When does a negative cash balance appear on the balance sheet? Should a balance sheet have a negative reserve? What is a negative account balance? Negative working capital most often arises when a business generates cash.

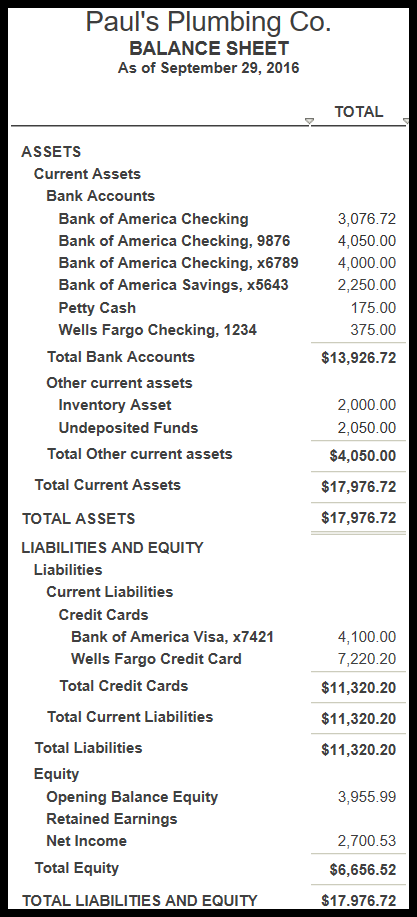

The more theoretically correct approach is to segregate the overdrawn amount in its own account, such as Overdrawn Checks or. Accounts payable account. Just drop the amount into. If total assets are less than total liabilities, the business has negative net assets.

For example, a business with $5in assets and $8in liabilities has net assets of ($300). If this is the case, net assets can and should be reported as a negative number on the balance sheet. They regularly show up on the accounts payable register as credits.

A negative liability is a company resource and ought to be treated as a prepaid cost. If you made a loss in the year you will almost certainly have a negative balance sheet. NB for filing to HMRC you have to submit a iXBRL file, ie you cant lob them a paper file.

However, the company may be able to operate if its cash inflows are greater and sooner than the cash outflows necessary for meeting its payments on its liabilities. When a company prepares its balance sheet , a negative balance in the cash account should be reported as a current liability which it might describe as checks written in excess of cash balance. The logic is that the company likely issued the checks to reduce its accounts payable. If a corporation has purchased its own shares of stock the cost is recorded as a debit in the account Treasury Stock.

When stockholder’s equity is negative , it is not noted as such on the balance sheet. Instea the total deficit appears on the company’s balance. NGW in the Balance Sheet In the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it reduces the valuation. Alternatively, goodwill may be recorded as negative (under assets) to indicate the amount of NGW.

This leads to an excess of recorded products in one place and a negative balance in another area. This can also come from recording wrong numbers of transferred inventory. Balance sheet insolvency occurs when a company’s total liabilities are greater than its assets – a situation that can be determined by taking a ‘balance sheet test. Along with a cash flow test, it provides a clear picture of the company’s financial status, and helps directors to avoid accusations of insolvent trading.

Remember that any liabilities present must be subtracted from this value. The balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount. On the first date of the New Fiscal Year, you offset the negative (= funds already removed from the business) with the RE (= new equity that would be provided by the prior year operations). Run the Balance Sheet to see Total Equity. Stop worrying about negative distribution.

It is always negative when there is Taking. Positive = contributions. But a negative balance simply means that your card issuer owes you money, which may.

In fact, you are owed money by your card issuer. For management, owners, and investors, this means that a company might soon have to file for bankruptcy. As long as a company has cash available, it may be able to continue operations. This is when a customer invoice is created first. How should you account for cash overdrafts (also called negative cash balances) on a balance sheet and in a cash flow statement?

It is year-end and your audit client has three bank accounts at the same bank. Two of the accounts have positive balances (the first with $50and the second with $20000). The third account has a negative cash balance of $40000. Since a net overdraft of.

So think about the journal entry when an investor purchases common stock. Common Stock See how common stock has a natural credit balance ? The dollar amount of treasury stock recorded on the balance sheet refers to the cost of the shares a company has issued and subsequently reacquire either through a share repurchase program or other means.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.