This document explains the particular requirements relating to Reverse Charge supplies. It even provides a range of suggested wording to be included on your invoice. Setting Up A Sales Invoice Layout For Reverse Charge VAT. For a sub-contractor the statements is : “VAT ON THIS SUPPLY TO BE ACCOUNTED FOR BY THE PRINCIPAL CONTRACTOR”. Is sales invoice subject to reverse charge?

Is VAT accounted for under a reverse charge? What does reverse charge mean? Reverse Charges Any Invoice Format Anonymous watch_later years, months ago we have to make invoice for reverse charges for supply received from unregistered person if yes can you send the format for the same. A reverse charge means that when you invoice your customers , they are responsible to pay the VAT according to the rates that apply in their home country.

In addition, you should comply by including all other required information on the invoice. Sample format for invoices. Customer liable for the tax (i.e. under the reverse - charge procedure) – the words ‘ Reverse charge ’. Intra-EU supply of a new means of transport – the details specified in Article 2(2)(b) of the VAT Directive (e.g. for a car, its age and mileage).

My understanding was that reverse charge invoices need to say this supply is subject to the reverse charge or something similar. It does not mention the reverse charge anywhere. Print Instantly- 1 Free! Drafted By Professionals - Finish In Just Minutes - Create Documents Effortlessly!

Select the Invoice type from the drop-down menu, enter the Reverse Charge Invoice name and use the symbol RCI for the new document. As we are preparing reverse charge document, therefore, select the VAT rate instead of (by default setting). After entering all the parameters, select the OK button. Generally speaking, when you issue an invoice , VAT is always taken into account.

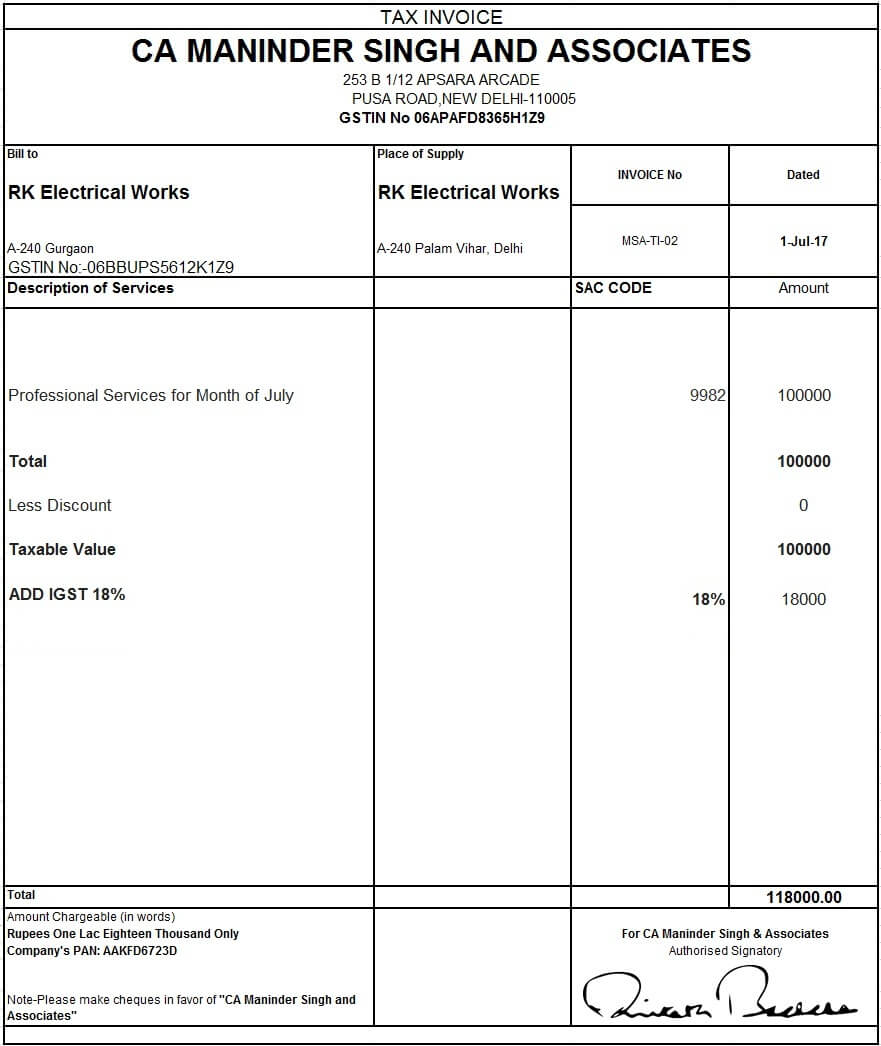

In other words, your client pays the entire sum, which includes value added tax. In the case of Goods. Here is a sample format of a GST invoice issued by the Government for reference: GST Invoice Format for Exports. Supplier authentication. Export invoices require a declaration citing that GST has been paid on such exports.

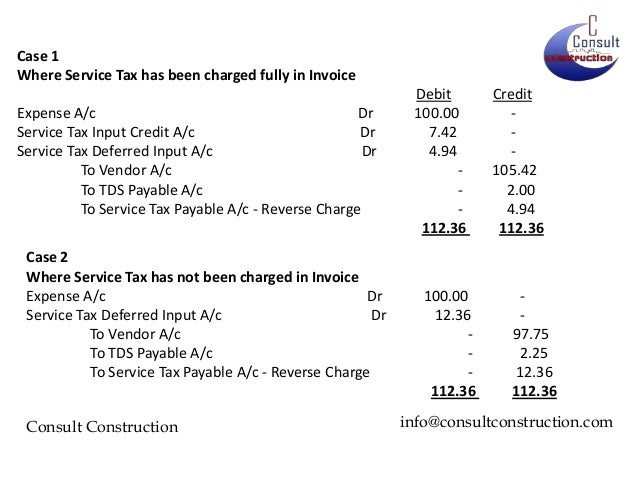

However, you, as a provider, are not allowed to keep such invoices, but must send them to the revenue office instead. With this in min our team has curated a number of VAT invoice sample templates including reverse charge invoice samples, valid invoice example, and VAT invoice. In addition to that, it contains the place of supply, invoice date, invoice number and applicability of reverse charge. Services Detail consists details like serial number, description, SAC code, quantity if applicable, units, rate and Total Sale. Taxation and remarks section consists of columns with sub column each for CGST, SGST, and IGST.

Under reverse charge , a registered person must issue a tax invoice in respect of goods or services received by him from an unregistered supplier. This means that the supplier of goods or services is not registered on the date of receipt of such goods or services under reverse charge mechanism. Furthermore, the recipient needs to issue a payment.

Automatically apply the reverse charge for VAT on invoices and expenses with invoicing software like Debitoor. The reverse charge refers to intra-community EU transactions, when the VAT is recorded by the buyer instead of the seller. Compared to when GST is charged normally, provisions for GST under reverse charge are different. In practice, a reverse charge simplifies VAT payments (at least on part of the supplier) and reduces the corresponding bureaucratic costs. Try it free for days.

However, the procedure in question is especially aimed to act against violations such as tax fraud and is known for combatting the so-called ‘missing trader frauds’, whereby tax-free cross-border shipments are used to evade VAT payments. The taxable invoice will only entitle the purchaser or receiver to claim input tax credit (ITC). There is no specified or fixed format for the invoice but certain prescribed information shall be mentioned on the face of GST invoice. Get Paid Instantly With Our Invoice Template. Simplify Your Transactions With Step-By-Step Templates.

No Software Required - 1 Free! Create An Invoice With Our Step-By-Step Process.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.