It covers claims made against you for alleged negligence or breach of duty arising from an act, error or omission in the performance of your professional advice or service. This policy covers third party claims for negligent acts, omissions or breaches of professional duty. What is QBE professional liability insurance?

Single project indemnity provided by Raheja QBE offers coverage to professionals such as architects, surveyors or engineers against claims arising from their professional work. Should they be faced with litigation or prosecution, they can be assured that QBE can help protect and support them. We help minimise the risk for businesses and professionals across a broad range of industries. QBE AUSTRALIA QBE is proud to re-launch its professional indemnity capabilities with enhanced coverage and pricing, as well as a new suite of tailored wordings to meet the needs of our key target professions.

QBE Insurance (Australia) Limited ABN. CONTENTS About this booklet About QBE Australia 2. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! The single project indemnity insurance provided by Raheja QBE offers security to architects, engineers or surveyors against claims arising out of their professional duty in relation to the specific insured project.

QBE is Australian owned and operate and provides all major lines of general insurance cover for personal and commercial risks throughout Australia. QBE has a long history of insuring professionals across a broad spectrum of industries, including architects, engineers, contractors, lawyers and accountants. Our customers value the longevity and continuity we bring, as well as our fair approach to pricing. QBE offers a civil liability wording that covers breach of professional duty.

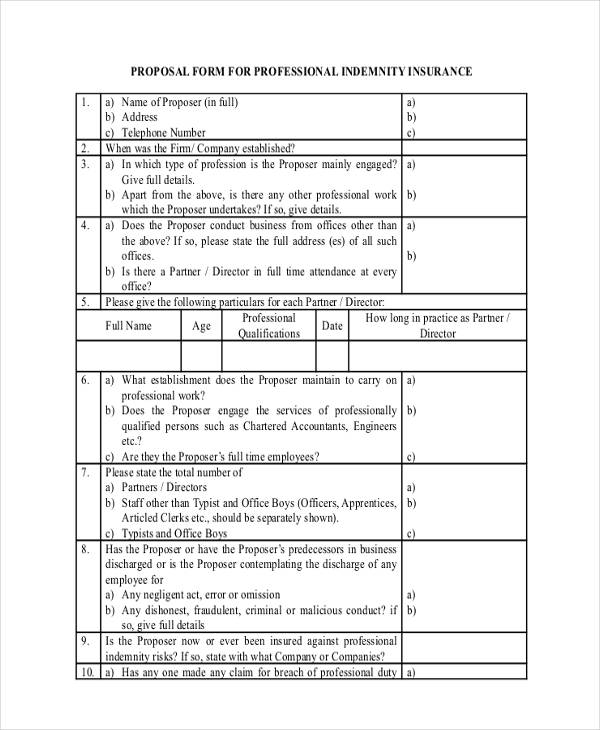

In consideration of payment of the Premium, Raheja QBE will provide indemnity in accordance with, and subject to, the Schedule, Conditions, Definitions, Exclusions, Deductible and other terms of this Policy (unless otherwise stated herein). Address of Head Office or principal office 1. Name of all entities requiring cover, including any subsidiary or newly created companies. For any entity established in the past months, please state the services provided. Date on which firm was.

Please list the professional bodies or associations you belong to. QBE have been around for over 1years QBE have been helping insure Australians for over 1years, they are Australia’s largest international insurance group and one of the top in the world. They provide cover for personal insurance, business insurance as well as workers compensation. We provide up to $10M limit of indemnity on an each and every claim and aggregate basis. We write both primary and excess layers and are happy to coinsure.

The insured should familiarise themselves with QBE ’s standard form of policy for this type of cover before submitting this proposal. Click here to download form) 2. Professional indemnity (PI) is our core class of insurance. Raheja QBE agrees to pay, the Costs and Expenses incurred with the written consent of Raheja QBE in the investigation, defence or settlement of any Claim covered by this Policy. PROVIDED ALWAYS THAT such Costs and Expenses shall be part of, and not in addition to, the Limit of Indemnity. The government indemnity covers only your work in your official government workplace.

If you engage in external work, like private practice or homes, the QBE indemnity will provide you the necessary coverage. In addition, the QBE indemnity covers you for as long as you stay insured with them, even if you switch practices. INSURING CLAUSES Legal Liability 1. Entity Employment Practices Indemnity QBE will pay on behalf of the Association against all Loss arising from any Valid Claim.

QBE has worked with schools, colleges and universities for the last years. They operate in all key insurance markets with offices in countries staffed by around 10team members. The cost of defending a claim can be very significant, whether or not the claim is justified and full cost recovery against the claimant is unlikely.

Please provide details of the types of professional services offered by the previous business(es) It is important that the claims and circumstances question within this Proposal Form fully refl ect the claims and circumstances history of any prior Practice or previous business. Application for Cover 26. Limit of Indemnity The sum stated in the Schedule which applies in respect of each and every claim, for which indemnity is provided underthisPolicy.

QGIF Insurance Policy – Statement of Cover is written on a ‘claims occurrence’ basis. This means QGIF will cover the Agency for an incident which occurs during the period when the policy was in force, regardless of when a claim is made or reported to QGIF. Cover is written on a claims-made basis but can include negligence, defamation, breach of confidence and infringement of intellectual property rights. Property management perils.

Allegations can sometimes verge on the bizarre, which underlines the reality that landlords and tenants alike are looking for someone to blame when problems arise.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.