Start days Free Trial! Edit PDF Files on the Go. You will need to redo the deed with the present owner(s) conveying to all the new and present owners and record it. No Installation Needed.

Hi - I am almost absolutely positive that there is a way to do this. I remember reading a column that addressed this issue. How to add a name to a deed? How Do I Add Someone to My House Deed ? How do you add a name to a property title?

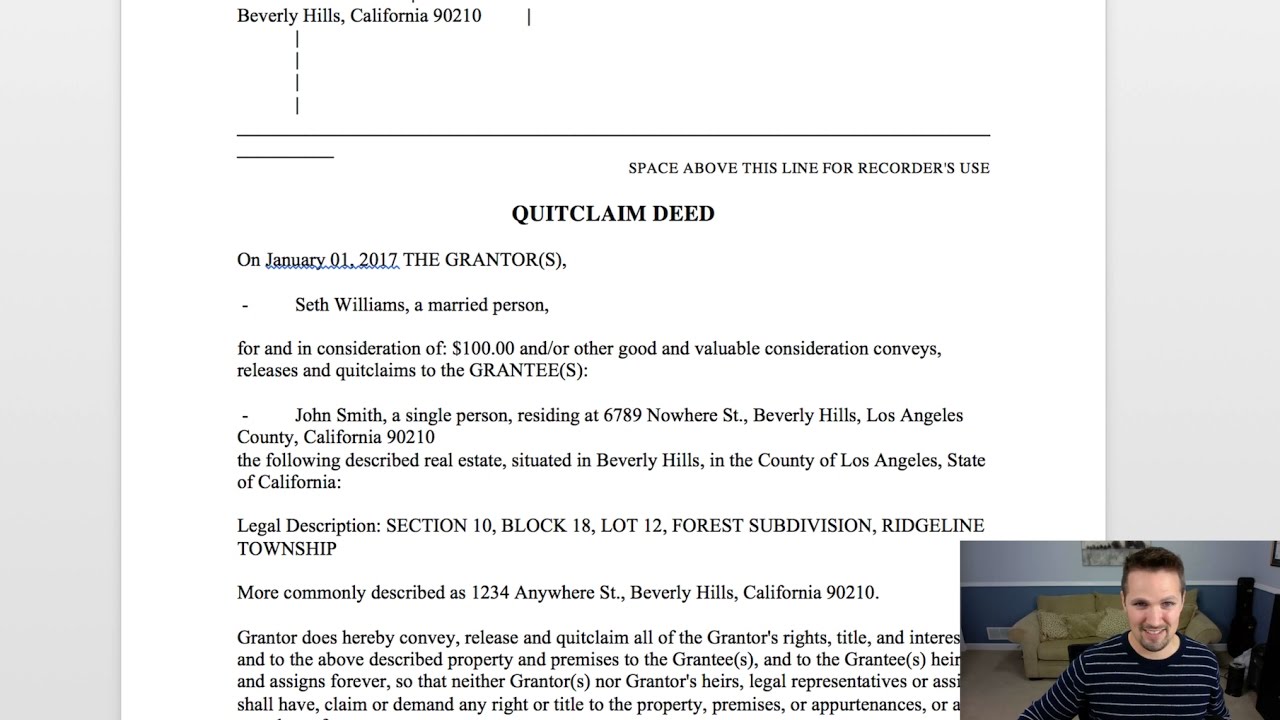

When do you need to get a quitclaim deed? When executed and notarize the quitclaim deed legally overrides the current deed to your home. Adding the name only gives him an ownership interest in the house both currently and in the future, while your own ownership interest would still be subject to probate. As the grantor of the property , you must sign the deed and have your signature notarized.

The notary will charge a small fee to witness your signature and notarize your dee typically less than $10. There is a fee for changing and recording a new deed. This process requires reviewing your loan documents and possibly seeking help from your lender and attorney. The deed also needs notarized.

A property owner who bought a home through a mortgage has the option of adding a person’s name to a deed who has not signed the. Where available, these tools allow property owners to pass title to their real estate to the named beneficiary or beneficiaries outside of probate court. If there is a mortgage on the property, title generally passes subject to the mortgage and any other liens or interests. Filing a beneficiary deed involves drawing up a notarized document that describes the property, lists the full names of your beneficiaries, and bears your signature. Note that while you can replace the beneficiary deed with a new version, making alternative arrangements in your will does not change or supersede what you publish in the beneficiary deed.

With a beneficiary dee you—and any other current o. See full list on info. During probate, the court appoints an executor or personal representative charged with, among other things, ensuring assets are distributed according to either your will or state law, if your will does not address distribution. Probate can be time-consuming and might be costlier than some other methods of transferring ownership of real estate. When people own property as tenants in common, each owner holds a divided share. For example, if you own property in your name alone and add your spouse as a tenant in common, you each own one half of the property.

This means that when either of you dies, your share will likely need to go through a probate proceeding to transfer to the other spouse. If you own property in your name alone but want to pass it to your spouse outside of probate court when you die, you may wish to add your spouse to the title as a joint tenant with rights of survivorship. In contrast to owning property as tenants in common, ownership structured as joint tenants with rights of survivorship means you each own an undivided interest in the property.

When one joint tenant dies, ownership of the entire parcel passes to the remaining joint tenants. Before you add adult children or others as joint owners, talk to a tax professional or an estate planning attorney to evaluate the potential pros and cons. There may be disadvantages that outweigh the potential benefit you hope to achieve. Because of the complexities involved in real estate, you might be better off working with a licensed attorney in your jurisdiction who is knowledgeable about estate planning and real estate transactions, rather than trying to navigate the process yourself.

Doing so may cost mo. With a quitclaim dee you can name your spouse as the property’s joint owner. The quitclaim deed must include the property’s description, including its boundary lines. A Lawyer Will Answer in Minutes!

Questions Answered Every Seconds. If you own the home outright, you can add a name by completing a quitclaim deed. The requirements for completing quitclaim deeds vary by state and even counties. When you use a warranty deed , you are saying to the grantee that you guarantee that no one else has any legal interest or right to the property. However, the general process is the same.

You are providing a promise or warranty that the property is free and clear. Both types of deeds transfer ownership of a property from one person to another. To change, add or remove a name on your deed a new deed needs to be recorded reflecting the change. Many people think they can come into the office and change the present recorded deed with a form, but that is not the case.

Once a deed is recorded it cannot be changed. Detailed information explaining how to easily add a name to property Deeds. Most people, when asking this question, are actually referring to the ownership documents, which technically are no longer the Deeds, but the Title Register and Title Plan.

The old style of property ownership resulted in a stack of Deeds, many of which were handwritten, ol worn and soiled. The three steps to adding a name to a Florida deed are as follows: 1. Provide your attorney with a prior deed or legal description for the property. If you are unable to locate either, your attorney can obtain those items free of charge. Once your lawyer prepares the new deed , the grantor (the current owner or the party transferring an interest in the property) simply signs the new Deed in the presence of two witnesses and has their signature notarized. If you want to transfer title to a friend or your chil the same principle applies.

You can convey your property into the trust on behalf of another person. In legal effect, you now do not own that property. It belongs to the trust. If you convey everything this way, your whole estate is freed from probate.

You can revoke the trust if you later change your mind on who should get the property. A transfer on death (TOD) deed. In addition to the deed , your attorney will also need to prepare transfer tax returns.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.