Satisfaction Guaranteed. Tax Return Envelopes, Tax. Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Returns are processed faster, refunds are issued in a matter of days, and it is safe and secure.

See full list on taxformfinder. Indiana has a flat state income tax of 3. What is a FICA exemption? Print or type your full name, Social Security number or ITIN and home address. Free IRS E-File - $14.

Hear from our Loyal Customers. Register and subscribe day free trial to work on your state specific tax forms online. Read the following to find the right one for you to file. For your convenience, Tax-Brackets. Form IT-for Full-Year Residents.

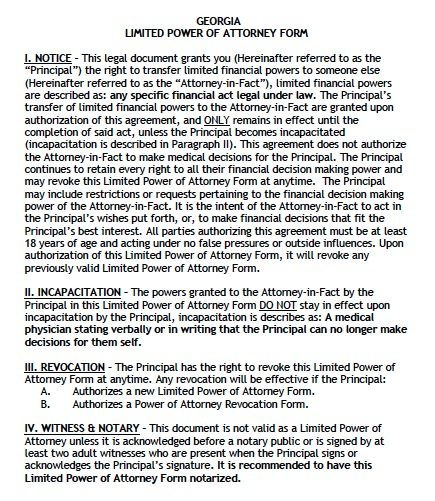

Most states will release updated tax forms between January and April. You must keep this completed form on file with your records for five years. If you use the calculator, you don’t need to complete any of the worksheets for Form W-4. Note that if you have too much tax withhel you will receive a refund when you file your tax return.

If you have too little tax withhel you will owe tax when you. Be sure to verify that the form you are downloading is for the correct year. As you proceed through the tax interview on eFile.

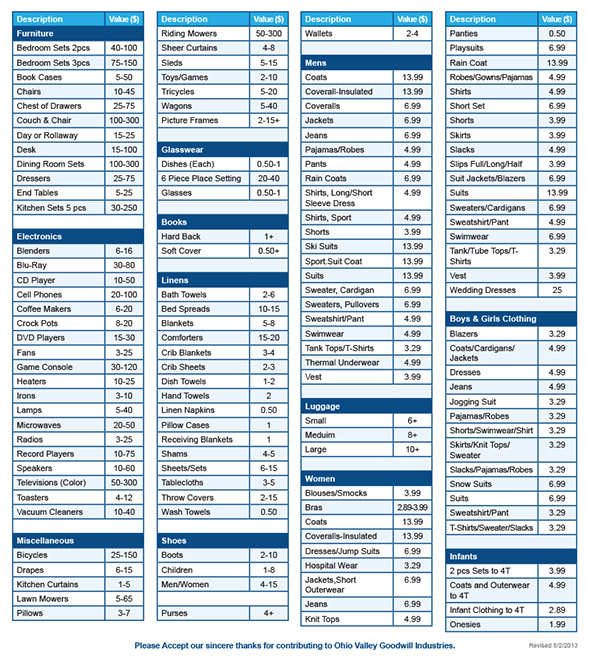

You can also select tax forms individually. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales- tax -free purchases. If Form NP-or extension is. Business tax types are now being administered in INTIME.

