What is the value of a turnover? It’s a good way for a buyer to value the business based on how they expect to shake things up and get operations to industry-standard. How are businesses valued? Unfortunately, the only truly valid method would involve an analysis of revenue traction over time and overall profitability of the business model.

Calculate Seller’s Discretionary Earnings (SDE) Most experts agree that the starting point for valuing a small business is to normalize or recast the business ’ earnings to get a number called seller’s discretionary earnings (SDE). If the business sells $100per year, you can think. Our calculator will also give you an approximate value for your business by taking the annual profit and multiplying it by the appropriate industry multiplier. Taking the same example of a law firm, suppose the profits were $4000. The valuation of the business is therefore a function of the EBITDA and a multiplier.

The multiplier used depends on both the industry sector and the size of the business being valued: the larger the business turnover , the higher the multiple. The value of your business is not expressed as a number. Businesses are not worth a multiple of turnover Many small business owners believe in valuation rules of thumb.

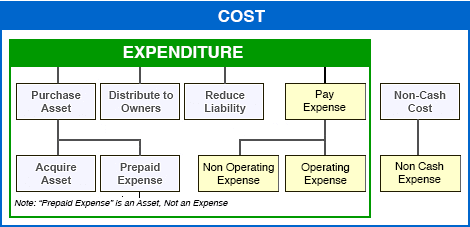

Tally the value of assets. Add up the value of everything the business owns, including all equipment and inventory. Subtract any debts or liabilities. But the business is probably worth a lot more than its net assets.

This method uses an estimate of the company’s cashflow over a certain period of time. The “terminal value” of the company is also calculated after this period has expired. Different industries have their own rules of thumb that can be used to determine your businesses value. X, for example, it means that the amount paid for the business is a value of 2. The checklist has a $5value but I will give it to you as one of my welcome gifts for joining Start- a-Business 101.

For example, a business that is doing $300in profit per year sold for at 2. The majority of buy-sell transactions are based on a value established for the assets of the company. Similar to bond or real estate valuations, the value of a business can be expressed as the present value of expected future earnings. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners, level of risk, and possible adjustments for.

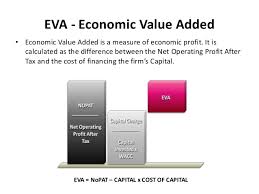

Income based approach This primarily involves calculating the value of the company using Discounted Cash Flow (DCF). In short and very simply, this means calculating the present value of the future cash flows of the company. Make a Practice of Regularly Valuing Your Small Business. Learning how to estimate the value of a company can be important for small business owners for many reasons.

There are a number of ways to determine the market value of your business. A business that owns property, machinery or stock-in-hand has tangible assets. These will have some resale value , making the business easier to value (including business asset valuation). Many businesses have almost no tangible assets beyond office equipment.

One of the easiest and most defensible ways to approach valuation of a private company is to compare against the recent sales of similar businesses. If the companies that have actually sold resemble your business closely, you can come up with a number of business market value estimates based on the so-called valuation multiples. And based on the value of your business , you can get loans to buy equipment, inventory, and branch out to new locations. The past couple of years have seen exceptionally good conditions for buying and selling businesses. The capitalization percentage needs to be high because profits higher than a normal return are difficult to maintain.

It can also refer to the rate at which employees leave a business. But turnover in accounting is how much a business makes in sales during a period. When is audit required?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.