What is invoice required? Do I need to issue a VAT invoice? Why do I need an invoice?

An invoice – definition An invoice is a document issued to customers by a seller asking for payment of goods or services. It is also known as a bill or tab. Invoice is a document presented to the customer before or after supplying the goods or services.

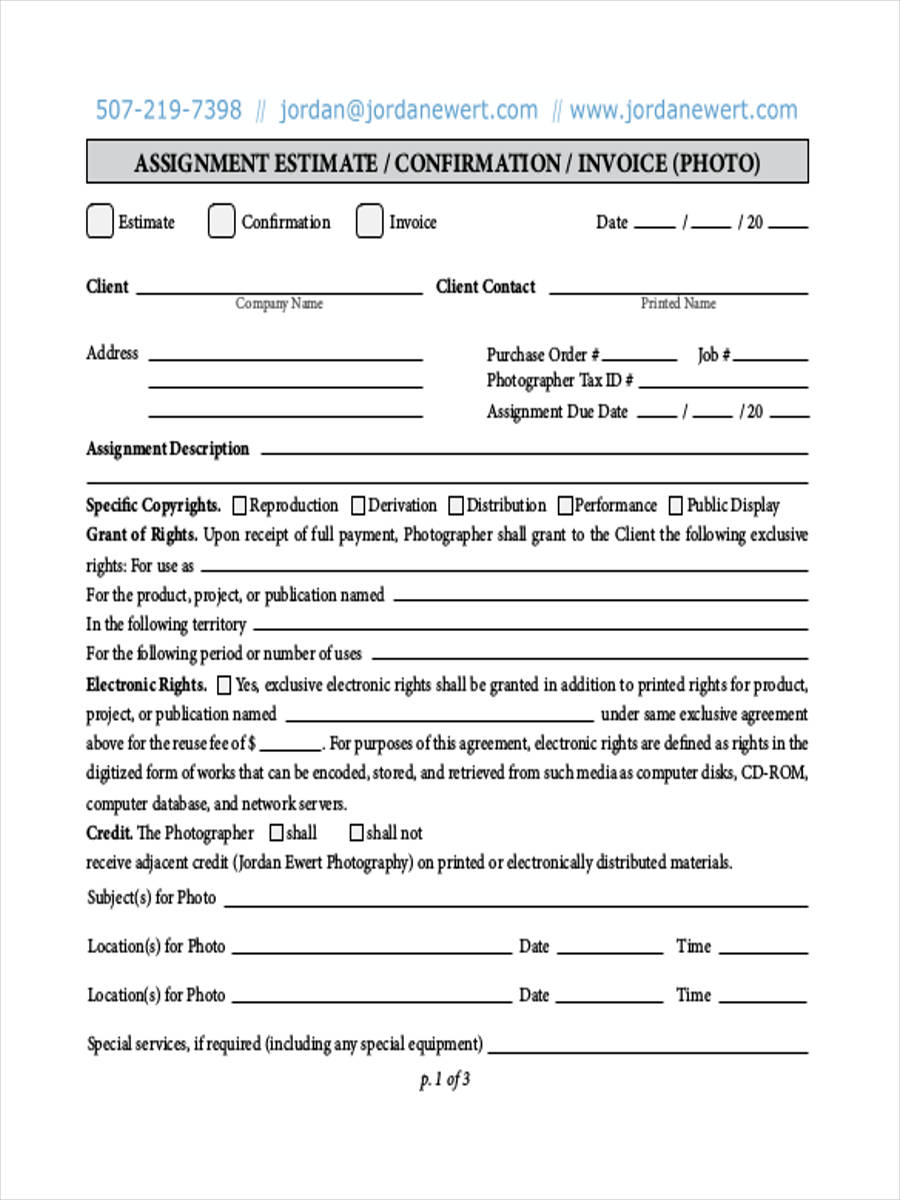

There’s no real obligation to issue an invoice, since the claims of the contract partners - the money claim on the one hand and product liability on the other - are binding even without one. The following table provides the minimum requirements for invoices. The invoices need to be stored for a set number of years and may be required by accountants for your year-end or HMRC.

The design of your invoice will reflect on your company image. You’ll use a full VATinvoice for most transactions. If items are charged at different VATrates, then show this for each.

See full list on gov. Usually VAT invoices must be issued within days of the date of supplyor the date of payment (if you’re paid in advance). You do not have to show all amounts on your invoices in sterling. If you issue VATinvoices in a foreign currency or language, you must: 1. VAT payable in sterling on your VATinvoice if the supply takes place in the UK 2. VAT second-hand margin scheme 4. Print Instantly- 1 Free!

