How do you compute a bond price? How is the price of a bond determined? How to calculate an APY of a bond? Coupon rate compounding freq. Annually, for Semiannually, for Quarterly or for Monthly) r = Market interest rate.

Other articles from thecalculator. Let us take an example of a bond with annual coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $100carrying an annual coupon rate of and maturing in years.

Bond price Equation = $8878. Since the coupon rate is lower than the YTM, the bond price is less than th. See full list on wallstreetmojo. Hence, the price of the bond calculation using the above formula as, 1. Store savings bond information you enter so you can view it again at a later date.

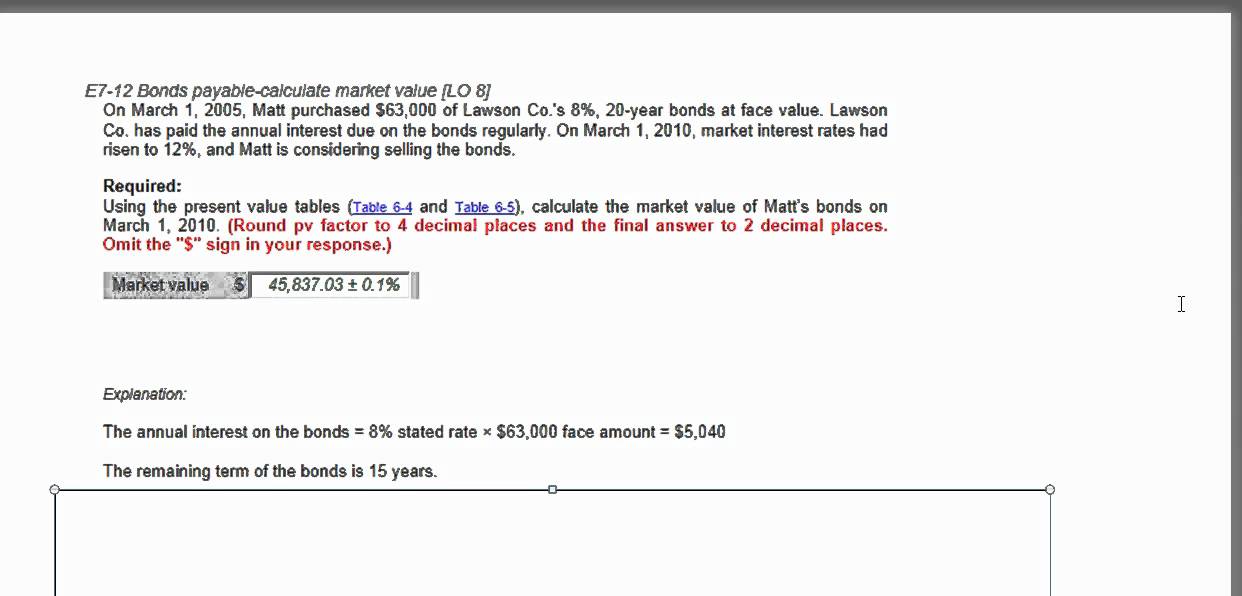

Guarantee the serial number you enter is valid. If a company has issued a bond having a face value of $150carrying an annual coupon of $0and maturing in years. A $0Bon N R and. PV of 7600 N 1 R 4. Interest paid semiannually means there are interest periods and the interest rates are halved in the formula below. We will be using the PV factors from the links below too.

To calculate the Price of the bon we’ll use. C = coupon payment, the amount of interest periodically paid to the bondholder. Let’s calculate the price of a Tata Corp. To compute the value of a bond at any point in time, you add the present value of the interest payments plus the present value of the principal you receive at maturity. Present value adjusts the value of a future payment into today’s dollars.

Say, for example, that you expect to receive $1in years. Once open, choose the series and denomination of your paper bond from the series and denomination drop-down boxes. Calculate bond price. Enter the issue date that is printed on the paper bond. For example, if a bond pays a interest rate once a year on a face amount of.

Find the present value of the bond. To continue with the example, if the bond matures in five years, its present. P(T0) = Price at Time 0. FV = Future Value, Par Value, Principal Value. R = Yield to Maturity, Market Interest Rates. N = Number of Periods.

For Annuities, it also represents the Frequency of the Annuity Payments. Press the following buttons to calculate the corresponding value. The Time Value of Money. Face Value Button - Press to calculate the Bone Face Value. And when N = then the PRICE is calculated with the following equation: DSC = number of days from settlement to next coupon date.

E = number of days in coupon period in which the settlement date falls. A = number of days from the beginning of the coupon period to the settlement date. F = Face value of the bond. PY = Payments a Year.

E = Days elapsed since last payment. TP = Time between payments (from above description). Given the face value, coupon rate, coupon compounding interval, years to maturity, and the current market rate, this is the price your bond would be trading at.

In other words, this should be the price a buyer would be willing to pay to purchase your bond.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.