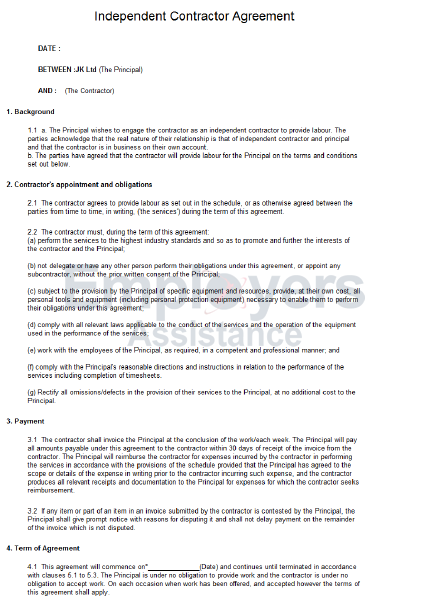

What is an independent contractor agreement? Are noncompetes with independent contractors enforceable? Independent Contractors. Nothing herein shall be construed to create any relationship of employer and employee , agent and principal , partnership or joint venture between the Parties. Each Party is an independent contractor.

Neither Party shall assume, either directly or indirectly, any liability of or for the other Party. They must pay self-employment tax— for Social Security and Medicare—as well as income taxes , but they must pay this on their own. This clause should simply come out and say something along the lines of, “ Contractor is an independent contractor and is not an. This period varies from one company to another and may range from six months to five years or even longer. This may seem like a no-brainer, but what should it look like?

We recommend that you include that the party will be an independent contractor and is responsible for payment of all taxes. See full list on businessese. Your agreement should specifically state how and when the independent contractor will be paid.

Be sure to include: 1. How the contractor will be paid 3. The amount to be paid 2. Whether an invoice is required prior to payment 4. Flat fee for the full project or for achievement of certain phases of the project 2. Time-base such as hourly or monthly Tip: Remember, an independent contractor is not an employee and is typically not a salaried position. Ensure that your agreement has clear termination provisions. At minimum, your termination provision should include: 1. Who may terminate – Make sure it is specific as to whether both parties have the right to terminate. How to terminate – What process needs to be followed before terminating?

When to terminate – How much notice is needed before the termination becomes effective? Payment – How is the payment handled if the agreement is terminated? Typically, the contractor will be paid pro rata, which means paid for the work completed until the termination is effective, but this should be specifically stated. Most independent contractor agreements will have a confidentiality provision.

If the contractor will receive access to any company logins, it is especially important to discuss how this information should be stored and used. We see this most frequently in the case of Virtual Assistants and Social Media Managers. In the event of a termination, ensure any passwords are easily accessible and changed.

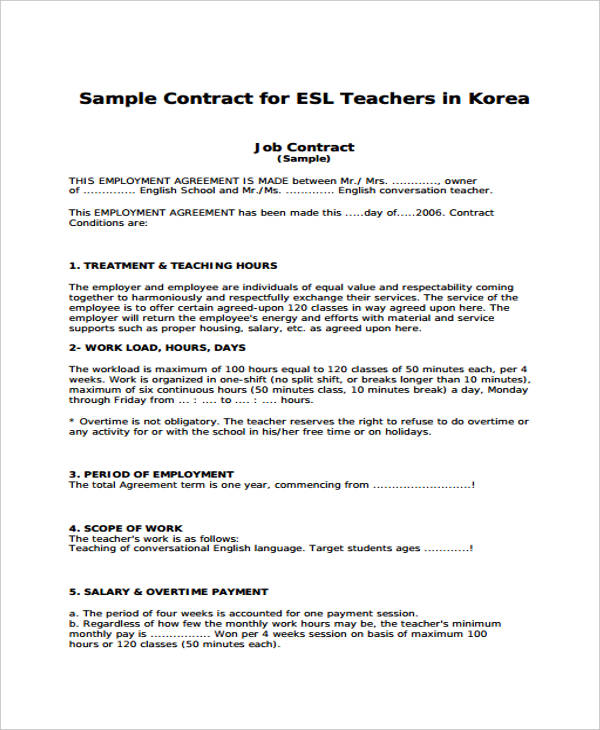

In order to be enforce these provisions must be reasonable. An independent contractor can agree to a restrictive covenant, such as a non-compete or a non-solicitation provision. Typically, in the online business worl we see these provisions used when a company is working with subcontractors who work in a similar field.