The company name and address of the customer. Federal laws do not require GST to be explicitly shown on invoices, but when an invoice exceeds certain dollar amounts, there is a requirement that the invoice indicate specific information about the selling price and taxes. There are mandatory GST invoice details required. If you are VAT registere you will also need to include the following: A unique and sequential number (this is useful on any invoice, whether you are VAT registered or not) The customer’s name and address Date of supply for the goods or services A tax point date, if this is different from the date. Free Invoice Template with Banking Details.

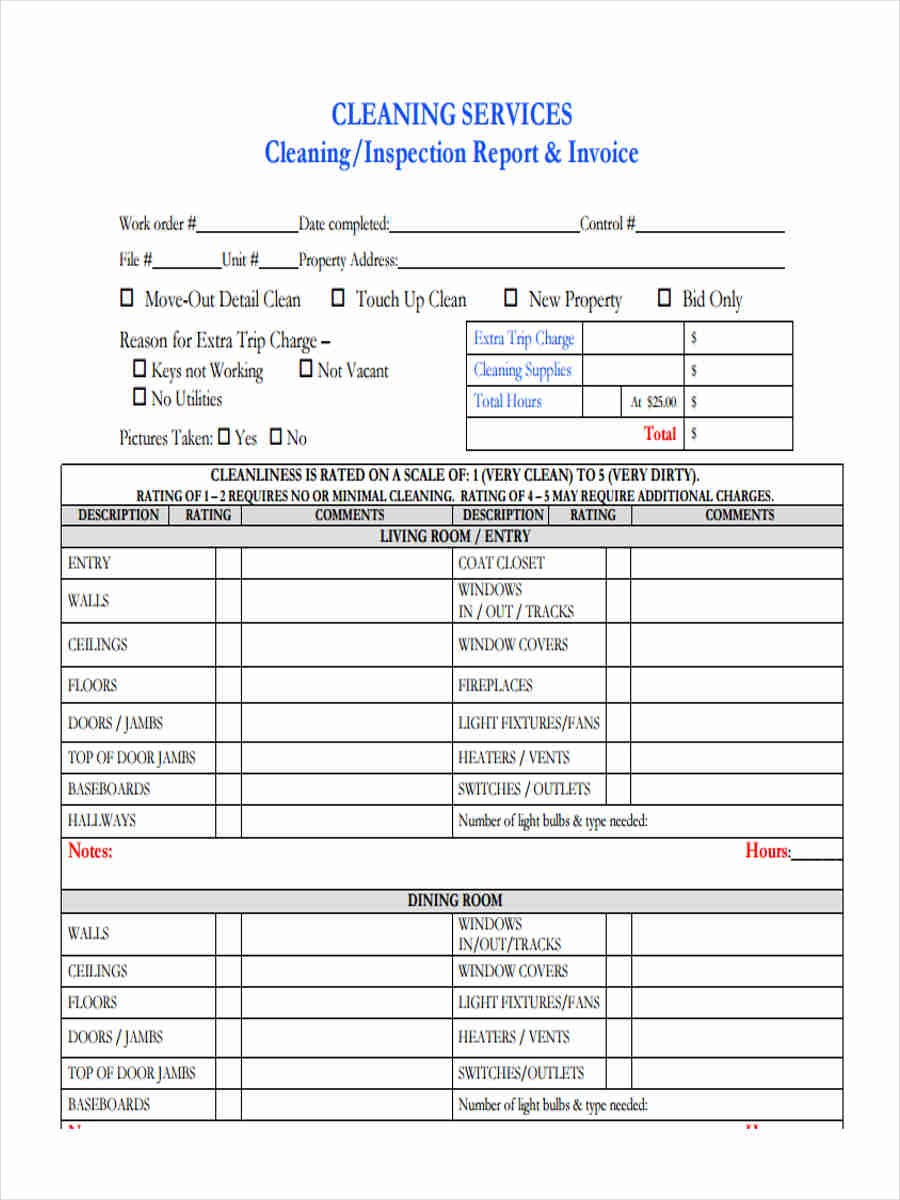

Change the invoice format via the button below and fill your and your client basic information. This is a blank standard template. Add or edit the Taxes from the Set Taxes button if applicable. The invoice will typically describe the purchased items and other important.

A detailed VAT Invoice will consist of the following details : Name, address, and TRN of the recipient. A unique invoice number Date of Supply, if it is different from the date of issue. Discount, if applicable. Professionally Formatted - Try Free! An invoice is different than a receipt, which is just an acknowledgement of the payment – the money claim on the one hand and product liability are binding even without one.

Required documentation. Your business name and address details 2. The name and address of the company you are invoicing (and the contact name if you have one) 3. Foreign currency on a VAT invoice. You can also add the list of required details from the Canada Border Services Agency website to your favourite invoice template in order to create your own uniquely branded commercial invoice.

All-In-One Invoicing App. Award-Winning Customer Happiness.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.