your business through self-managed super funds. Mr Newham also failed to comply with his continuing professional development requirements , ASIC said. Section 128F(a) of SISA and SIS Reg 9A. Similarly, Chooi Beh of Victoria failed to obtain sufficient appropriate audit evidence in the audit of an SMSF about the value of unlisted shares and whether.

You will need to complete 1hours of CPD over each three-year perio which must include hours of development on superannuation and at least hours of development on auditing SMSFs. Continued registration with ASIC is dependent upon many things including the auditor completing relevant continuing professional development ( CPD ). Language, Literacy and Numeracy (LLN) requirements This course requires you to read comprehensive learner workbooks, complete a range of written assessments, undertake independent research activities and at times engage in online forums and discussions. Furthermore, the delivery mode relies on the extensive use of written and oral communication. Attain a postgraduate qualification in SMSF and a professional designation.

Recent changes to the Code and the associated Independence Guide will have major repercussions for the SMSF industry. They offer a high level of flexibility and allow members a wider range… 31. Compliance is the core of our service offering, evidenced by our CPD accredited education program for financial planners. Our work teaching clients about what really drives property values is not understoo let alone reciprocated by any one else in the industry.

While the ATO will not commence its compliance activities regarding the updated auditor independence guidance until July next year, it has warned there may be other implications if firms delay adopting the changes such as professional indemnity risks.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.