Create A Deed Of Trust Online. Real Estate Lending Business Today. Register and Subscribe now to work with legal documents online. XXX (the Founder) and. Trustees (the first Trustees) PREAMBLE A. It is the intention and desire of the Founder to create a Trust for the welfare and benefit of.

A testamentary trust is a trust that is specified in a persons will, and that is handled upon that persons death. A will can contain more than one testamentary trust. To explore this concept, consider the following testamentary trust definition. See full list on legaldictionary.

The difference between a testamentary trust and a living trust is that a living trust goes into effect when the settlor signs the trust , has it notarize and then transfer property into that trust. This kind of trust is called a living trust because it goes into effect while the settlor is still alive. Living trusts can be made to be either revocable or irrevocable.

An example of a testamentary trust that is a revocable trust is a trust that can be revoked at any time. Probate is the court-involved process of settling a persons estate. It can be costly, time-consuming, and is often more trouble than it is worth. Property that is left to beneficiaries through a living trust can pass on to them without the need for probate.

Irrevocable trusts cannot be revoked once theyre finalized. There are several different versions of this type of trust. This is another significant difference between a testamentary trust and a living trust. A childs trust is a trust that is set up so that money can be left to children through a will. The most common use of a testamentary trust is for children.

The reason why a childs trust is created in the first place is because minors, by law, are not allowed to receive substantial sums of money directly. Any money or property that is left to a child must be managed by an adult. Not only does a childs trust allow a settlor to leave money to a chil but it also permits him to name someone he trusts as the guardian of his gift. The trustee is then left in charge of the trust until the minor becomes of age and can effectively manage the trust himself.

The settlor decides the age at which the minor will receive the trust and specifies that age in his will. Tom and Barbara have one child together, Stephanie. They also name Stephanie as an alternate in case they both die at the same time.

There is also a type of trust known as a pot trust. A pot trust is incorporated into a will when there are multiple children to include in the will. This works to distribute the property evenly to the children in accordance with the wishes of the settlor(s). Harris and The First National Bank filed a petition asking the court to reform the trust. Peter MacDonald did not join in the petition, so he was assumed to either be deceased or, for some reason, no longer a beneficiary of the trust.

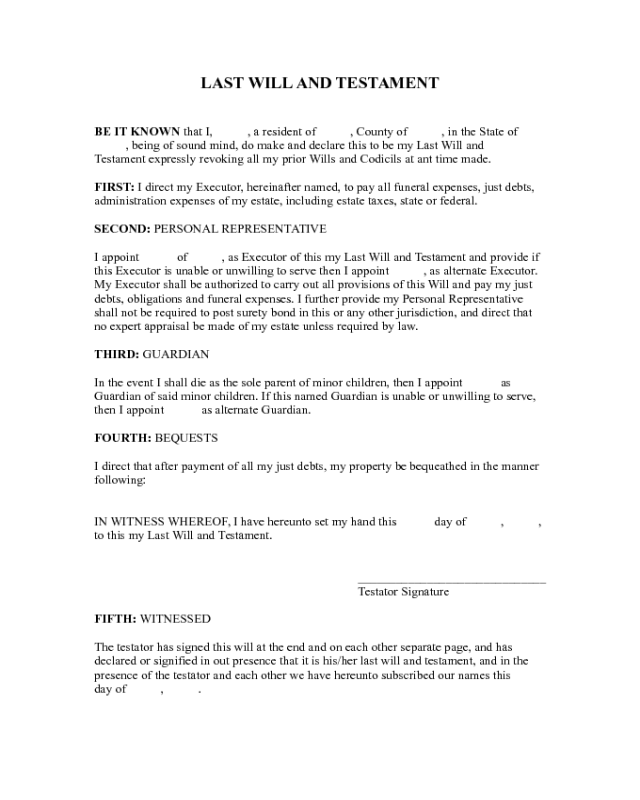

The trustees asked that three revisions be made: No one opposed these changes, and so the district court granted them. Unhappy, however, with the way the QSST was to be set up, the trustees filed an appeal. A typical Australian ( template ) last will and testament establishing a testamentary trust where the intended beneficiary is a person with an intellectual impairment. The Court of Appeals therefore affirmed the district courts actions. This one is established by a person’s last will and testament naming the trust as the beneficiary.

A testamentary is not the whole will but a provision in the will, instructing the estate’s executor to make the trust. Learn more about Wills. Is there a difference between a deed and a deed of trust?

How does deed of trust construed? What is a deed of trust to a private trustee? The trust deed or Will, as the case may be, should clearly specify the intention and purpose to create a trust.

If your property is conveyed to the trust under your Will, then as per stamp laws. Instant Download and Complete your Trust Forms, Start Now! All Major Categories Covered.

TRUST DEED Every trust is governed by a trust deed. This sets out how the trust must be run, what the trustees can do in running the trust and who the beneficiaries are. This is contrasted with the creation of a trust while you are alive using a trust deed.

When you make a gift under a testamentary trust will, that gift is held on trust for your beneficiaries. See Sample Children’s Trusts will provisions. The primary purpose of most living trusts is to avoid probate. Testamentary Trusts Do Not Avoid Probate.

Unlike living trusts , testamentary trusts do not avoid probate. Unlike a living trust , a testamentary trust comes into existence only after the settlor dies. The terms of the trust are specified in the will. Discretionary (Family) Trust Deed. It is frequently used when the beneficiary or beneficiaries are children or disabled people.

We also show you testamentary trust example wording and provide free last will and testament templates.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.