Do I need to sign the letter of engagement? What are engagement letters? Timing of the Engagement. We expect to begin our services upon receipt of this signed engagement letter. TEMPLATE OF A CONSULTANCY ENGAGEMENT LETTER (INCLUDING A TAX INVESTIGATION ) This letter may be adapted to meet specific circumstances.

Where this is a separate engagement for an existing client reference can be made to the original engagement letter in relation to the terms. Tax engagement letters CONTRACTUAL STATUS OF ENGAGEMENT LETTERS. An engagement letter is not a contract—or is it?

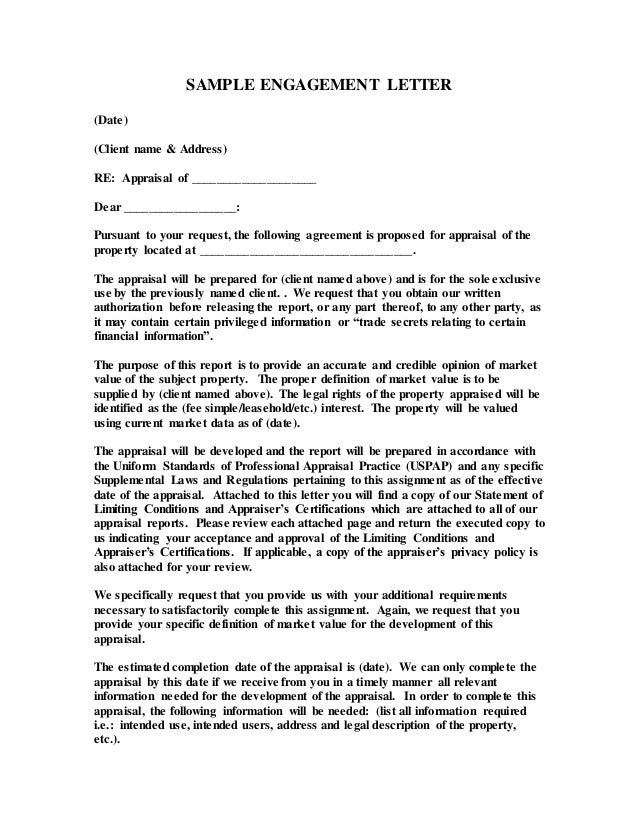

An engagement letter can. It is critical to specifically identify the client or clients. Sometimes in a tax engagement , any. Assortment of tax engagement letter template that will perfectly match your needs.

When composing a formal or company letter , discussion style as well as layout is crucial to earning a good impression. These themes supply superb examples of exactly how to structure such a letter , as well as include sample web content to act as an overview of layout. Variety of tax preparation engagement letter template that will perfectly match your requirements. A tax organizer is a client-facing document to help with the collection and submission of client information necessary to prepare a tax return.

The below templates are provided in fillable PDF and in Word (for Word versions, see the zip file). In addition, they allow you the opportunity to market additional services and ultimately create a stronger relationship with your clients. Engagement Letters provide you with essential protective wording for your practice.

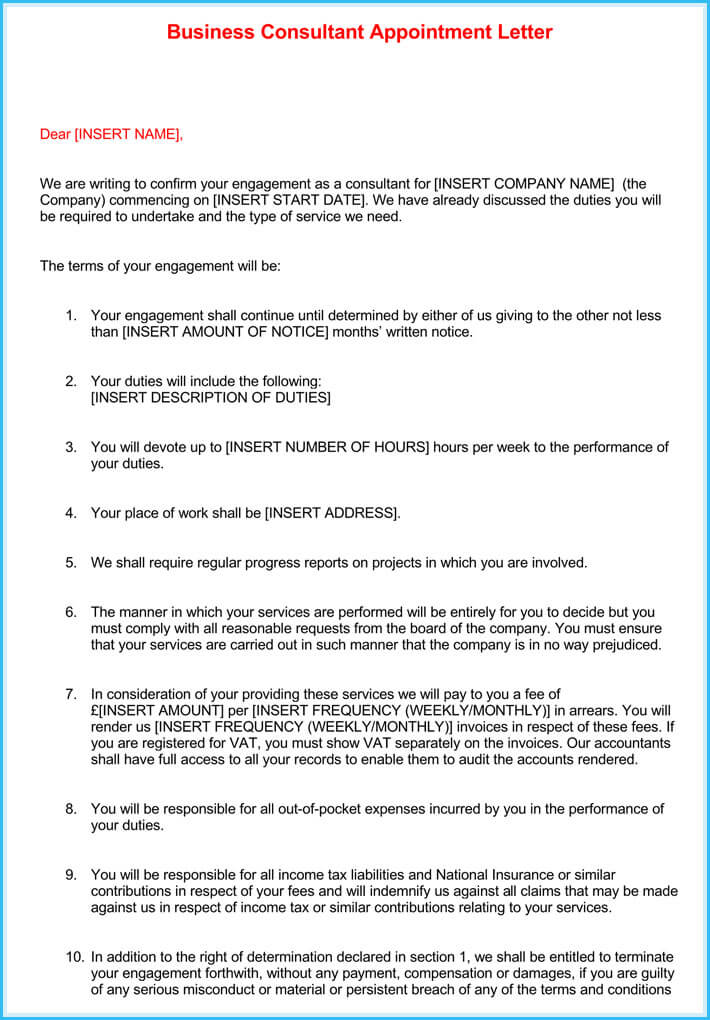

While obtaining a signed engagement letter prior to rendering services is the preferred risk management metho this may not be practical or cost-effective for all clients. Engagement letters should be sent to individual tax clients along with tax organizers at the beginning of tax season. Good ones are a balance between providing enough information and clarity to the tax client about the services you are providing, but not so detailed that the client is scared off by the length of the letter. Issue a separate letter to reflect changes in the nature or scope of a previously agreed upon engagement , including the provision of additional tax compliance, tax consulting , or tax planning services and representing the client before the IRS or other taxing authority. Tax reference materials include, but are not limited to the Internal Revenue Code (“IRC”), tax regulations, Revenue Rulings, Revenue Procedures, Private Letter Rulings and court decisions.

We will not update our advice after the conclusion of the engagement for subsequent legislative or administrative changes or future judicial interpretations. This letter states the terms and conditions of the engagement , principally addressing the scope of the engagement and the terms of compensation for the firm. If we do not get a signed copy of this engagement letter back from you we will assume that you have agreed to the terms and conditions set out in this letter. The collaboration section is now simplified and changed.

This engagement letter will apply for all future years tax preparation services unless the agreement is terminated in writing or amended in writing by you or the tax preparer. Please keep a copy for your records. We want to express our appreciation for this opportunity to work with you. American Institute of CPAs (AICPA). Ad Vea Tax Consulting.

Ahorre Tiempo y Encuéntrelos Aquí. Ad Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! The engagement letter is a contract and not a marketing device.

Particularly with amended tax return and tax audit engagements, do not guarantee outcome or. Successor and assigns. To prevent having to ask clients to sign an additional engagement letter if the firm is acquired by another firm, include successor-and-assigns language.

Only the job profile and the other details regarding the job may vary. It is a formal type of letter and hence must be short and precise. It must be to the point and must include all the details that the candidate needs to know about the job.

It spells out what you do for them, what you need the client to provide, how much and how often you get pai and more.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.