There are three general ways to value a company: the Income Approach, the Market Approach and the Asset Approach. The asset approach is less common and used more for companies facing a liquidation scenario, or companies that have negative. It is nearly impossible to beat the market.

Professionals such as mutual fund managers are smart people, but even they rarely beat the market. What is an example of a negative enterprise value? What are examples of negative earnings?

For some investors, the possibility of stumbling upon small biotech with a potential blockbuster drug, or a junior. Smart Business spoke with David E. A firm with negative earnings or abnormally low earnings is more difficult to value than a firm with positive earnings. In this section, we look at why such firms create problems for analysts in the first place and then follow up by examining the reasons for negative earnings. Comps is a relative valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business (CCA) method operates under the assumption that similar firms in the same industry have similar multiplesTypes of Valuat.

See full list on corporatefinanceinstitute. As we can see, private company valuation is primarily constructed from assumptions and estimations. While taking the industry average on multiples and growth rates provides a decent guess for the true value of the target firm, it cannot account for extreme one-time events that affected the comparable public firm’s value.

As such, we need to adjust for a more reliable rate, excluding the effects of such rare events. Additionally, recent transactions in the industry such as acquisitions, mergers. We hope this has been a helpful guide to private company valuation. To keep learning more about how to value a business, we highly recommend these additional resources below: 1. Valuation MethodsValuation MethodsWhen valuing a company as a going concern there are three main valuation methods used: DCF analysis, comparable companies, and precedent transactions. Next, calculate the EV, or enterprise value of each public company.

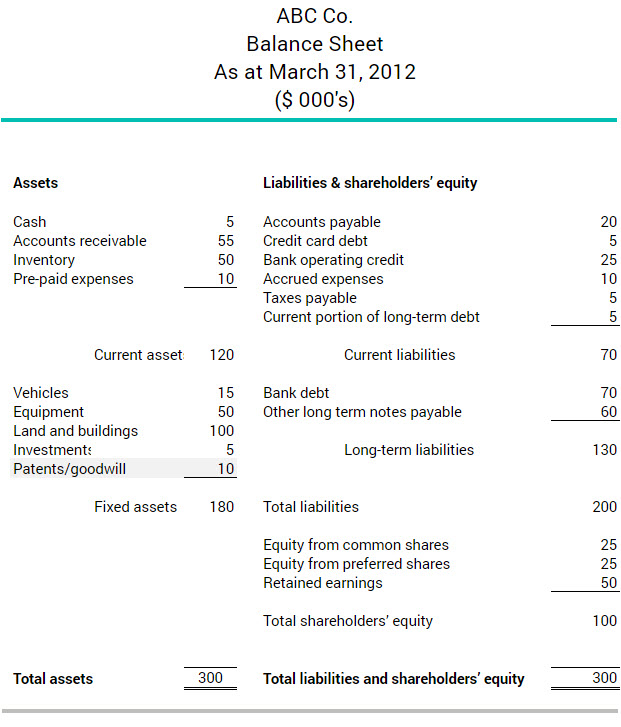

To calculate, take their market cap (shares outstanding times stock price) and add in their net debt (total LT debt minus cash). This is the total value of the company , including both equity and debt. Before sitting down with prospective buyers or investors, small business owners should understand how this valuation metric will be used to calculate the worth of their company.

So if the market value of your business is $million but actually holds only $600worth of assets, the rest $400of value belongs to goodwill. If the value of your company is less than the value of its assets, then the difference between the two is a minus number and become negative goodwill. EBITDA Multiples by Industry. Some small business owners hold on to the ownership of real estate when they sell their business and agree to lease the property back to the new owner on a long-term lease agreement.

The admonition not to put all your eggs in one basket is especially appropriate for speculative investments. That is the company ’s value is negative. This is a flaw that is usually avoided in accounting and economics as a company cannot have a negative value. This is because a company is only liable up to the amount Negative equity is only used in real estate and mortgages, representing the situation where the value of an asset used to secure a loan. They are considering what the future stream of cash flows from your company will be worth.

A simple way to think about the. A steady stream of revenue and financial records make it easier to calculate the value of the business. Figure 1: A Financial Balance Sheet for a Declining Business Little or no value from growth. Can even be negative , if firm pursues bad investments All of the value comes from existing assets, but some of these asset may be woth more liquidiated.

If your business has a lot of assets, such as property or lan the negative goodwill can occur. So use an asset-based approach when valuing your business. The rule of thumb way of doing this is a multiple of annual net profit. The best way to learn is by doing.

Enterprise value multiples don’t immediately assume that the equity of a business has value. This can be a dangerous assumption. Calculation using Formula 1. Operating Profit given as $1million and Depreciation and Amortization is $5million. When doing this, it is important to remember to also adjust the business income statement (negatively) to reflect a market rent expense. The ability to make distributions comes from another line of business as well as the fact that they have a contract.

If your DCF is resulting in a negative share price, you should consider using a different valuation method. The OP should consider using the dividend discount model to value the business. Since regulated utilities often offer a very large dividend this valuation method is appropriate.

How to Value an Unprofitable Business Suppose you value a money-losing business with the valuation I most recommend for small businesses, the multiple of earnings approach. Plugging in a negative number for profits gives the business a negative value , indicating the seller should pay you to buy the business!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.