Whether the capital Gain on contribution of land by partner. What is immovable property transfer? Can I charge stamp duty on immovable property? Can property be transferred to partnership firm? Is stamp duty on transfer payable?

Stamp duty on transfer is payable as per applicable state laws. The stamp duty on gift deed may or may not be equal to the general stamp duty you pay on selling or relinquishing the property. It is different for different states in India.

Circle rate is the minimum price at which stamp duty is payable in case of transfer of immovable property. It may also be noted that in Article 4 no stamp duty is chargeable on dissolution, if property brought in as capital by a partner goes back to the same partner. As per section of the Act immovable properties vest in and stand transferred to the LLP without any further assurance, act or deed. Thus, the law deals with legal vesting where under, in the strict sense of the term, no Stamp Duty is payable for a legal vesting. It is automatic and by force of operation of law.

But if such value is less than the value adopted for stamp duty purpose, then as per sec 50c, such value adopted for stamp duty propose will be treated as the sale price. He should transfer the land in the name of firm through a proper transfer deed. STAMP DUTY AND TD PAYABLE ON. SALE OF IMMOVABLE PROPERTY. IN CORPORATIONS, SPECIAL GRADE AND SELECTION GRADE MUNICIPALITIES.

The same issue has been resolved in the case of Carlton Hotels (P) Ltd. The entire movable and the immovable properties of the firm get vested into the company automatically. No capital gain tax is also charged on transfer of property from partnership firm to company.

In Vali Pattabhiram Roa v Shri Ramaniya Ginnning Rice Factory (P) Ltd. Comp cas 5(AP), the Court has held that there is no transfer under general law if the constitution of the firm is changed in to that of company by registering it under part IX of the Companies Act, as there. No instrument of transfer is required to be executed and hence no stamp duty is required to be paid. No Capital Gain Tax No Capital Gains tax shall be charged on transfer of property from Proprietorship firm to Company. Generally the applicable fee is similar to that of a Gift Deed.

B (a) Where immovable property contributed by a partner remains with the firm at the time of outgoing: 40. Instrument of Constitution. B(a) on the market value of the property allotted to the other partner (b) In any other case: 40. Should a transfer of immovable property meet all the conditions in Regulation 2(1)(b) et seq.

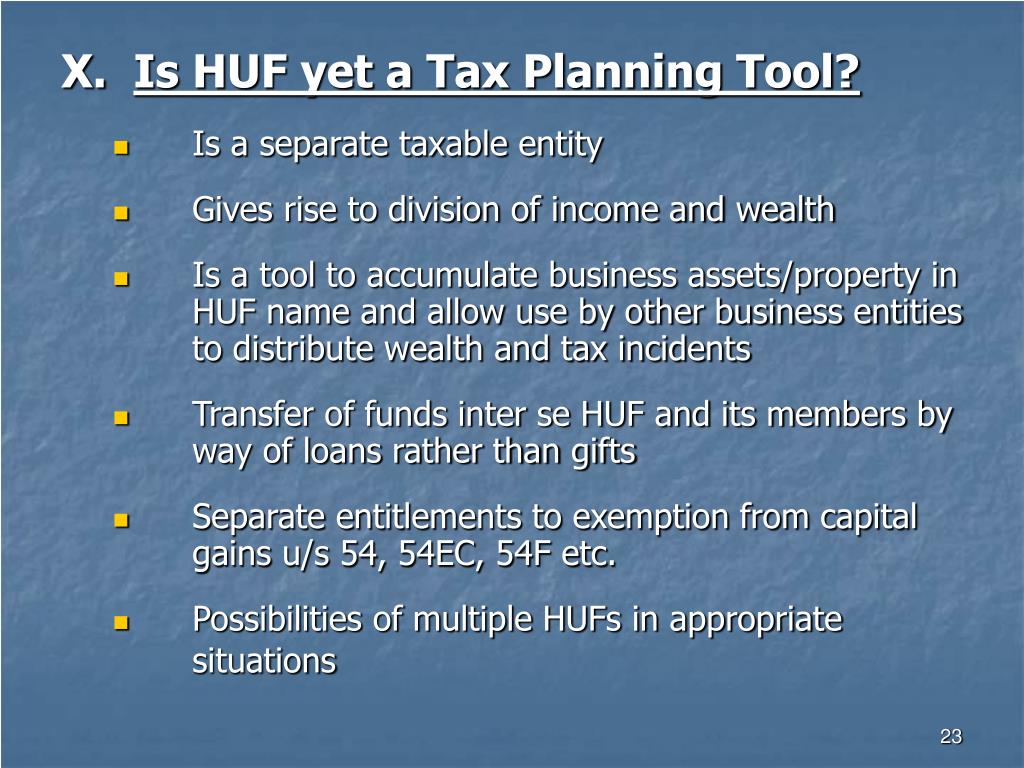

Order, then the duty on the transfer shall be charged at the rate of EUR 1. Whatever property or assets brought into the partnership or subsequently acquired by it would be the property of the firm and none can separately deal with it despite the common right over the entire properties. Benefits of converting Partnership firm as a Corporate Entity. There is no stamp duty. Corporatization always has its own advantages like limited liability, perpetual succession, easy access to funds, transferability of shares and lot more.

Hello, in case of reconstitution, where immovable property contributed as share by a partner or partners remains with the company at the time of outgoing in whatever manner by such partner or partners on reconstitution of such partnership , then the stamp duty is on the market value or the immovable property remaining with the firm. All movable and immovable properties of the company automatically vest in the LLP. Certain exemptions apply to the stamp duty payable on immovable property where the property in question is the matrimonial home (not owned jointly), or where the will leaves the immovable property to those who would have inherited had there been no will (an intestacy), in the same shares as they would have inherited on an intestacy.

As per the provision of taxation of gifts, any Gift received from any person on the occasion of the marriage is not liable to income tax. The prescribed stamp duty for partnership , in case the capital contribution is more than Rs. Intra Group Relief Subject to the conditions set out in section of the Stamp Duty Ordinance (the Ordinance), stamp duty relief is available for the transfer of immovable property or shares from one associated body corporate to another.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.