To See Sample Warranty Deeds Now. Create Your Warranty Deed Online. Free Online - 1 Comprehensive. Is a warranty deed the same as a conveyance deed? Does a will override a warranty deed?

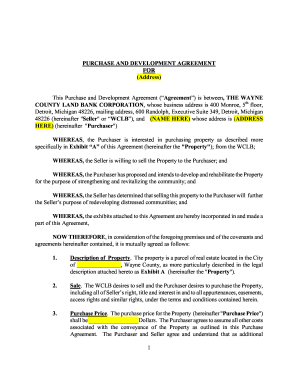

What is a deed without warranty? The warranty deed is commonly used when a property is purchased at or around its fair market value. A deed of trust transfers the legal title of a property to a third-party trustee, who holds the title until the terms of the contract are fulfille when the borrower repays the lender in full. A warranty deed transfers property between a grantor (the seller) and a grantee (the purchaser). When it comes to a Warranty Deed vs.

Quitclaim Deed , the central difference lies in the guarantees. Purchasing a home involves a lot of paperwork and documents to be signed. Most people utilize a mortgage loan to finance the purchase. Generally, a buyer places a bid on the home he wishes to purchase.

If the seller accepts the offer, the buyer will need to get a loan approved in that amount minus any down payment. When the transfer is complete, the seller must sign a warranty deed and the buyer signs a type of security instrument with intent to repay the loan. The state of Georgia calls this instrument a security deed , while others call it a mortgage or deed of trust. Warranty deeds act to complete the transfer of property ownership, or conveyance.

Usually, the seller is an individual or a building company. The seller is called the grantor on the deed. The buyer, called the grantee, is the person purchasing the home.

When a warranty deed is use there is also an implied guarantee that the grantor holds a clean title to the property. This warranty protects the buyer if a claim is made on the property in the future from a previous owner, creditor or lien holder. See full list on pocketsense. When a mortgage loan is obtained in Georgia, a security deed must be signed at the time of the loans closing.

It also states the loan amount and its maturity date, or when it should be paid in full. The security deed further explains the terms of the loan, when payments will be due and what the conditions of a missed payment are. Overall, the security deed provides proof of debt and places a lien on the property.

Once the loan is paid in full, the mortgage lender cancels the security deed and the lien is removed. Security deeds stipulate the conditions of missed payments and the foreclosure process. Depending on the state in which the property is locate foreclosures may need to be mediated through the judicial system.

However, security deeds do not require court interjection. When a security deed is signe the lender can begin foreclosure without a court order. This expedites the process and eliminates legal fees for the lender.

Although security deeds and warranty deeds function in separate ways, both must be filed in the county land records system. This ensures that the proper information will appear on future title searches done on the property. In Georgia, the clerk of the superior court is responsible for recording and maintaining property records in each county. The documents must also meet recording requirements set by the state and county. Advertiser Disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions. However , it only promises a clear title for the time that you, as the seller , have owned the property.

This type of deed is generally used in commercial real estate transactions. The difference between a Warranty Deed and Special Warranty Deed is the extent of the coverage of the warranty. If a claim ever arises against the property in the future, the grantor will have to compensate the grantee. The deed pledges or warrants that the owner owns the. Real Estate, Landlord Tenant, Estate Planning, Power of Attorney, Affidavits and More!

All Major Categories Covered. The main difference between a warranty deed and a trustee deed lies in who it protects. Like all deeds, these two legal documents are both used to transfer titles from one owner to another.

A trustee deed lets a third party. The transfer can be done with a legal document called a “deed. There are two major types of deeds: a quitclaim deed and a warranty deed. A quitclaim deed terminates your interest in a property, but it does not give protections to the beneficiary (the person receiving the interest).

To further clarify warranty deed vs. It works like a warranty on a new car that guarantees the car will perform as promised for a period of time. Additional language regarding the extent of the warranty being given is included in the deed.

The grantor states that the property has not been sold to anybody else and they will warrant and defend the title against the claims of all persons. You may also hear it called a Covenant Deed. Read more to find out how to use this type of deed. Electronic Signature Solutions by SignNow.

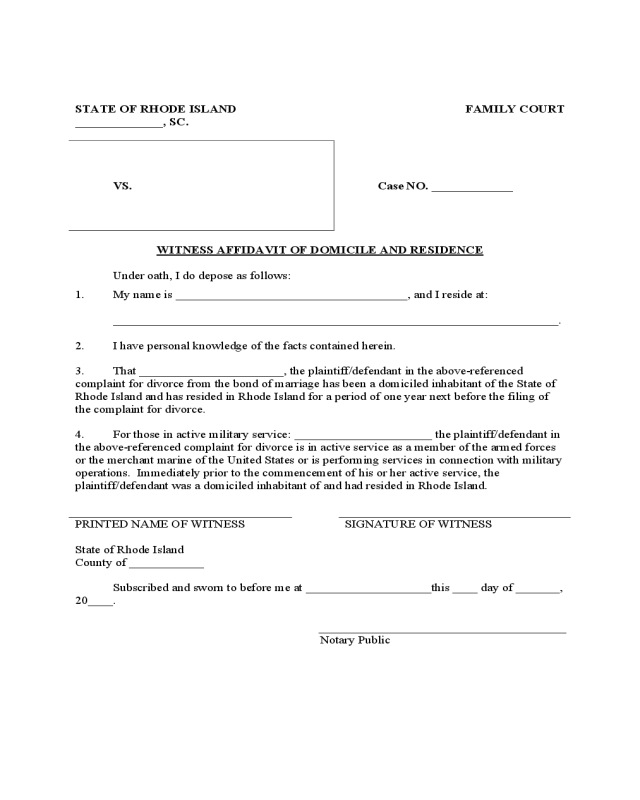

A statutory warranty deed is a legal document that transfers ownership of real property from the seller (called the grantor) to the buyer (called the grantee).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.