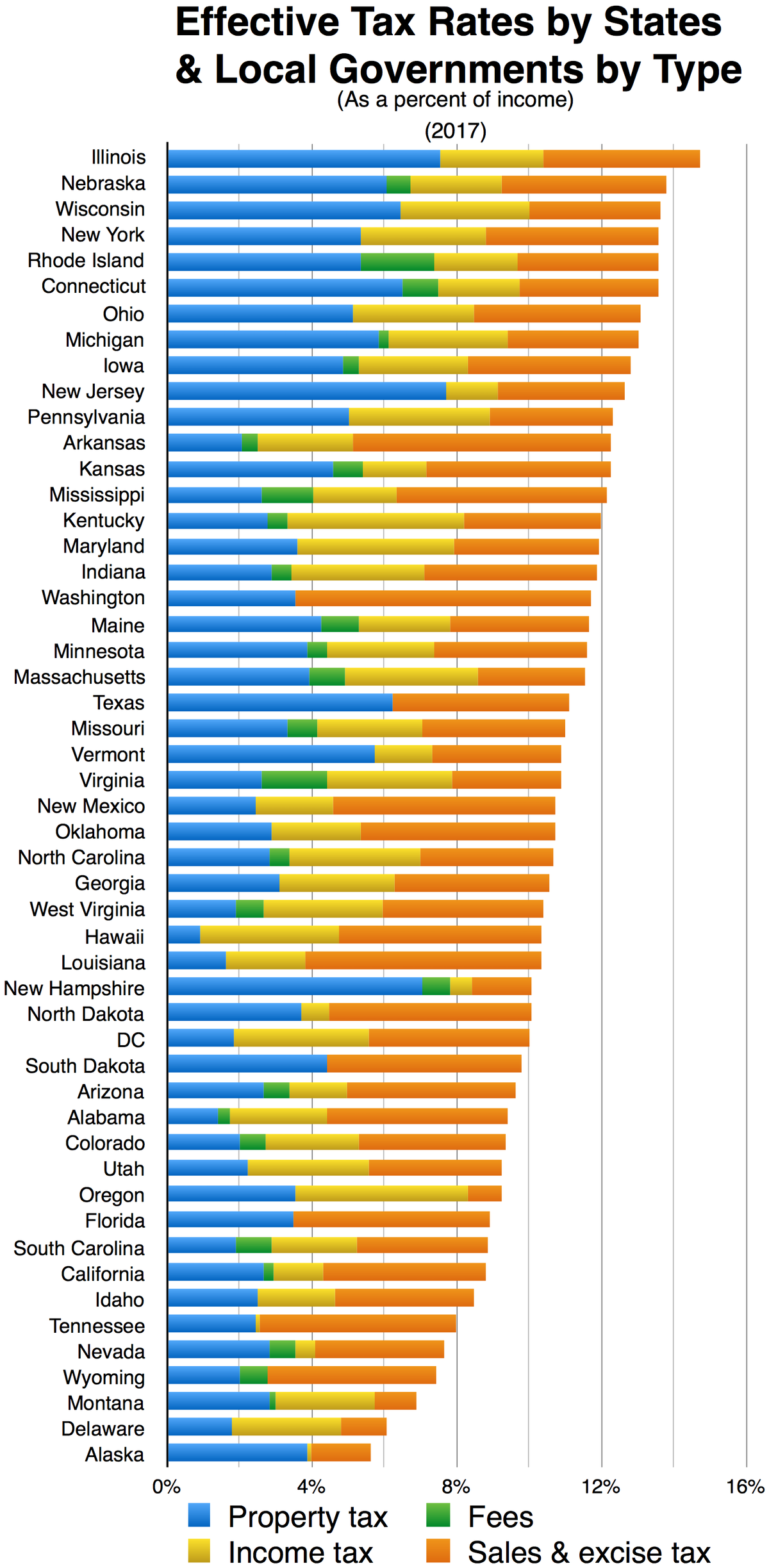

Must be field with Form 103-Long to receive deduction. Click on any state to view, downloa or print state tax forms in PDF format. This interactive tool will help you find out the status of your refund. Make Your Searches 10x Faster and Better.

Powerful and Easy to Use. Filing and Payment Extensions for Individuals and Corporations. There is no additional transmission cost for electronically filing state forms.

When that date falls on a weekend or holiday, filers get until the next business day to submit their state returns. This business needs to complete both a Form 103-Short and a Form 104. Start on page of the Form 103—Short. We filed a joint federal return. How do I obtain a state tax number to collect sales tax ? Do I have to figure county tax ? All states have different state tax forms.

In states which impose a state tax , it is not possible to use the federal tax forms in place of the state tax forms. If taxpayers are looking for services, dial 2-1-to find a nearby VITA location and schedule an. For most income tax filers, federal tax forms must be postmarked by this filing due date to avoid penalties. It is not required if you are already contributing in enough tax. Sometimes, the state will send out these forms even if you owe a small amount.

But as long as you are paying enough in through withholdings, you do not need to make estimated payments.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.