What is the formula for selling a business? How do I value and sell my business? How can I calculate the value of a business? For example, if you are selling a law firm that made $100in annual sales, the industry sales multiplier is 1. This is best dealt with by having an accountant to help you assess the value of the business.

When doing a major purchase such as a business, it is imperative to go through the books of the business, if you are buying the business. Hey Softail, To find out the value of your business - act like you are trying to buy one! Goodwill is traditionally calculated my the difference between sale price and book value of the company not the other way around. Though I get the question.

See full list on how. This method determines a business’ value by adding up the sum of its parts. No need to spend time or money on a business valuation firm.

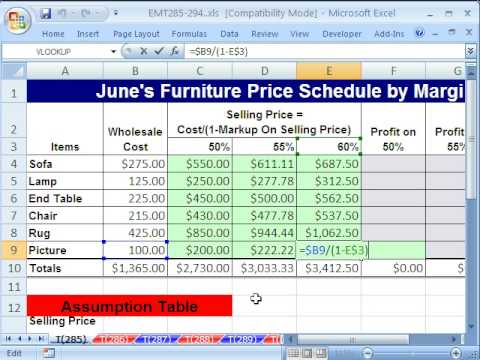

Just enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. The formula we use is based on the Multiple of Earnings method which is most commonly used in valuing small businesses. If you have net liquid assets of $700 the total value of your business is $22000. If Only It Were That Simple You may have noticed that much of what constitutes valuation is based on what you “think. Earnings multiple – A buyer applies a multiple, usually in the range of 1-(depending on the size of the business ) and multiplies it by the annual profits.

Counter wise this can also be a multiple of revenue (total sales) for larger fast growing businesses. There are a number of ways to determine the market value of your business. Tally the value of assets. Add up the value of everything the business owns , including all equipment and inventory. Subtract any debts or liabilities.

For a simple business asset valuation, add up the assets of a business and subtract the liabilities. You might want to use a business value calculator to do this. So, if a business has $500in machinery and equipment, and owes $50in outstanding invoices, the asset value of the business is $45000.

Calculate Seller’s Discretionary Earnings (SDE) Most experts agree that the starting point for valuing a small business is to normalize or recast the business ’ earnings to get a number called seller ’s discretionary earnings (SDE). How to Value the Small Business for Sale Now that we’ve recast (or normalized) the tax return to arrive at seller’s discretionary earnings, we need to multiply by the appropriate multiple. At this level of SDE, the appropriate multiple is about 3. Unlike EBITDA, though, you’ll also add back in the owner’s salary and owner’s benefits. Add the total value of your net liquid assets to the figure you calculated in step 2. Related: How to determine the fair market value of your business. There are several ways to calculate the value of a business : Asset Valuations: Calculates the value of all of the assets of a business and arrives at the appropriate price.

Free Small Business Valuation Calculator : This business valuation calculator is designed as a research tool only to provide small business owners with a free and confidential (no personal info required) instant business valuation result that can be used to help determine an approximate asking or sales price when valuing a small business for sale. The market approach is perhaps the most subjective,” Zwilling says, as it tries to “factor the size of the opportunity, market conditions that control comparables, and goodwill associated. Example - Assumptions to Value a Small Business for Sale Let’s assume the tax return of a small business shows $850in revenues with taxable income of $5000. Included as expenses on the tax return are interest expense of $100 depreciation of $10and amortization of $000. Liquidation Value : Determines the value of the restaurant’s assets if it were forced to sell all of them in a short period of time (usually less than months).

Below are three of the most common business valuation methods that restaurateurs should consider first. Income Valuation Method. The income approach looks at how much income a business will generate for its owners.

Needless to say - the higher the projected income, the higher valuation a business tends to be given.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.