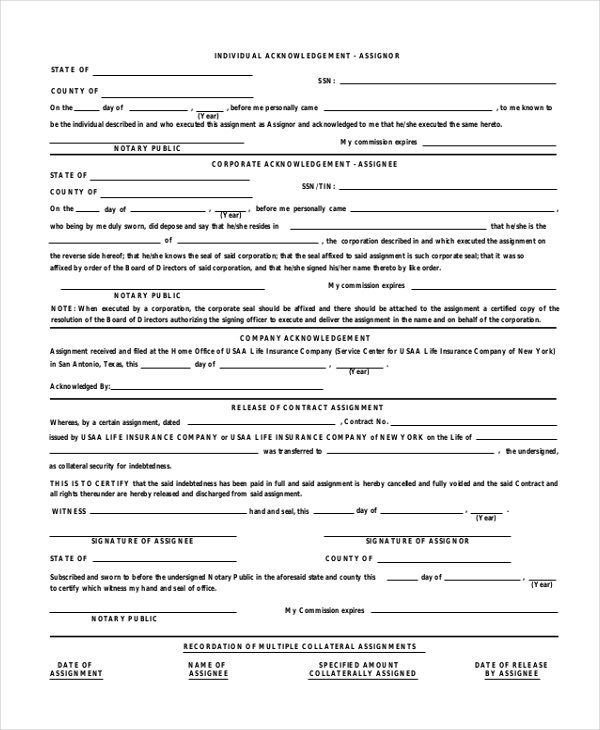

For example, if you own a Virtual Assistant company that hires other virtual assistants to subcontract for specific products, the contract may contain restrictive covenants to ensure that the subcontractor does not try to solicit your clients. Facts that provide evidence of the degree of control and independence fall into three categories: 1. Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job? Financial: Are the business aspects of the worker’s job controlled by the payer? Type of Relationship: Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?

Businesses must weigh all these factors when determining whether a worker is an employee or independent contractor. Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor. There is no “magic” or set number of factors that “makes” the worker an employee or an independent cont. Be aware that it can take at least six months to get a determination, but a business that continually hires the same types of workers to perform particular services may want to consider filing the Form SS-8(PDF). Once a determination is made (whether by the business or by the IRS), the next step is filing the appropriate forms and paying the associated taxes.

Forms and associated taxes for independent contractors 2. There are specific employment tax guidelines that must be followed for certain industries. If you classify an employee as an independent contractor and you have no reasonable basis for doing so, you may be held liable for employment taxes for that worker (the relief provisions, discussed below, will not apply). Employment Tax Guidelines: Classifying Certain Van Operators in the Moving Industry(PDF) 2. If you have a reasonable basis for not treating a worker as an employee, you may be relieved from having to pay employment taxes for that worker.

To get this relief, you must file all required federal information returns on a basis consistent with your treatment of the worker. Register and Subscribe now to work with legal documents online. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! All deliverables are expected to be completed within this time.

In case the contractor is able to complete the services earlier than the date specifie the tenure will be reduced to such time as the contractor makes final delivery. Nothing in this Agreement shall be deemed to constitute a partnership or joint venture between the Parties or constitute any Party to be the agent of the other Party for any purpose. It is critical that business owners correctly determine whether the individuals providing services are employees or independent contractors. Generally, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee.

Additionally, an independent contractor has his or her own business and provides goods or services to the host business. Therefore, non-compete agreements are often unenforceable against independent contractors because this would cause the business to forfeit its own profit and prosperity in simple exchange for a portion of its business.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.