How do you pay taxes on rental income? What is rental income tax? Is rental income tax deductible?

List your total income , expenses, and depreciation for each rental property on the appropriate line of Schedule E. On this form, you list your property’s rental revenue, expenses, and. When do I owe taxes on rental income ? In general, you must report all income on the return for the year you actually receive it , even though it may be credited to your tenant for a different year. Your rental earnings are £1000.

Rental income tax breakdown. You can claim £6as rental expenses. As a result, your taxable rental income will be: £1400. The first £10will be taxed at : £4in rental income tax. The next £4will be taxed at : £9in rental income tax.

Under current law, rental income is classified as “passive income ” and that income simply passes through to the owner’s personal tax return and they pay ordinary income tax on it. Reporting rental income and expenses. In most cases, a taxpayer must report all rental income on their tax return. If a taxpayer has a loss from rental real estate, they may have to reduce their loss or it may not be allowed. Such rental income is explained under Section 4(d) of the Act.

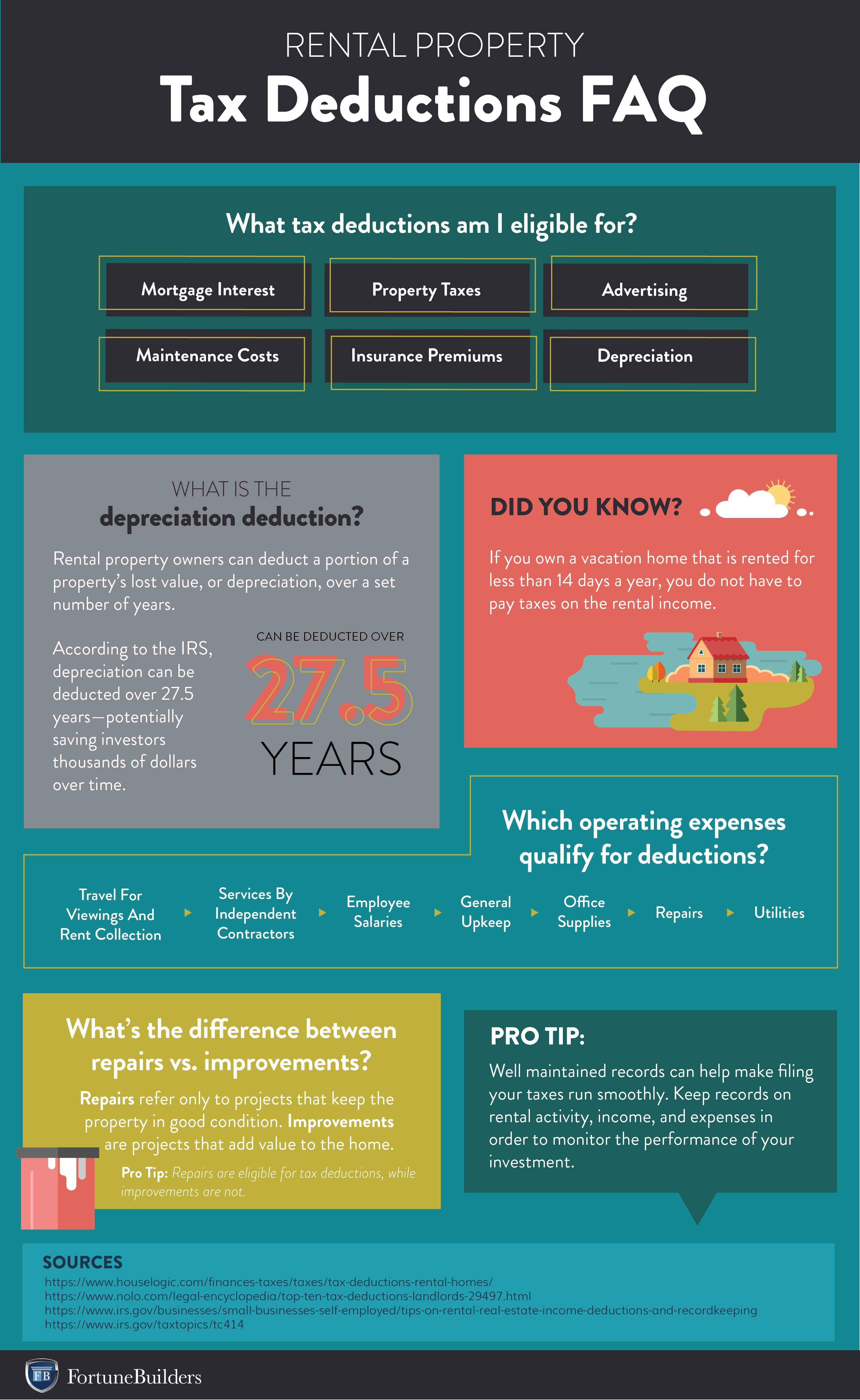

For information on these limitations, refer to Publication 92 Passive Activity and At-Risk Rules and Topic No. On Schedule E, you’ll list your total income , expenses and depreciation for each rental property. Expenses include, advertising, auto and travel, insurance, repairs, taxes and more.

Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited. If you itemize deductions on Schedule A, you can deduct allowable interest, taxes , and casualty losses.

Declaring losses on rental income. Losses from UK rental properties can be carried forward to set against future profits from your UK properties. You report your rental income and deductible expenses on IRS Schedule E. Often, you have a loss for tax purposes even if your rental income exceeds your operating expenses. This is because you get to depreciate (deduct) a portion of the cost of your rental property each year without having to lay out any additional money. The wear and tear allowance covers.

The idea is that income from the renting of residential properties would receive a exemption from income tax. KARACHI: The government has revised tax slabs for rental income from property to eight from five. If without rental property losses your residual income tax liability may be higher than $5consideration will be required to determine provisional tax obligations and effort will be required to manage. Incurred outside the rental period. Penalty imposed for late payment or non-payment of property tax.

Follow the on-screen instructions as you proceed through the rental and royalties section. The taxes on selling a rental house can add up fast. Net Investment Income Tax basics. Specifically, taxpayers with adjusted.

The NIIT only applies to certain high- income taxpayers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.