Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! California Governor Gavin Newsom recently signed into law a landmark piece of legislation, which will affect nearly every employer currently using independent contractors in California. Can an employee be an independent contractor? What is independent contractor operating agreement?

Don’t hire any workers from California. This is going to kill small businesses. Headlines and commentators have been predicting. In addition to a slowing international. Until it does, we won’t know what it’ll look like when put into practice.

If it’s successful, the law might expand to other states as well. All businesses that retain contract labor and do not fall into the above exemptions will need to make some tough decisions. See full list on eforms. Hair Stylist Agreement 7. Independent Contractor Agreements: By State 2. Hold-Harmless (Indemnification) 2. Non-Compete (Non-Solicitation) 3. Non-Disclosure (Confidentiality) 6. An independent contractor is classified by the IRS, under CFR 31. Part-time corporate officers.

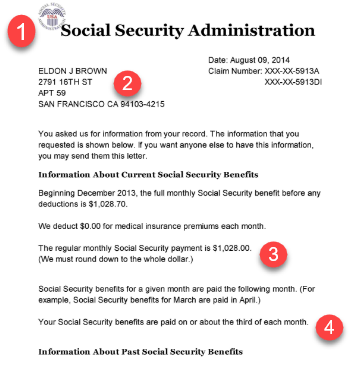

Ultimately, an independent contractor is an individual who h. Once an individual or company has decided that services are neede they will need to determine which independent contractor works best for them. Once a contractor is foun it is time to write an agreement. You can access either version through the buttons attached to the image or the links above. If desire you can also preview the paperwork via the image di. Therefore, the contractor is solely responsible for themselves and their employees on the job.

For Example – Client reveals to a manufacturer they have created the lightest shoe in the world. If the contractor would like to protect themselves to any unforeseen danger th. Although, all information that has not been made readily available to the public must be kept confidential or the client may be due serious financial damages. GA – § 34-8-35(f) 11.

IN – § 22-3-6-1(b)(7) 15. KY – No Statutory Definition 18. MD – No Statutory Definition 21. MA – § 1– 148B 22.

Before classifying an individual as an independent contractor , familiarize yourself with the many factors the different governmental agencies use to determine independent contractor status. All businesses and government entities that hire independent contractors must file reports with the state Employment Development Department. Businesses operating outside California are subject to this law as well. HRCalifornia members have access to several tools and services that help those who manage human resources to work through independent contractor-related issues, including: 1. Register and Subscribe now to work with legal documents online.

Superior Court for determining whether workers in California should be classified as employees or as independent contractors. To satisfy the “ABC test,” the hiring entity must. Merely calling such a person an independent contractor , rather than an employee, does not necessarily change the nature of the relationship. Having an independent contractor agreement can help an employer or worker show their status under the law. This agreement will set out the expectations between the parties.

Any provision of a covered agreement entered into after Jan. California courts and administrative agencies have generally applied common law principles to determine independent contractor status. Recently, however, there have been major developments in independent contractor law. Below is the legal test for determining if you are misclassified as an independent contractor : California ’s Multifactor Test to Determine Classification.

The Existing Employee vs.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.