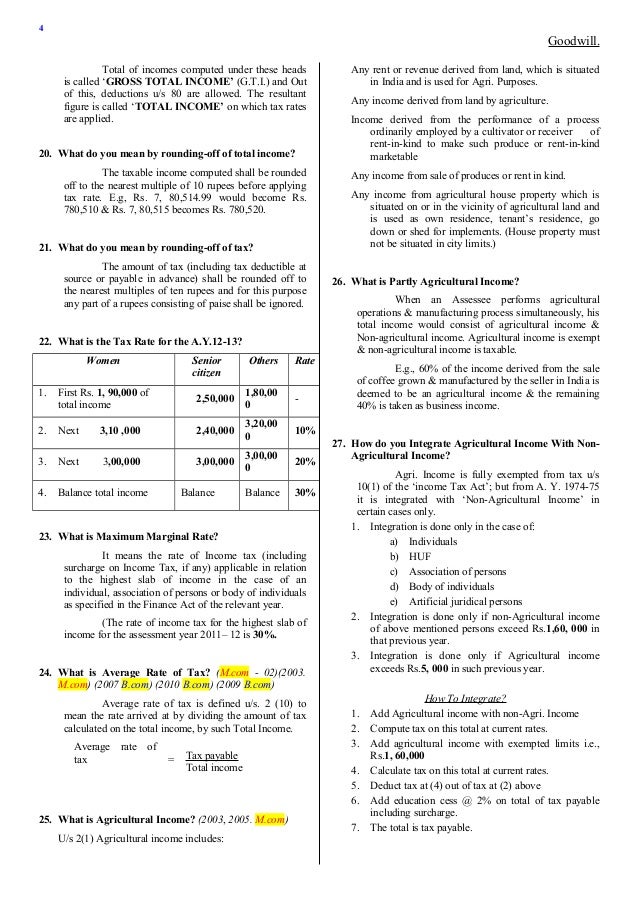

Total Income and Tax shall be rounded off to the nearest. How do you round to the nearest multiple? What is the rounding off of income tax? How many rupees to round off tax payable? Example: if the total income is Rs.

The rounding off of tax would be done on the total tax payable or refundable and not to various different sub-heads of taxes like income tax, education cess, surcharge etc. Explanation: The total income, as compute shall be rounded off to the nearest multiple of ten rupees and for this purpose any part of a rupee consisting of paise shall be ignored. The amount of total income computed in accordance with the foregoing provisions of this Act shall be rounded off to the nearest multiple of ten rupees and for this purpose any part of a rupee consisting of paise shall be ignored and thereafter if such amount is not a multiple of ten, then, if the last figure in that.

All numbers are rounded to the nearest dollar by IRS rule, but it really does not matter that much. If $51you would get $5. Rounding to the Nearest Multiple. Suppose you wanted to round off the money value of $76.

According to section 288A you need to round off your taxable income to the nearest multiple of rupees. While deriving paise should be ignored. This means, If total income is Rs. Section 288B talks about rounding off of tax payable or refund.

If the last digit in the total figure is less than the total amount should be reduced to the nearest lower amount which is a multiple of Rs 10. This rounding off of income should be done only to the total income and not at the time of. How to round off total income before computing tax liability? The taxable Income computed should be rounded off to the nearest multiple of Rs. Paise is more than Paise, it should be rounded upward to the nearest Rupee and if the value in Paise is less than Paise, it should be rounded downward to the nearest Rupee.

I do it all the time in my financial calculations. For example, if I need to calculate percentage discounts and it gives me a number such as $47. In Excel, it’s very easy to do that with the ROUND formula!

For example, imagine looking at the income statement with the following sales amounts over the past three years: $51989. Now look at the amounts rounded to the nearest thousand: $5$3$266. The rounded figures allow you to focus on the relevant digits.

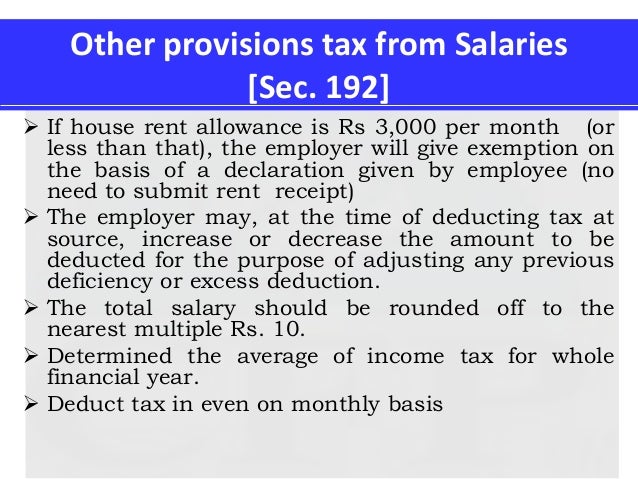

Employer is advised to quote Total Taxable Income in Annexure II without rounding - off and TDS should be deducted and reported accordingly i. This from a “happy coincidence” when multiplying, rounding , and summing certain decimals. In this example, the rounding differences cancel each other out, and the effect is a wash when calculating tax with the total tax rate (both calculation methods come to $10). Whether an amount is rounded or not is an important part of your model logic.

When a money amount is going to be rounded (e. g. an item total ), your model should always return or store this amount as a rounded value. No other model should ever see the original value before rounding. Candle central has $4of total variable expense for a sales level of 6units and $1of total variable expense for a sales level of 9units. Surcharge of per cent is payable by an individual where the total income exceeds: a) Rs.

None of the three Ans c 2. Free 4th grade place value and rounding worksheets, including building and digit numbers from their parts, finding missing place values, writing numbers in normal and expanded form, and rounding to the nearest ten, hundred or thousand. If 4hours are worked in a month, total utility cost ( rounded to the nearest dollar) using the high-low method should be $9Direct material $3. This income should be rounded off to the nearest multiple of ten rupees.

AA, as discussed in para 4. Income -tax on such income shall be calculated at the rates given in para 2. If you have to add two or more amounts to figure the amount to enter on a line, include cents when adding and only round off the total. By contrast, the income tax calculation is much simpler. Pay is rounded to the whole pound before looking up the tax amount in the tax tables or applying the relevant percentage. As pay is rounded to the nearest poun the resulting ‘tax due’ amount is never more than to two decimal places, that is, to the penny. It will return you a float number that will be rounded to the decimal places which are given as input.

If the decimal places to be rounded are not specifie it is considered as and it will round to the nearest integer.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.