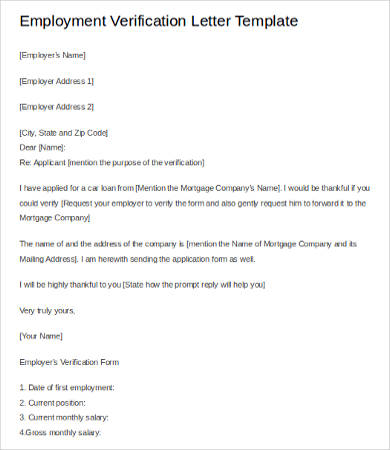

Who approaches a bank for a car loan? What is a request letter for salary certificate? How do salary certificates work? When employee approaches a bank for car loan or housing loan, bank first inquire about repayment capacity of borrower.

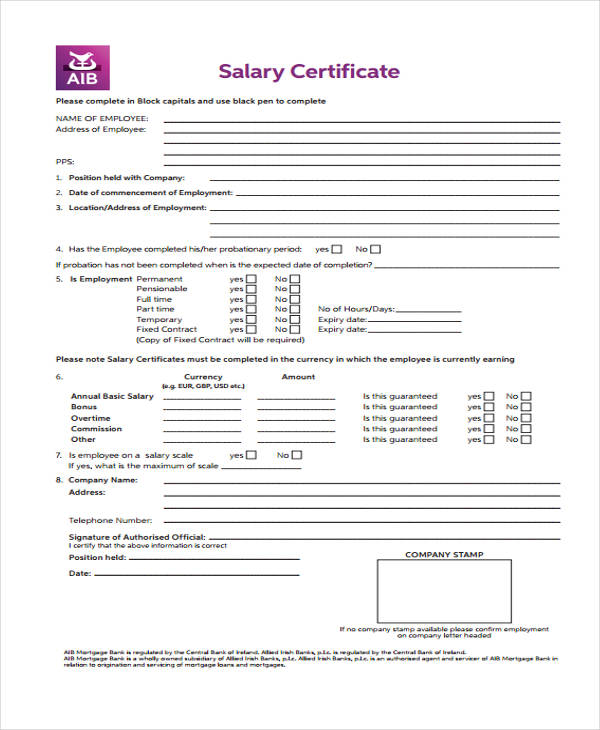

This certificate contains the information about the employee such as total salary, total deductions on monthly basis, and summary of net salary received by the employee and a lot more. Format of salary certificate for bank loan “Make sure you get the information which that you ‘re looking for. With your abilities you also should mention the benchmark and the position you’re searching for. This template sample is significantly more direct and straightforward.

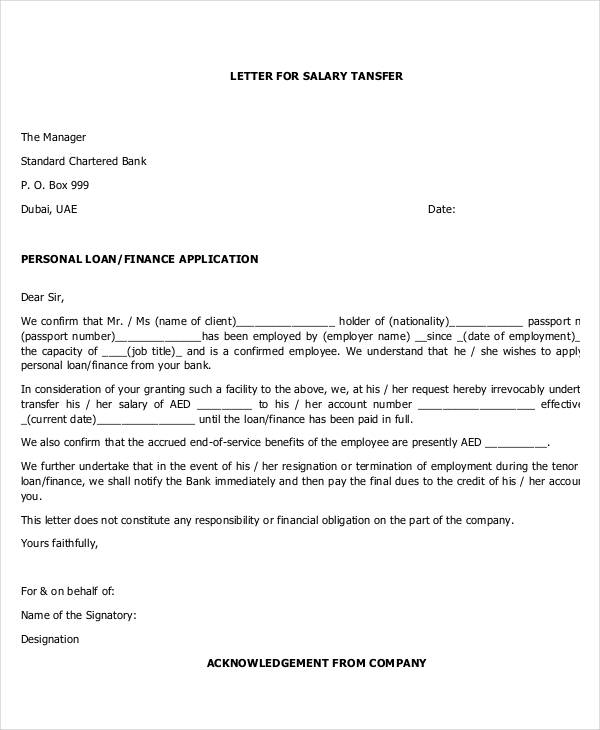

It’s possible to also see Blank Templates. Template for Salary Certificate Format for Bank Loan in Word doc. In such cases, the employee needs to put the reason for which he is requested for the certificate. Request letter for salary certificate is written by the employee to the employer or the finance manager in request for a salary certificate. This certificate is useful in many ways such as application for loan from a bank, application for mortgage, opening a bank account, application of visa, application of credit card and application of income tax among other uses.

Before printing salary certificate check whether all the necessary details are mentioned or not. He joined the company on _____ and currently working as (job title) in (department). His present salary is _____ per month.

It is usually granted by the head office department or human resource officer upon request made by an employee. Otherwise, then the aforementioned templates are the ideal method to prepare a permission slip on your own. In applying for a loan , for instance, salary certificate s are considered as one of the needed requirements that the applicant must comply with. They also come in various frequencies or duration depending on the request of the applicant.

Salary certificates are used for various financial transactions. National Bank of Dubai Dubai UAE Subject: Salary Certificate This is to certify that Mr. Ahmad Al Tariq holder of Indian Passport No. Submitting this document is often mandatory for the employees so that the bank can verify the income and gauge their ability to pay back the loan. Therefore, employers have to issue such salary certificates upon demand from the employee.

COM When is a salary certificate required? To get a loan from home country bank. To take credit cards from India. Some bankers might insist for a certificate on their letter head of office. Allied Irish Banks, p. A competitive variable rate loan from Bank of Melbourne.

Other terms, conditions and exclusions apply. Salaried individuals who hold a corporate salary account with IDBI Bank can apply for this loan. The models of salary cert. Applicants need to be over the age of years to avail a personal loan from IDBI Bank. Loans can be prepaid or foreclosed months after the disbursal of the loan.

Existing borrowers can avail a top-up personal loan. A salary certificate or salary verification letter is a letter from an employer that shows the carrier of the letter commands an income and has a regular, dependable position, according to Rocket Lawyer. Copy of employee ID attested by NBP Branch (where applicable). Attested copies of last three (3) months salary slips.

FOR SALARIED PERSONS OF MNCs AND NBP APPROVED COMPANIES.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.