Depending on the type of rental property, investors need a certain level of expertise and knowledge to profit from their ventures. Real property can be most properties that are leasable, such as a single unit, a duplex, a single-family home, an entire apartment complex, a commercial retail plaza, or an office space. In some cases, industrial properties can also be used as rental property investments. More commercial rental properties, such as apartment complexes or office buildings, are more complicated and difficult to analyze due to a variety of factors that result from the larger scale. For older properties, it is typical to assume higher maintenance and repair costs.

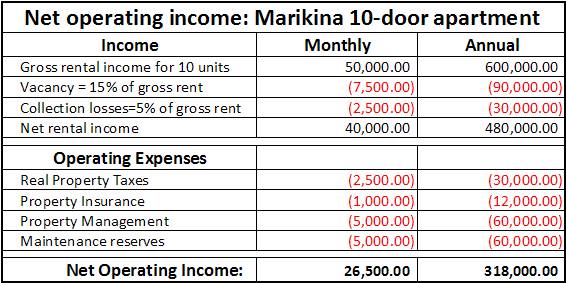

However, compared with equity markets, rental. See full list on calculator. Real estate investing can be complex, but there are some general principles that are useful as quick starting points when analyzing investments. It is important that they be treated as such, not as replacements for hard financial analysis nor advice from real estate professionals. Operating expenses do not include mortgage principal or interest.

The other can be used to pay the monthly mortgage payment. This can be used to quickly estimate the cash flow and profit of an investment. Rule—The gross monthly rent income should be or more of the property purchase price, after repairs. It is not uncommon to hear of people who use the or even Rule – the higher the better. A lesser known rule is the Rule.

This is a rule for purchasing and flipping distressed real estate f. Internal rate of return (IRR) or annualized total return is an annual rate earned on each dollar invested for the period it is invested. It is generally used by most if not all investors as a way to compare different investments. The higher the IRR, the more desirable the investment. Capitalization rate , often called the cap rate , is the ratio of net operating income (NOI) to the investment asset value or current market value.

Cap rate is the best indicator for quick investment property comparisons. It can also be useful to evaluate the past cap rates of a property to gain some insight into how the property has performed in the past, which may allow the investor to extrapolate how the property may perform in the future. If it is particularly complex to measure net operating income for a given rental property, discounted cash flow analysis can be a more accurate alternative. When purchasing rental properties with loans, cash flows need to be examined carefully. Cash Flow Return on Investment (CFROI) is a metric for this.

Sustainable rental properties should generally have increasing annual CFROI percentages, usually due to static mortgage payments along with rent incomes that appreciate over time. Whether a short recession depreciates the value of a property significantly, or construction of a thriving shopping complex inflates values, both can have drastic influences on cap rate , IRR, and CFROI. Even mid-level changes such as hikes in maintenance costs or vacancy rates can affect the numbers. Monthly rent may also fluctuate drastically from year to year, so taking the estimated rent from a certain time and extrapolating it several decades into the future based on an appreciation rate might not be realistic. Furthermore, while appreciation of values is accounted for, inflation is not, which might distort.

Aside from rental properties, there are many other ways to invest in real estate. The following lists a few other common investments. REITs Real Estate Investment Trusts (REITs) are companies that let investors pool their money to make debt or equity investments in a collection of properties or other real estate assets. REITs can be classified as private, publicly-trade or public non-traded. REITs are ideal for investors who want portfolio exposure to real estate without having to go through a traditional real estate transaction.

For the most part, REITs are a source of passive income as part of a diversified portfolio of investments that generally includes stocks and bonds. Generally, real estate is purchase improvements are made, and it is then sold for profit, usually in a short time frame. Sometimes no improvements. How to compute the rental income tax?

What is the tax rate on rental income? How do you calculate rental property income? Estimated Selling Price (FV) - The rental income calculator creates a cash flow statement from the time you purchase the property until you sell it. The selling price determines the capital gain or loss.

Set this to and the calculator will calculate it using the Annual Appreciation rate. The calculator allows you to apply VAT to a figure entered or calculate the VAT paid on the figure entered. Enter the Total Annual Income from Properties.

Your rental earnings are £1000. You can claim £6as rental expenses. Rental income tax breakdown. As a result, your taxable rental income will be: £1400.

The first £10will be taxed at : £4in rental income tax. The next £4will be taxed at : £9in rental income tax. Returns between 5- are reasonable for rental properties, if you’ve included some conservative cushions for annual repairs, vacancy rate, etc. An ROI of over is a good deal, assuming you’ve used accurate and conservative numbers in your calculation. Subtract total expenses from gross income to determine taxable income.

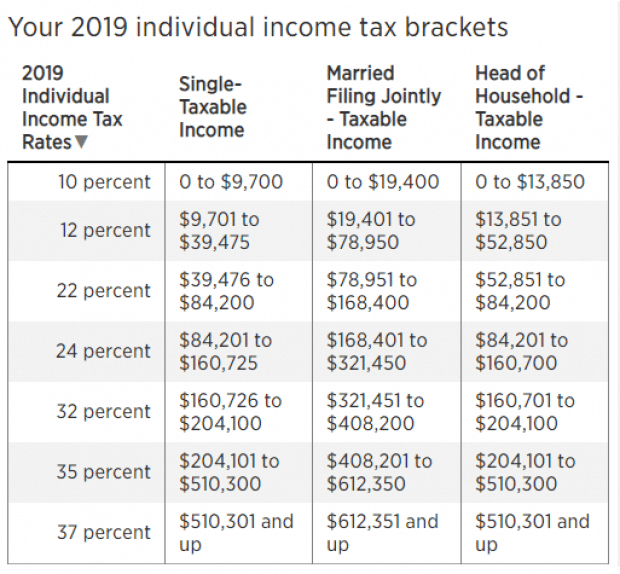

If the difference is greater than zero, this is your taxable income from your rental. On Schedule E, you’ll list your total income , expenses and depreciation for each rental property. Expenses include, advertising, auto and travel, insurance, repairs, taxes and more. The federal income tax system is progressive, so the rate of taxation increases as income increases. Marginal tax rates range from to.

Find out why Tax Dome is a better solution for your tax practice. To get an idea of what your rental income might look like on your tax return, let’s do some math: Let’s say you bought a property for $30000. Your monthly rental income stream is $60 and you’re in the marginal tax bracket. You might not use the rental property personally.

If so, you don’t need to prorate your expenses between personal and rental use. Reporting rental income. Deduct rental expenses in the expenses section of Schedule E. The HMRC have put together a few examples of users to illustrate how income tax from the property will change over the years. Landlord Tax Calculator is developed by converting an BM excel tax calculator. Clear losers in the changes are higher and additional tax ratepayers as will see from the Buy to Let Tax Calculator.

The cap rate calculator , alternatively called the capitalization rate calculator , is a tool for all who are interested in real estate. As the name suggests, it calculates the cap rate based on the value of the real estate property and the income from renting it. Assuming no other changes, you’d pay $24in tax that year. Your rental profits are taxed at the same rates as income you receive from your business or employment – , , or , depending on which tax band the income falls into.

Your rental income gets added to any other income you earn, which could tip you into a higher tax bracket. See an example of how the rate of tax on a rental profit is. Access IRS Tax Forms.

Complete, Edit or Print Tax Forms Instantly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.