Get free, professional invoices custom made for your company. Track all your payments. No Credit Card Required! Start Your Sunrise App Today! What is the difference between an invoice, bill, and receipt?

Does an invoice mean you paid? Do you provide an invoice or payment receipt? Should I use invoice or sales receipt? An invoice tracks the sale of a business’s goods or services. A receipt is issued post the payment.

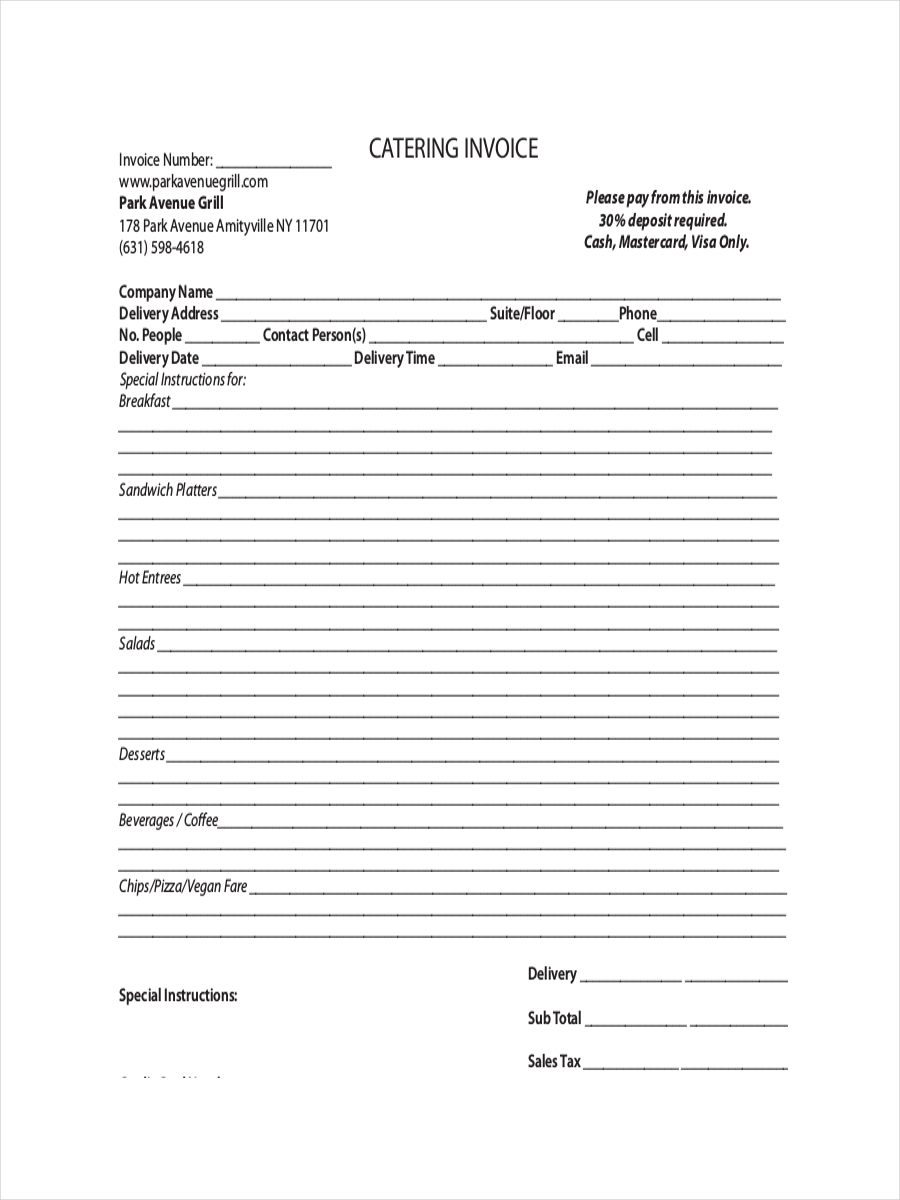

They are often referred to by customers as the bill, and they can arrive in the mail, be delivered by hand or sent online. Here are some dedicated invoice templates for your reference. Receipts: Receipts are given after the transaction is made, and they serve as proof of purchase. This is a key difference between an invoice and receipt.

Customers who get an invoice will also get a receipt when they pay. It’s essentially proof of purchase. If you slip up and accidentally send a second invoice , your customer can use a receipt to prove that they have already paid what they owe you.

The vendor and the customer can use the invoice for bookkeeping purposes. First and foremost, register your 360. There should be a card where you fill in your info and then mail it back to MS.

Or you can do it online. You aren't _required_ to furnish them with receipts for your purchase. The receipt will serve as proof as. The itemized invoice you have provided them will serve as their receipt and they can use that in whatever manner they prefer. It is perfectly reasonable to tell them.

The significant difference between the two is that the invoice is issued prior to the payment while the receipt is issued after the payment. On the contrary, receipt acts as documentation for the buyer that the amount of the merchandise has been paid. The invoice is used to track the sale of goods or services. As per the introduction, a service receipt is a document issued from the service provider to the customer as proof of payment made for services offered.

Businesses that provide products or services to customers before receiving payment send invoices. At the end of the invoice will be a complete total of the costs incurred by the client for the products or services that were purchased. Invoices Online - Customize Now.

A physical receipt or invoice lists each item and amount separately, while your canceled check only proves a total amount paid to a merchant or person, as written on the check itself. Using canceled checks to prepare your return is fine – you (or your tax preparer) have all the information you need to enter information for your deductions or credits. Provide getters and setters for each attribute, making sure that the numeric values given are not negative. Vague and complicated invoice payment terms, like “Net 30” or “Payment due upon receipt ” can confuse clients, which can lead to late payment.

Use precise language in your billing due dates. These duo-service forms will be useful for establishments that provide both in-store transactions (which will require over-the-counter receipts ) and deliverables (which will require invoices ). Therefore, using payment terms such as “due on receipt” can be subject to a customer’s interpretation. The country’s tax authorities require businesses to use fapiao to compel companies to pay tax in advance on their future sales. In this way, China’s fapiao invoice system serves as a paper warranty against tax evasion, unlike other countries where invoices serve as a tax receipt.

Expertly Designed Forms - Try Free!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.