Ad Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! No Installation Needed. Convert PDF to Editable Online. Ad Register and Subscribe now to work with legal documents online. What is independent contractor operating agreement?

The client is able to specify the services they require as well as the designated wage, completion date, termination procedures, and other matters which help establish the working relationship between both parties. The new law addresses the “employment status” of workers when the hiring entity claims the worker is an independent contractor and not an employee. While supporters of the bill have emphasized its impact on independent contractors, the bill also severely impacts legal obligations governing businesses that hire other businesses.

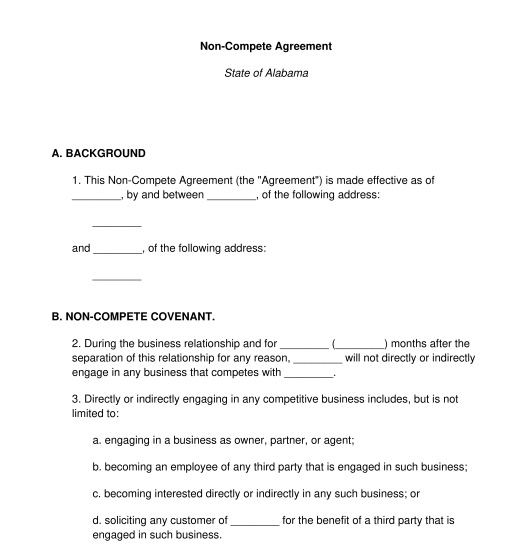

See full list on eforms. Hair Stylist Agreement 7. Hold-Harmless (Indemnification) 2. Non-Compete (Non-Solicitation) 3. Non-Disclosure (Confidentiality) 6. An independent contractor is classified by the IRS, under CFR 31. Part-time corporate officers. Ultimately, an independent contractor is an individual who h. Once an individual or company has decided that services are neede they will need to determine which independent contractor works best for them.

Once a contractor is foun it is time to write an agreement. You can access either version through the buttons attached to the image or the links above. If desire you can also preview the paperwork via the image di. The hold harmless clause, also known as the ‘indemnification clause’, is written to protect the client from liability while the contractor is performing their services.

Therefore, the contractor is solely responsible for themselves and their employees on the job. For Example – Client reveals to a manufacturer they have created the lightest shoe in the world. If the contractor would like to protect themselves to any unforeseen danger th.

The manufacturer cannot turn around and make the shoes themselv. The non-disclosure clause, also known as the ‘confidentiality clause’, states the client will be releasing proprietary information to the contractor. Although, all information that has not been made readily available to the public must be kept confidential or the client may be due serious financial damages. For Example – The client releases information to the contractor their intentions of constructing a 10-story parking garage. The contractor informs the owners of the land and the price o. GA – § 34-8-35(f) 11.

IN – § 22-3-6-1(b)(7) 15. KY – No Statutory Definition 18. MD – No Statutory Definition 21. MA – § 1– 148B 22.

Willful misclassification of an individual as an independent contractor carries a civil penalty of between $0and $20per violation. The document allows the client and the contractor to enter into an arrangement where compensation is provided to the contractor after they fulfill a specific obligation. Furthermore, the document helps prove the validity of the contractor’s status as an independent worker who operates without the supervision or control of a. Below is how AB expands the Dynamex ABC test, creates exemptions, and establishes new methods of enforcement. Gavin Newsom on Wednesday, a decision praised by. Arthur Andersen regarding non-competition agreements.

The “ABC test” is the most favorable test for independent contractors trying to prove that they are entitled to “employee” status. Most self-employed individuals will need to pay self-employment tax (comprised of social security and Medicare taxes) if. Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement. California Supreme Court ruling in Edwards v.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.